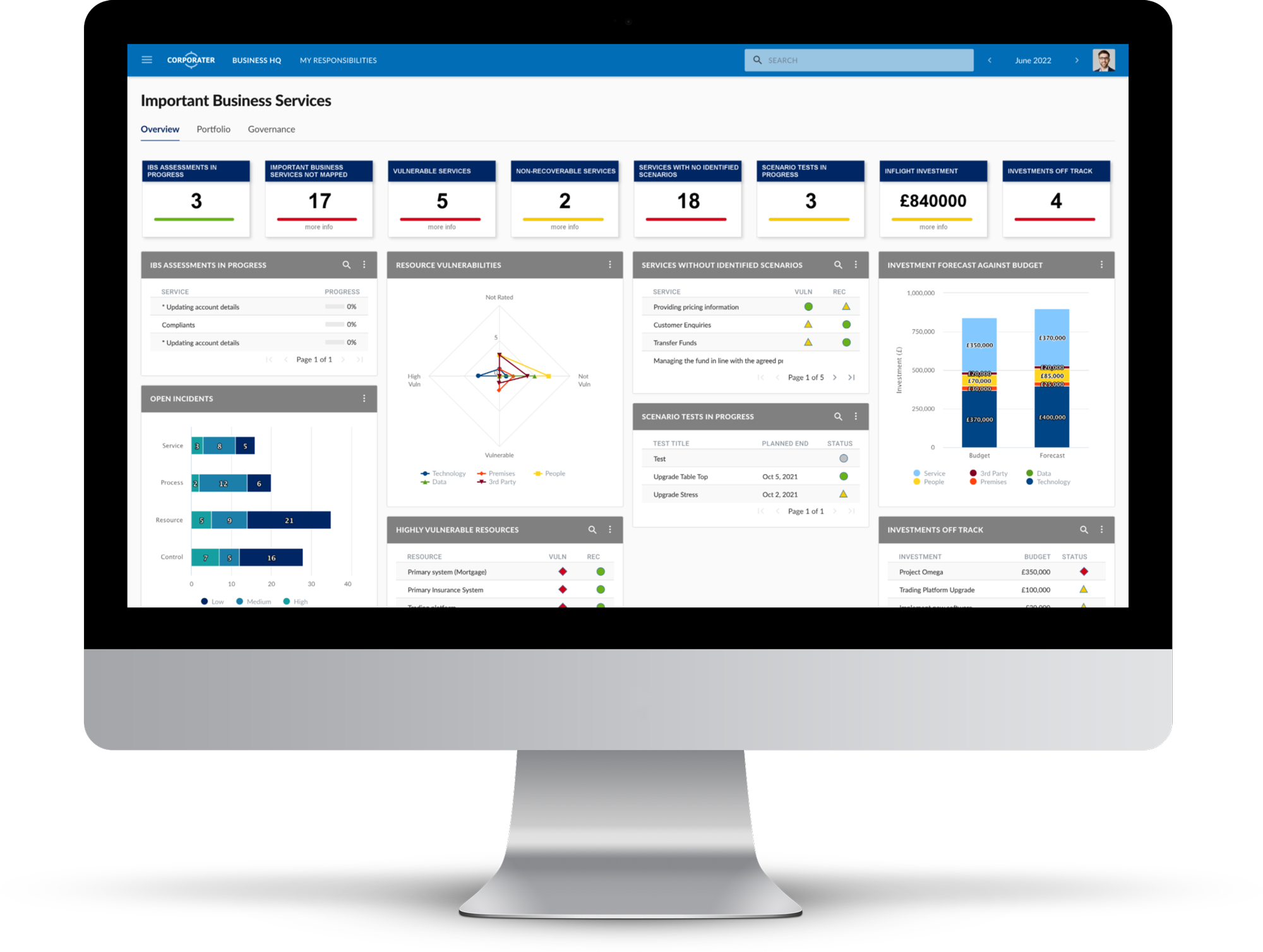

Facilitate effective risk governance and risk appetite framework with technology support. Communicate and visualize the Board and Senior Management responsibilities across the broad range of activities that your financial service institution engages in regularly.

Financial services institutions need technology solutions that have the agility and flexibility to meet ongoing requirements as well as to prepare for increased regulatory expectations. Corporater enables you to have a holistic view of the firm’s overall health and makes it readily accessible to all key stakeholders, all of the time. Improved oversight of the entire range of resource types, updated frameworks, clear organizational structure, and the timely detection of resource and other vulnerabilities are key to making sure that those responsible have the data they need to take actions.