As financial institutions grapple with increasing regulatory pressure under DORA, many plan for DORA compliance as a box-ticking exercise, often relying on traditional Business Continuity Management (BCM) practices. Yet BCM and resilience overlap; there is a fundamental difference between BCM and resilience: resilience is proactive and business-integrated by design. Rather than settling for minimal compliance, forward-thinking companies have an opportunity to transform their governance, risk, and compliance programs into holistic, integrated frameworks. With a resilience-by-design approach, Corporater GRC empowers financial institutions to not only meet DORA’s requirements but also build lasting operational strength.

The EU Digital Operational Resilience Act (DORA), which officially came into force on January 17, 2025, is a regulation by the European Union aimed at strengthening the digital resilience of financial entities to ensure financial stability. In an increasingly interconnected and dynamic world, where cybersecurity threats, digital operational failures, and outages can cause massive operational disruptions, DORA aims to ensure that financial institutions (including banks, insurance companies, investment firms, and others) are prepared to withstand, respond to, and recover from ICT (Information and Communication Technology) disruptions3.

But DORA isn’t just about protecting financial services; it’s about building resilience at a systemic level, ensuring that financial institutions can continue to operate without jeopardizing the broader economy. The act’s scope spans across 20 different types of financial entities. It includes specific provisions for third-party ICT service providers, recognizing that modern financial services are deeply reliant on external vendors and digital infrastructures.

“Organizations must weave resilience into their business strategy and ensure that resilience becomes a proactive, holistic part of how they operate, innovate, and manage risk.”

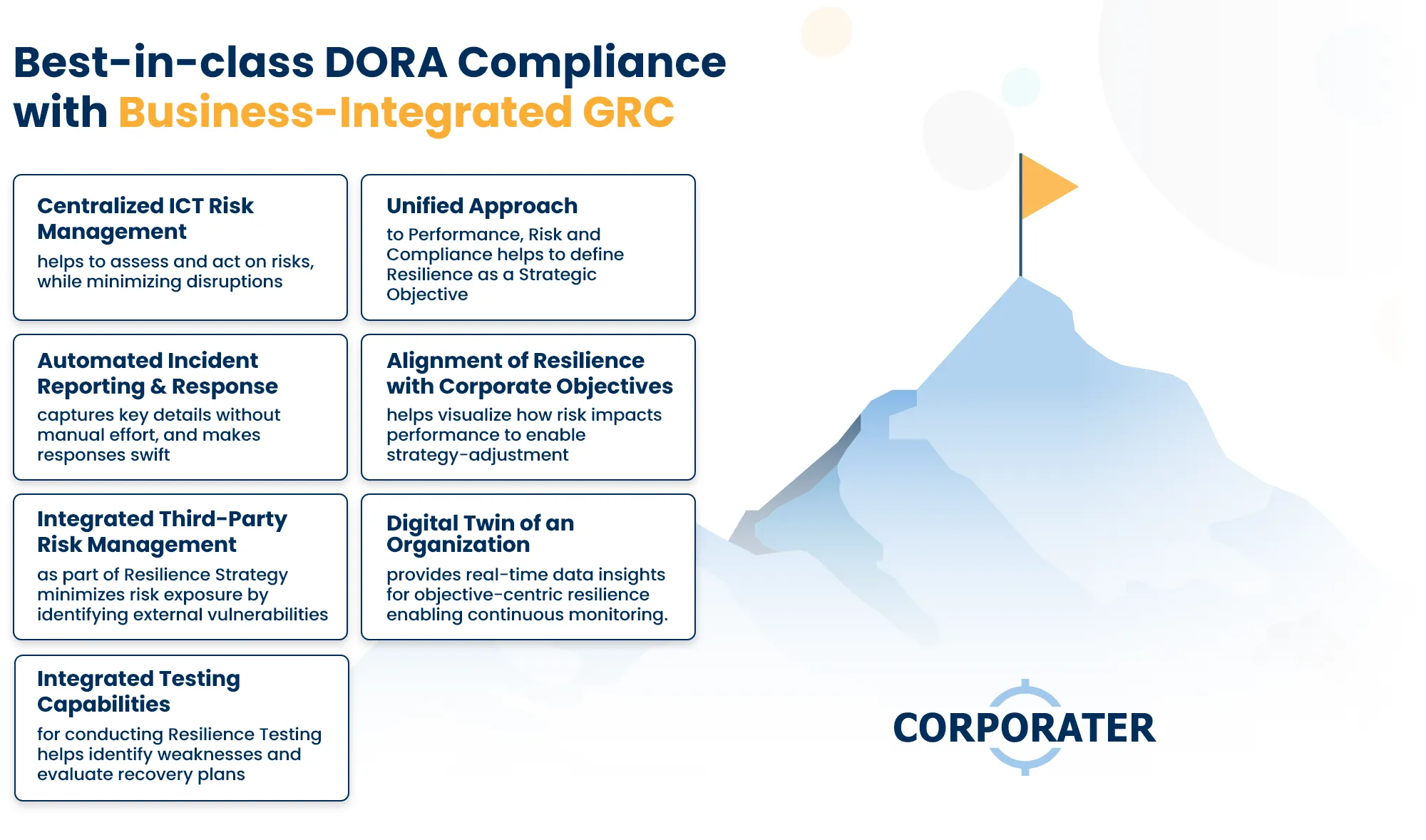

For financial institutions to comply with DORA, resilience must be integrated into every layer of their operations, governance, and risk management processes. This is where business-integrated GRC – or GPRC1 (Governance, Performance, Risk, and Compliance) comes into play. Simply meeting DORA’s ICT risk management and reporting requirements is not enough. Organizations must weave resilience into their business strategy and ensure that resilience becomes a proactive, holistic part of how they operate, innovate, and manage risk.

Much like DORA’s objectives, rather than treating resilience as a separate or isolated function, business-integrated GRC (GPRC1) allows institutions to align their risk management efforts with business objectives, ensuring resilience is a core part of their performance and compliance strategies. This approach not only enables DORA compliance but also extends traditional operational risk with the new resilience obligations into a strategic advantage, providing financial institutions with the agility and foresight needed to navigate the challenges of today’s rapidly evolving digital landscape.

Centralizing ICT Risk Management for Stronger Resilience

At the very heart of DORA is the requirement for a robust ICT risk management framework. Financial institutions must be able to identify, assess, and mitigate ICT risks to ensure systems are resilient enough to minimize operational disruptions. This isn’t just about creating a series of isolated risk management processes and ad-hoc vulnerability scans. The most essential key to resilience is integration – enabling shared data, shared capabilities, and shared objectives.

Risk management should never be a siloed effort. In a world of hybrid threats and integrated risks, risk management must also be holistic and integrated. ICT risk management in the context of DORA presents a unique opportunity to guide the organization into a contemporary approach to integrated risk management. We need to ensure resilience for our most important/critical business services and functions, involving any risk domain, spanning strategic, objective-centric, and operational-centric outcomes. This ensures that resilience is not just an afterthought, but a business objective. Through real-time data insights and automated workflows, financial institutions can identify potential risks early, respond promptly to resolve them, and adjust their strategies in response to the evolving, highly integrated risk landscape.

Corporater’s integrated risk management capability empowers organizations to manage multiple risk domains, including ICT risks and third-party risks, within the context of their business strategy and objectives. Through live dashboards and automated workflows, financial institutions can focus on the critical business services and functions, quickly assess risks, take action, and adjust strategies to minimize disruptions, ensuring operational resilience.

Simplifying Incident Reporting and Response

When an ICT incident occurs, DORA requires financial institutions to report the disruption to relevant authorities promptly and in a standardized format. This level of transparency is vital to ensuring that regulators have a clear understanding of incidents and their potential impact on operational continuity.

To make this process more efficient, organizations should integrate incident management directly into their overall holistic GRC and Performance (GPRC 1) framework. With centralized workflows, financial institutions can track and report incidents more efficiently, ensuring that all critical details, such as the nature of the incident, affected services, and recovery efforts, are captured and communicated in real time.

Instead of relying on fragmented systems to track and report incidents, organizations can automate data collection, incident categorization, and escalation. This ensures that organizations are always ahead of potential disruptions and able to meet DORA’s reporting requirements without unnecessary delays or manual work.

Corporater helps simplify this process by automating incident tracking, reporting, and communication across the organization. Through its centralized incident management system, financial institutions can capture key details, such as the nature of the disruption, affected services, and recovery efforts, instantly and without manual effort. This means that when an incident occurs, the response is swift, organized, and fully aligned with the regulatory requirements, ensuring that organizations remain in compliance with DORA’s stringent timelines.

Managing Third-Party Risk as Part of Your Resilience Strategy

One of DORA’s five pillars is third-party ICT risk management. With many financial institutions relying on external service providers for critical ICT functions, it’s essential to ensure that these third-party vendors meet the same wide-ranging resilience standards required by DORA. If a third-party vendor experiences a disruption, it can affect the entire organization.

Rather than treating third-party risk as a separate function, Corporater seamlessly incorporates it into the broader governance and risk management framework. By using dynamic dashboards and customizable workflows, institutions can continuously assess and track the resilience of third-party vendors, ensuring they meet DORA’s standards and any other relevant standards. This approach not only minimizes risk exposure but also integrates vendor risk into the organization’s overall risk strategy, making it easier to identify vulnerabilities and take proactive steps to address them.

This holistic approach to managing third-party risk ensures that external vulnerabilities are handled as part of an organization’s overall risk strategy, enhancing operational resilience across the board.

Navigating EU DORA: A Timeline of Compliance & Integrated Resilience

Building Resilience Through Continuous Testing

DORA also requires financial institutions to conduct regular resilience testing, which simulates potential disruptions to assess the effectiveness of response and recovery plans. These tests are an essential part of ensuring that institutions can bounce back from ICT-related incidents quickly and efficiently. But testing should not be a one-time event or something that only happens when a crisis occurs.

Financial institutions should view resilience testing as part of their continuous improvement process. By regularly simulating different types of disruptions and stress scenarios, institutions can identify weaknesses in their systems and processes before a real incident happens. With integrated testing capabilities, organizations can conduct both basic and advanced tests, ensuring that all recovery plans are rigorously evaluated and ready for deployment when needed.

Corporater provides capabilities to support continuous testing. These capabilities enable financial institutions to simulate various disruptions and stress scenarios, helping them evaluate recovery plans and identify weaknesses before a real incident occurs. Regular testing isn’t just about ticking a compliance box—it’s about continuously improving an organization’s ability to respond and recover, ensuring that resilience is always in sync with the organization’s broader business goals.

Resilience testing shouldn’t be an isolated event but rather a key part of the overall GRC strategy that keeps your organization prepared and adaptable in the face of digital disruption.

Aligning Resilience with Business Objectives

While DORA focuses on digital operational resilience, the real power lies in understanding the business-integrated intentions of DORA. Aligning resilience with business objectives will help an organization exceed the DORA requirements, achieving resilience by design, not only by taking into consideration ICT and Third Parties but also by considering other essential resources required to provide its services. This ensures that resilience is not just about meeting compliance requirements, but also about aligning your organization’s resilience with its broader goals and performance objectives.

By defining resilience as a strategic objective, you can ensure that risk management, performance, and compliance are aligned and working toward the same strategic vision. This alignment creates a more agile and adaptable organization that is not only resilient to ICT disruptions but also prepared for whatever the future holds.

Corporater’s platform enables exactly this kind of integration. Aligning risk management, performance, and compliance with organizational objectives creates a unified approach that keeps resilience at the heart of business strategy. With advanced data insights, financial institutions can visualize how risks impact performance and adjust strategies accordingly, ensuring that resilience becomes a competitive advantage rather than just a compliance requirement.

DTO driving Objective-centric Resilience

DORA compliance isn’t a destination; it’s an ongoing journey that, done correctly, can provide value to the business beyond compliance. Financial institutions should seize the opportunity to implement an objective-centric model of resilience, where business services are connected to all relevant data that drives resilience. Financial institutions must continually monitor their potential business impact, the vulnerability and recoverability of their business services, ICT, and 3rd party risks, and adjust their strategies accordingly.

The digital twin of an Organization2 plays a pivotal role in this ongoing journey. By maintaining a virtual replica of the relevant parts of the organization’s operations and systems, a digital twin enables financial institutions to continuously assess how different risks, disruptions, and regulatory changes impact business services and their business performance. With Corporater’s GRC & Performance platform, organizations can leverage real-time data insights from digital twins to uncover trends, simulate potential risks, and refine their GRC strategy, ensuring resilience remains agile and adaptable.

“Resilience isn’t a compliance checklist; it’s a continuous capability that empowers financial institutions to adapt and thrive.”

DORA compliance is more than just about meeting regulatory requirements; it’s a great platform for creating a culture of operational resilience that drives long-term success. By integrating risk management, incident reporting, third-party oversight, resilience testing, and business strategy, organizations can position themselves for success in a rapidly changing world.

With the right business-integrated GRC platform, organizations can tie all these efforts together, creating a unified approach that empowers them to stay resilient, agile, and prepared for whatever challenges lie ahead. When resilience becomes a core part of the business strategy, organizations don’t just survive, they thrive.

As one Group Executive VP aptly put it: “Can you help us look up from the traditional operational risk methodology and help us focus on the business services?” This shift in mindset is precisely what Corporater enables — moving beyond isolated risk registers and compliance metrics to a model where resilience directly supports business performance, agility, and long-term success. It’s not about abandoning risk fundamentals but rather elevating them to be business-relevant and objective-centric.

Operational Resilience Quick Demo