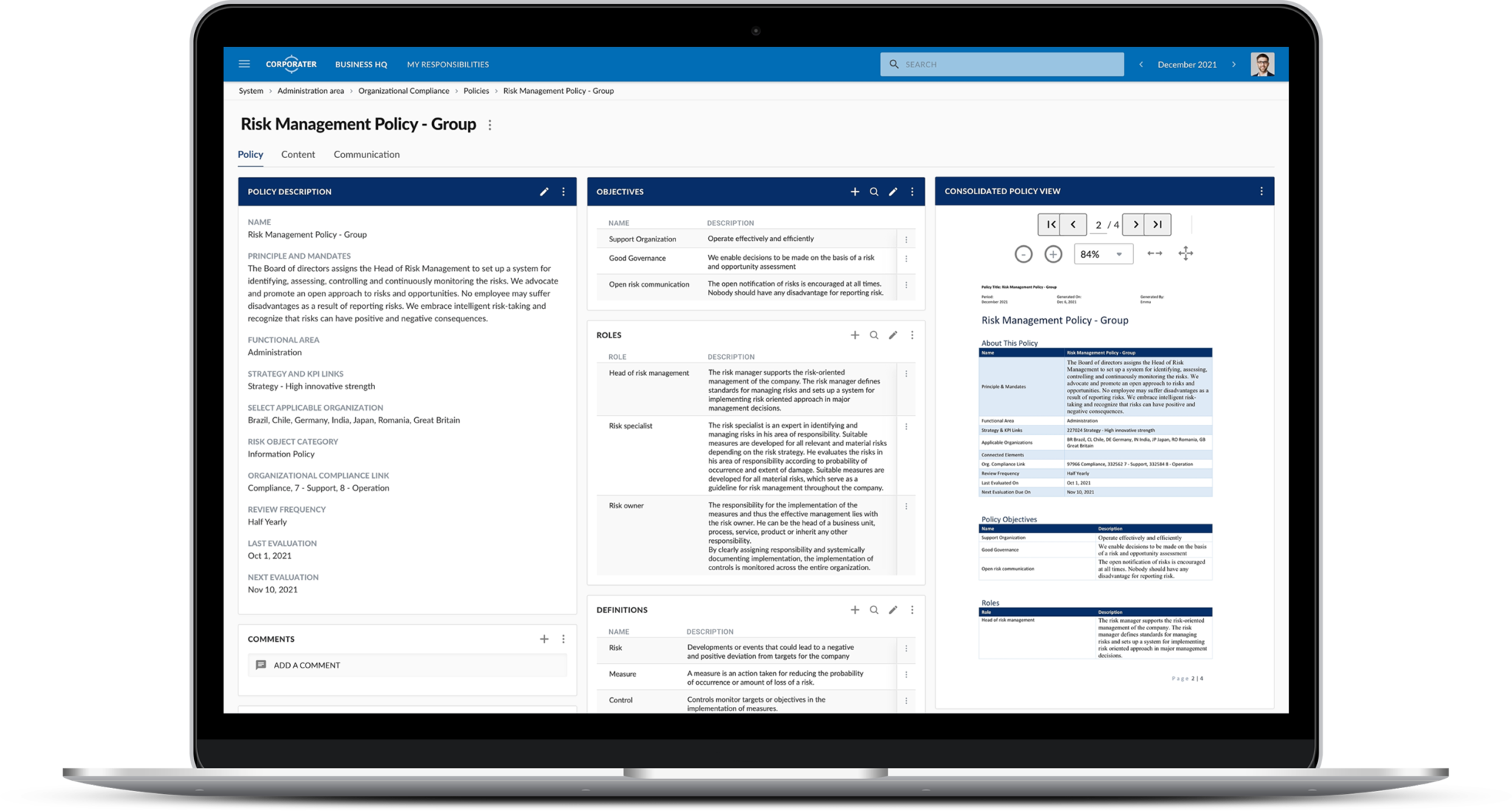

Corporater Risk Management solution for IDW PS 340 n.F. audit standard is a digital tool for early identification, analysis, and management of risk. It enables organizations to implement effective measures following § 91 (2) AktG for the early recognition of risk developments that could jeopardize the company’s continued existence and demonstrate compliance with the IDW PS 340 n.F. – audit standard issued by the Institute of Auditors (IDW – Institut der Wirtschaftsprüfer).

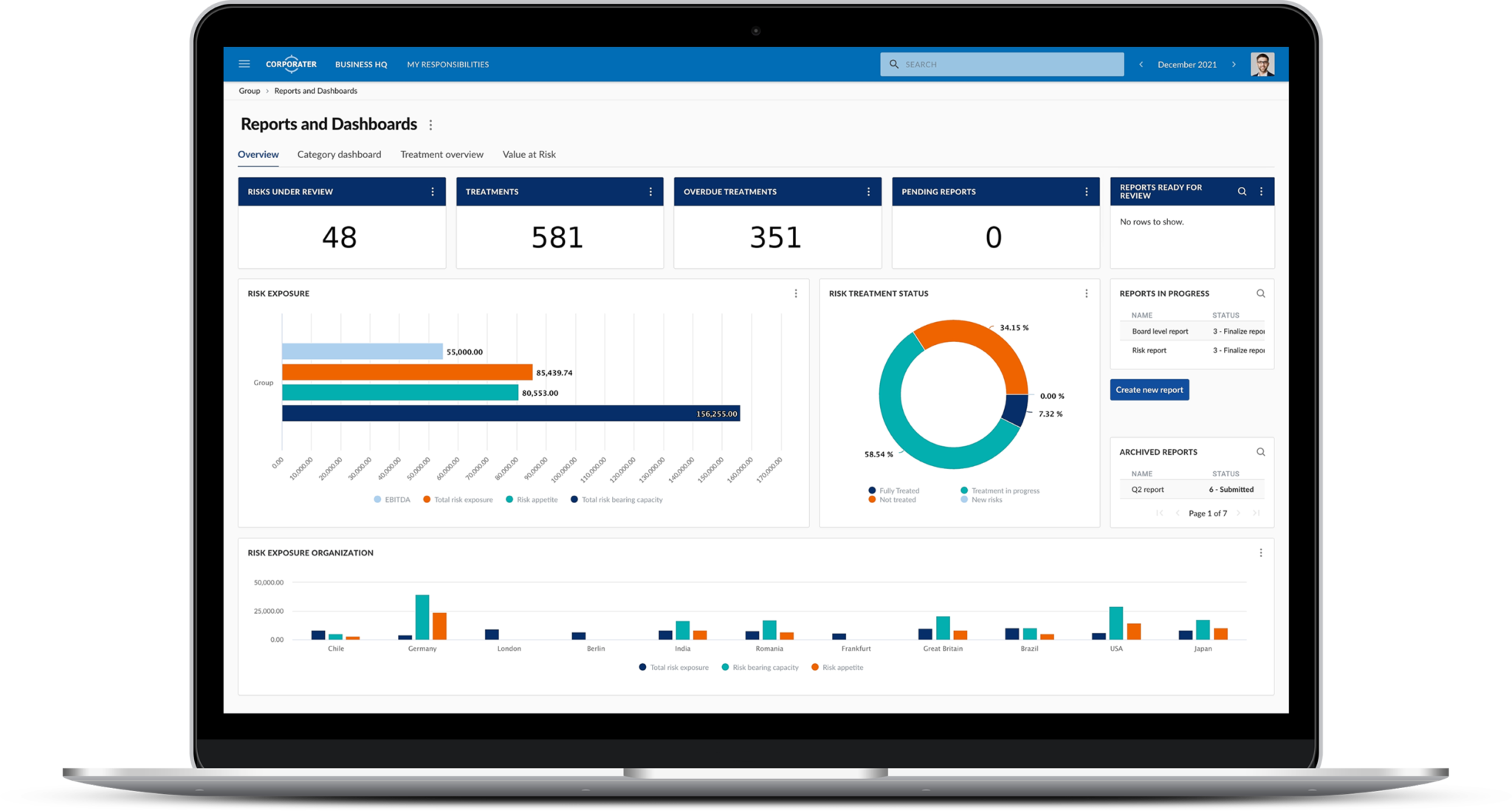

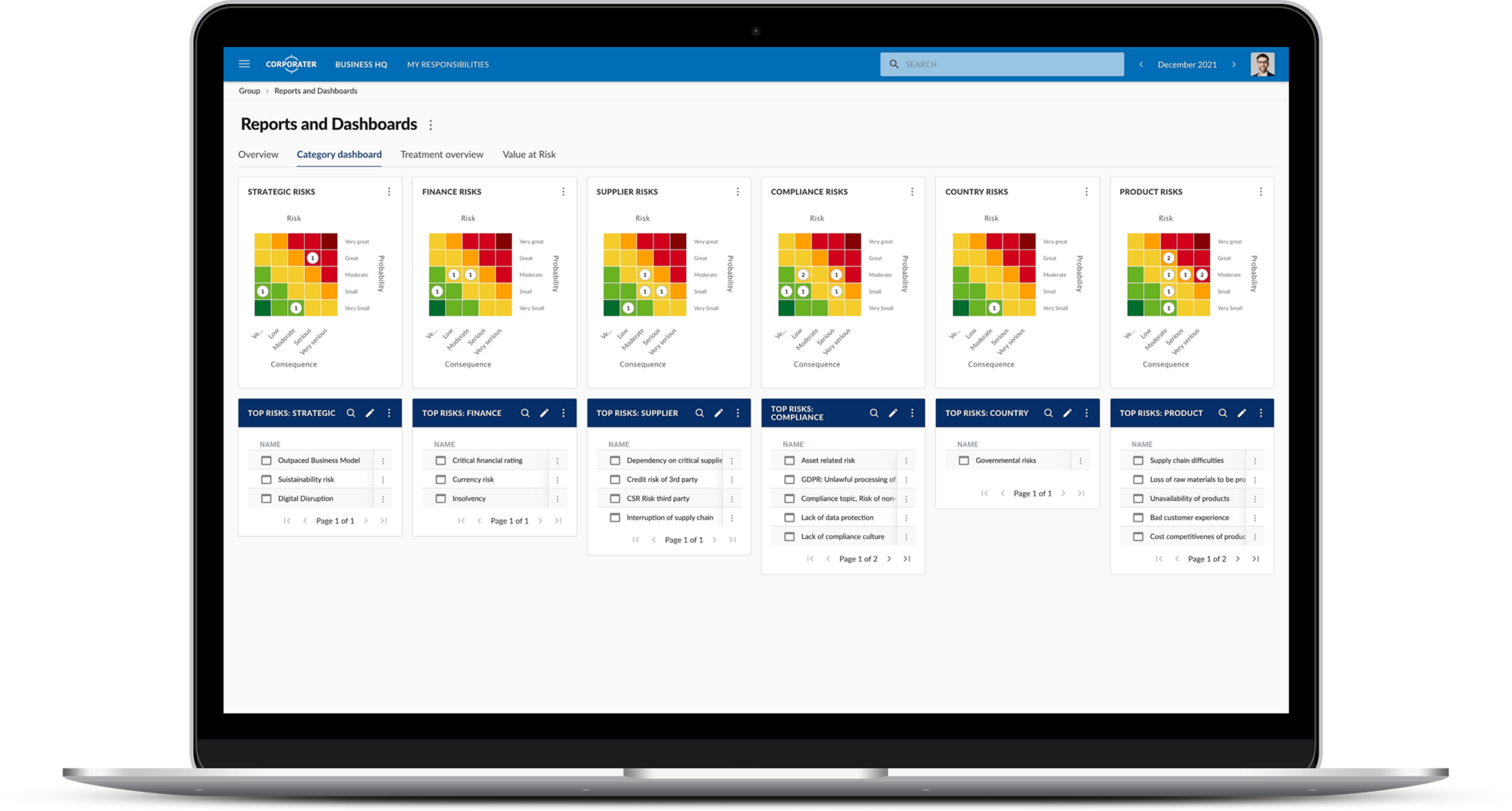

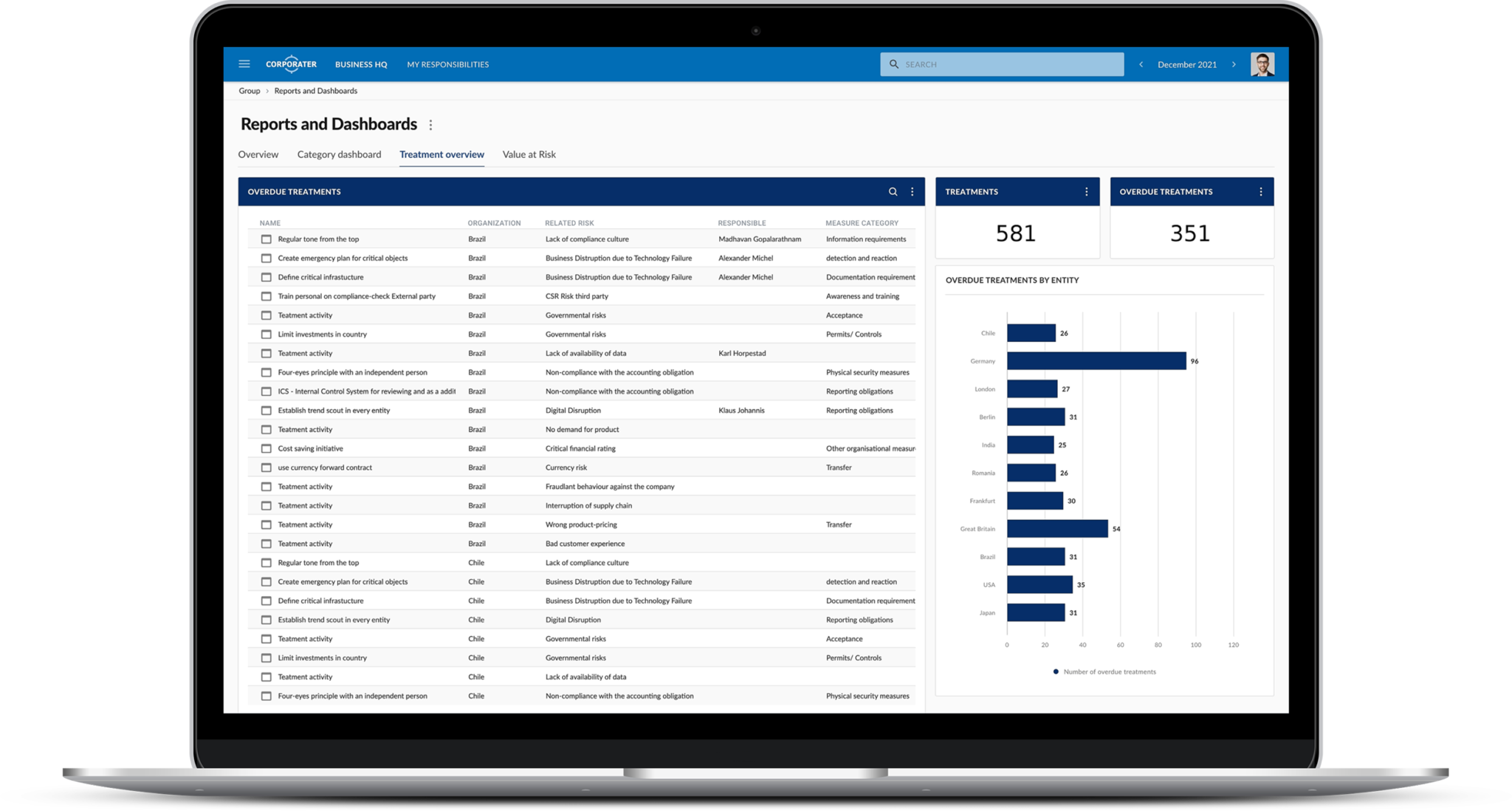

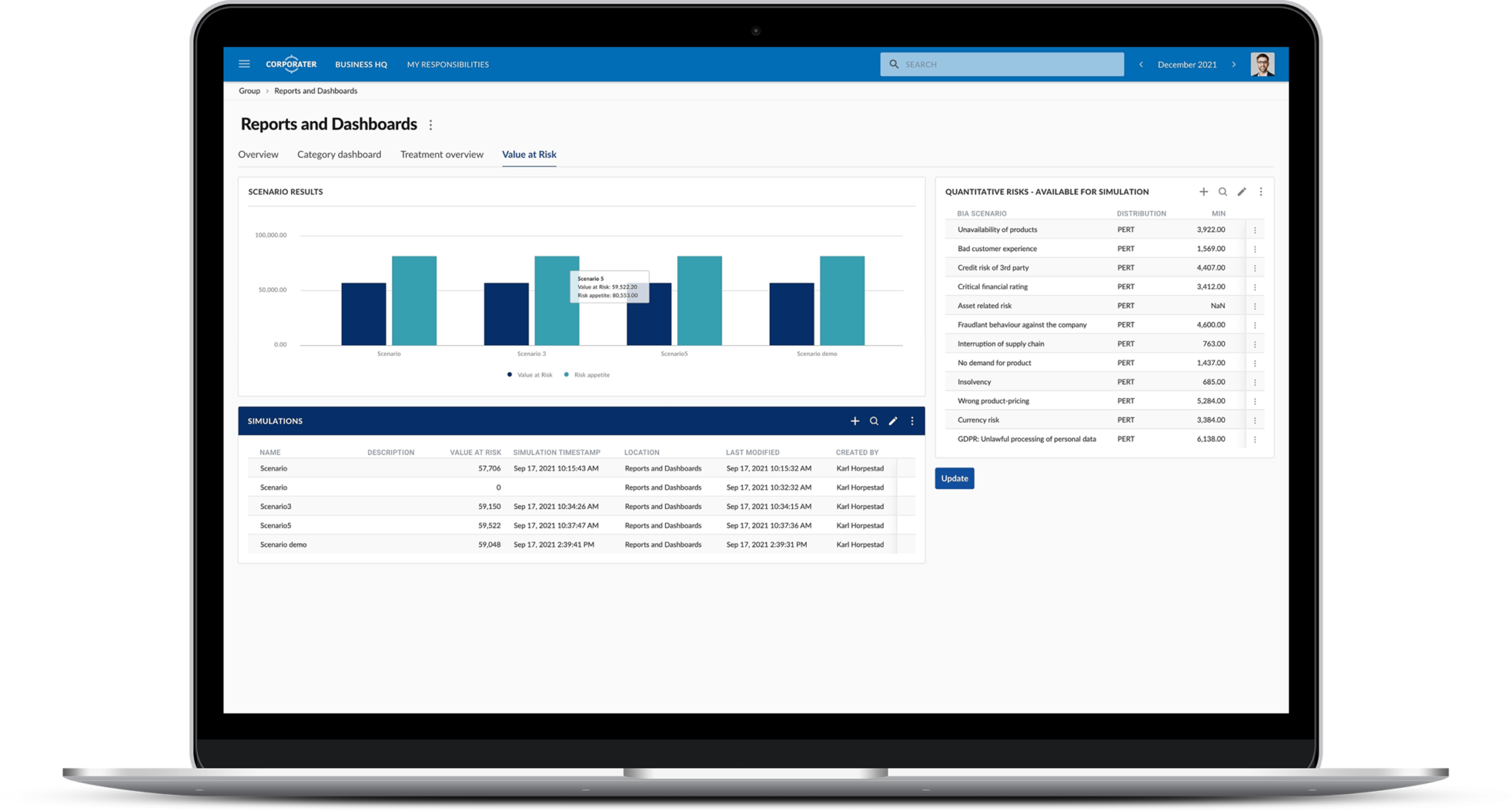

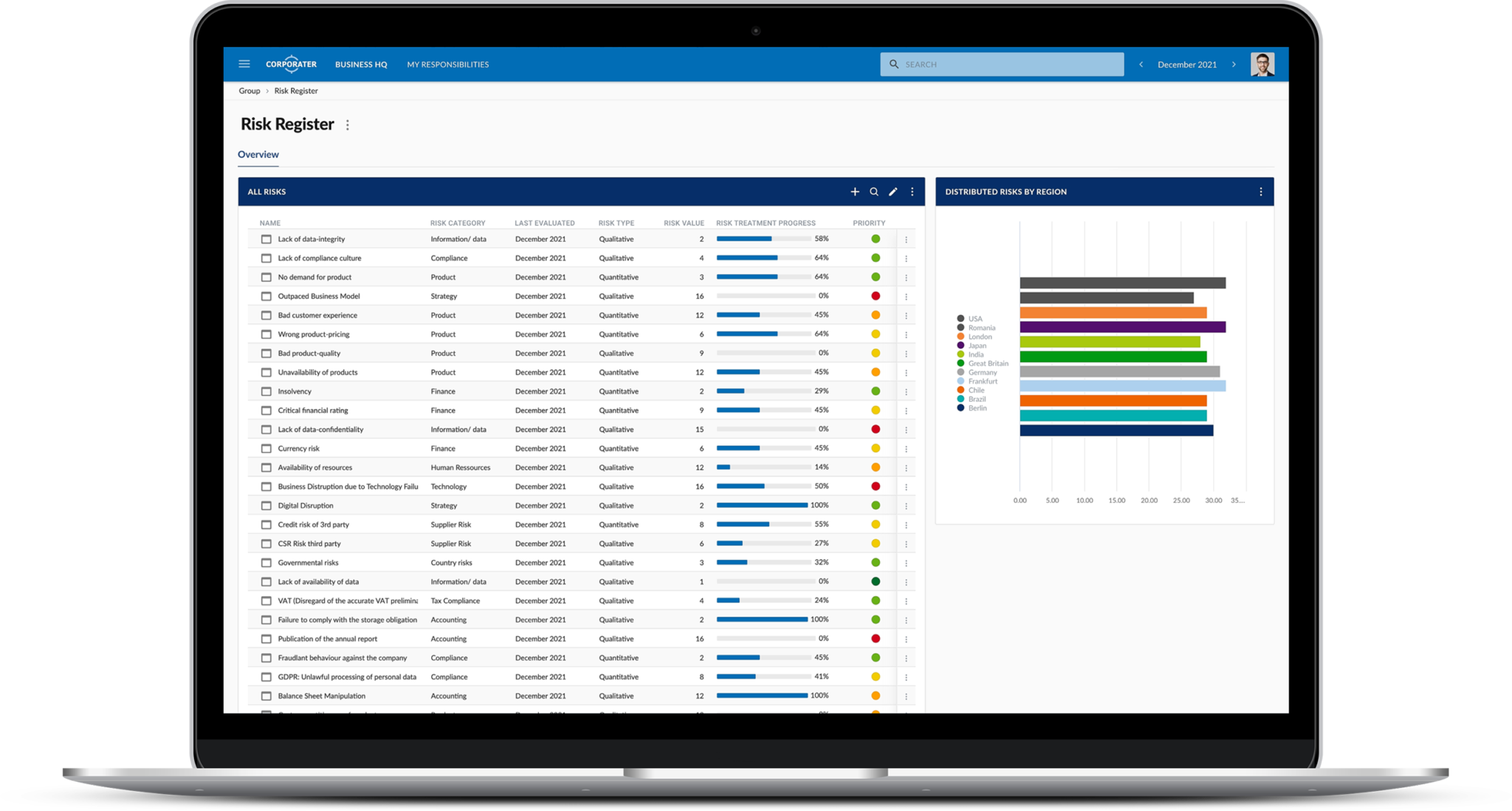

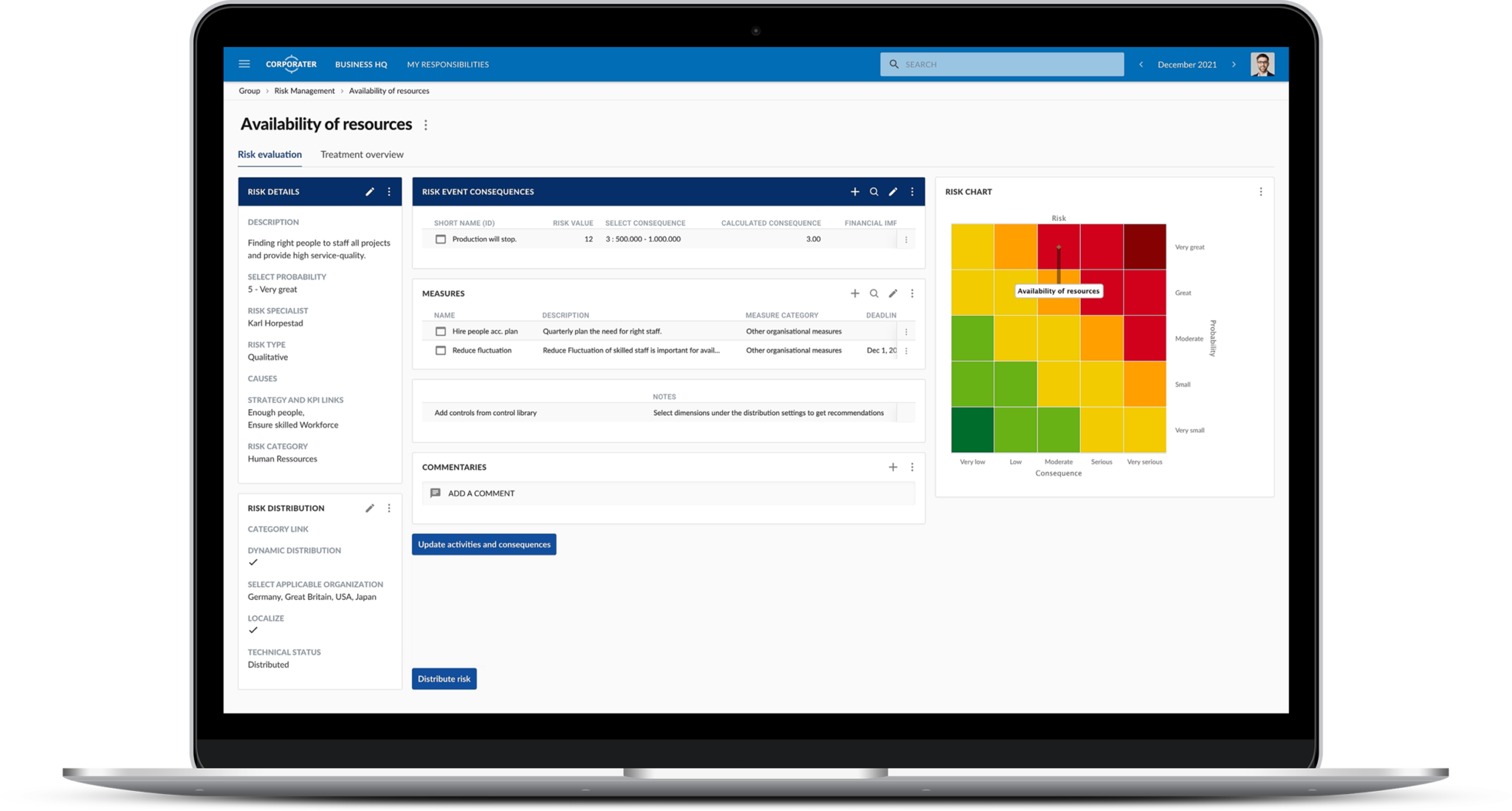

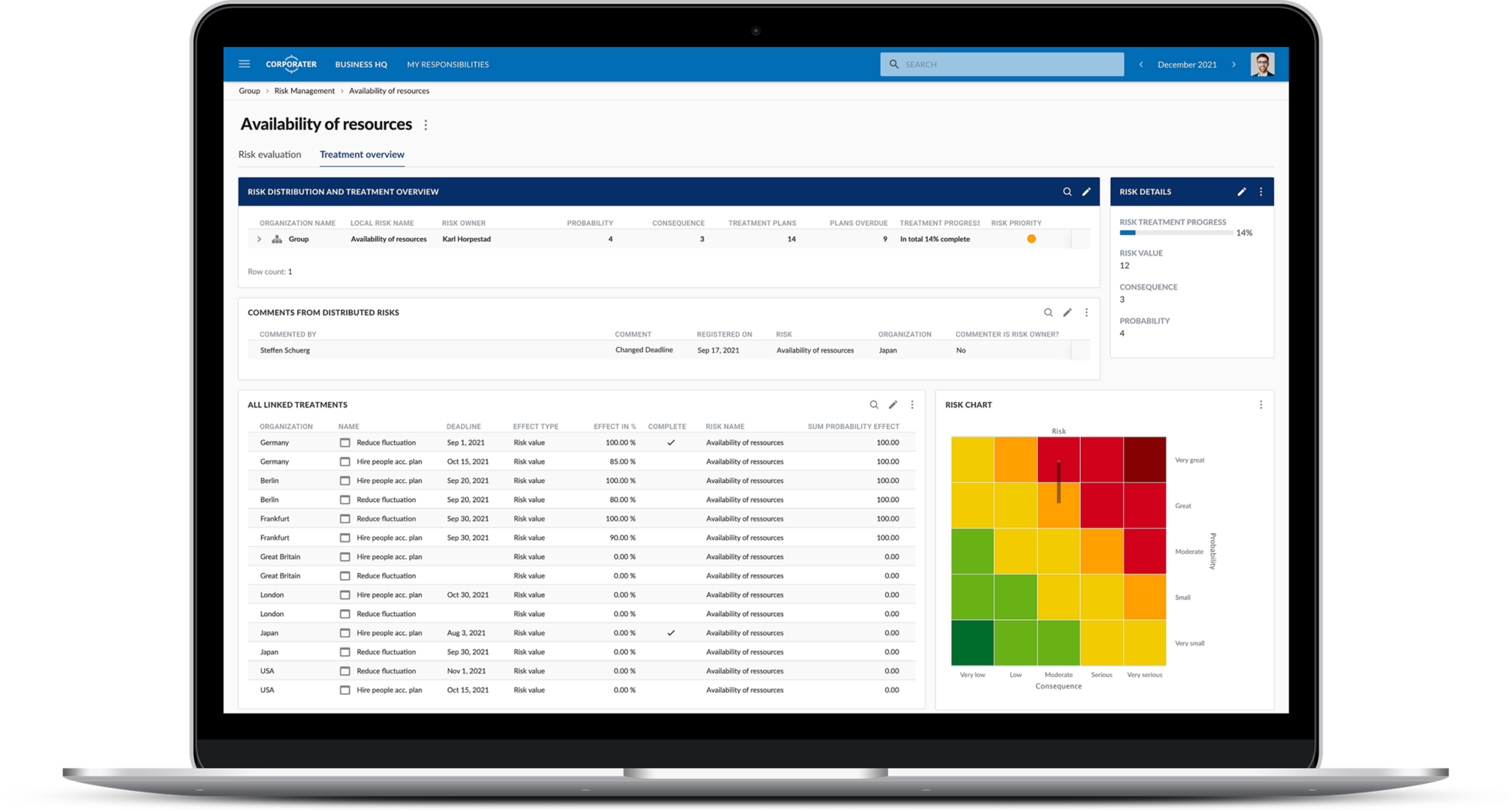

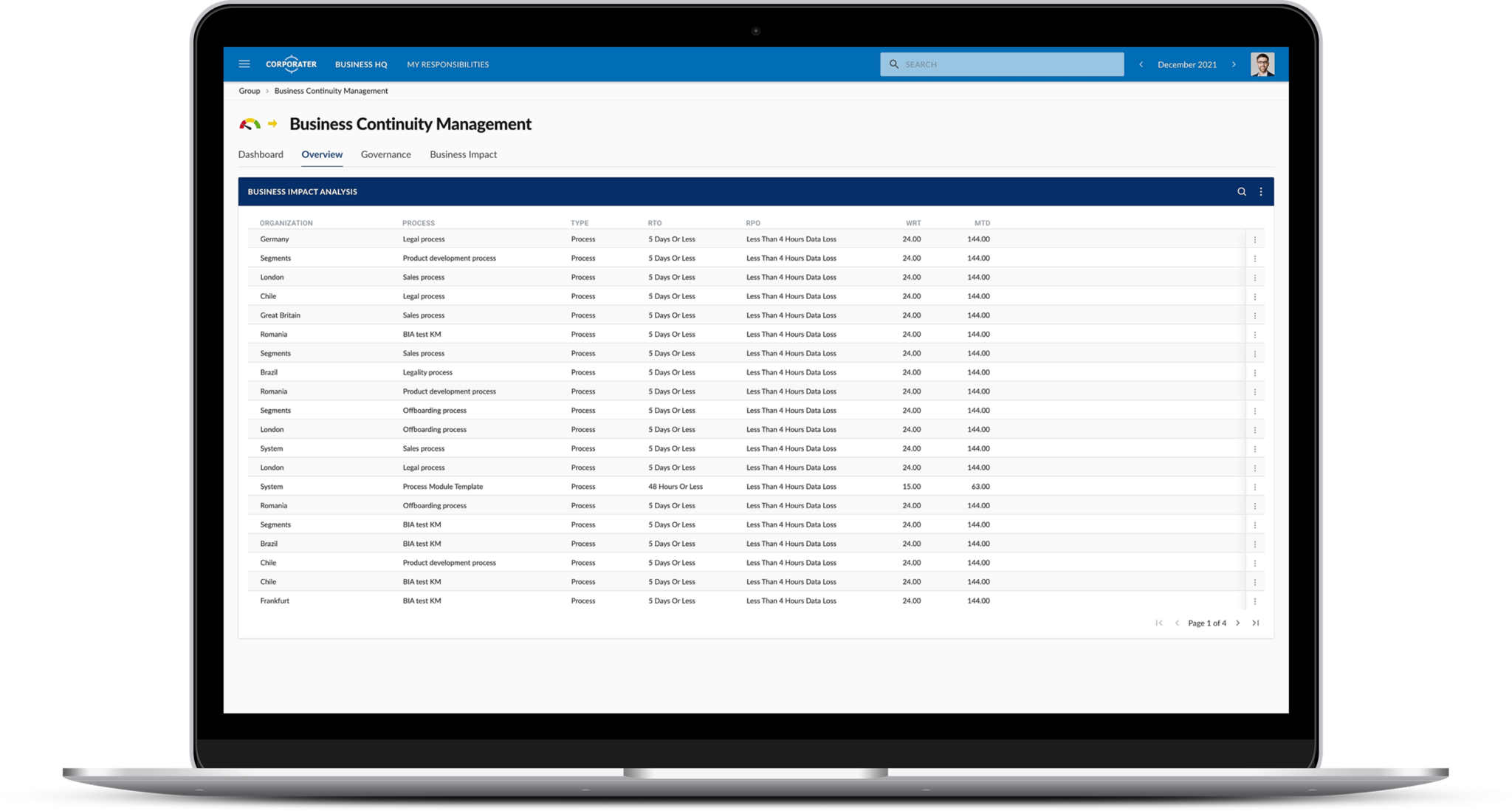

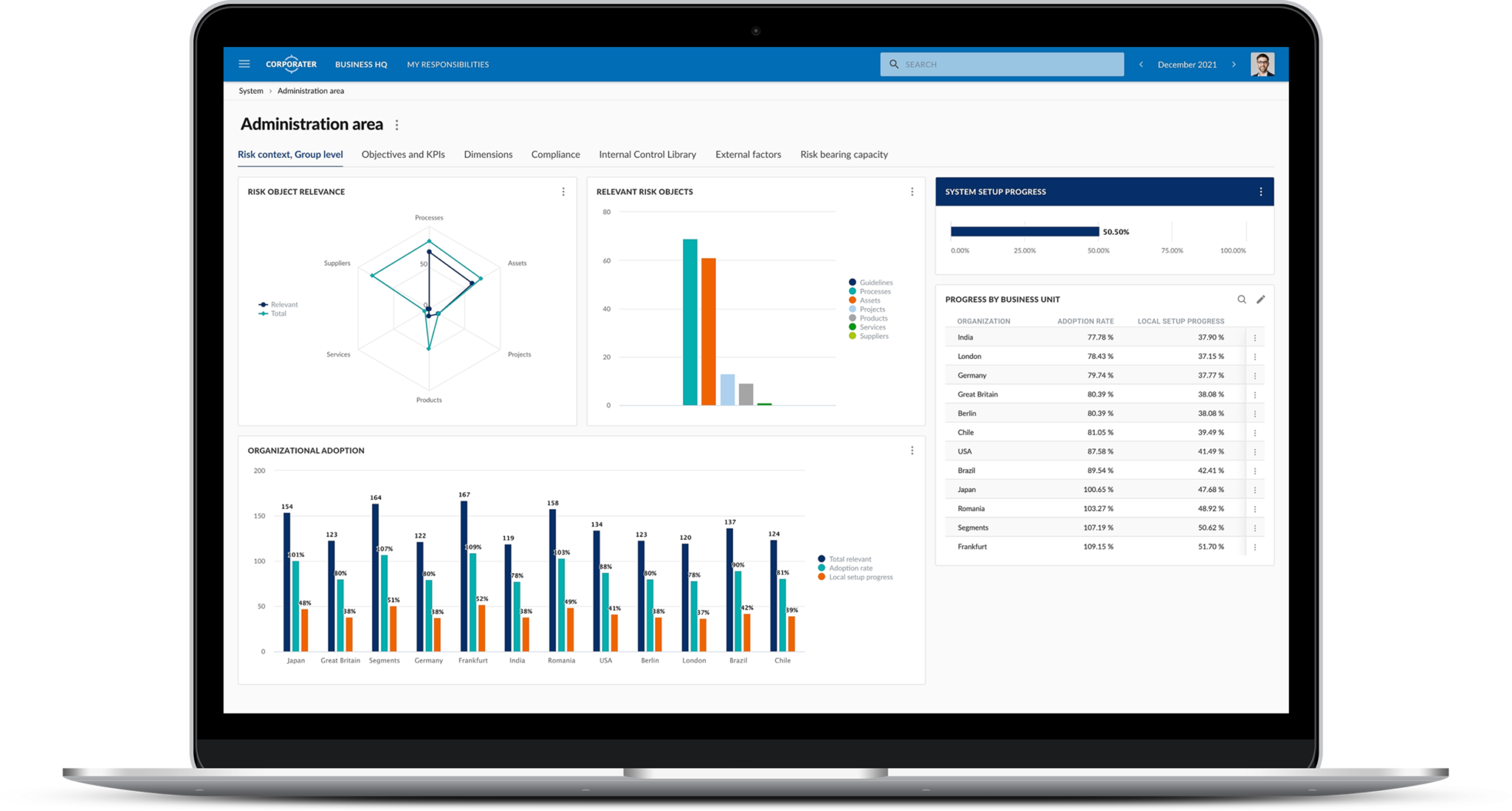

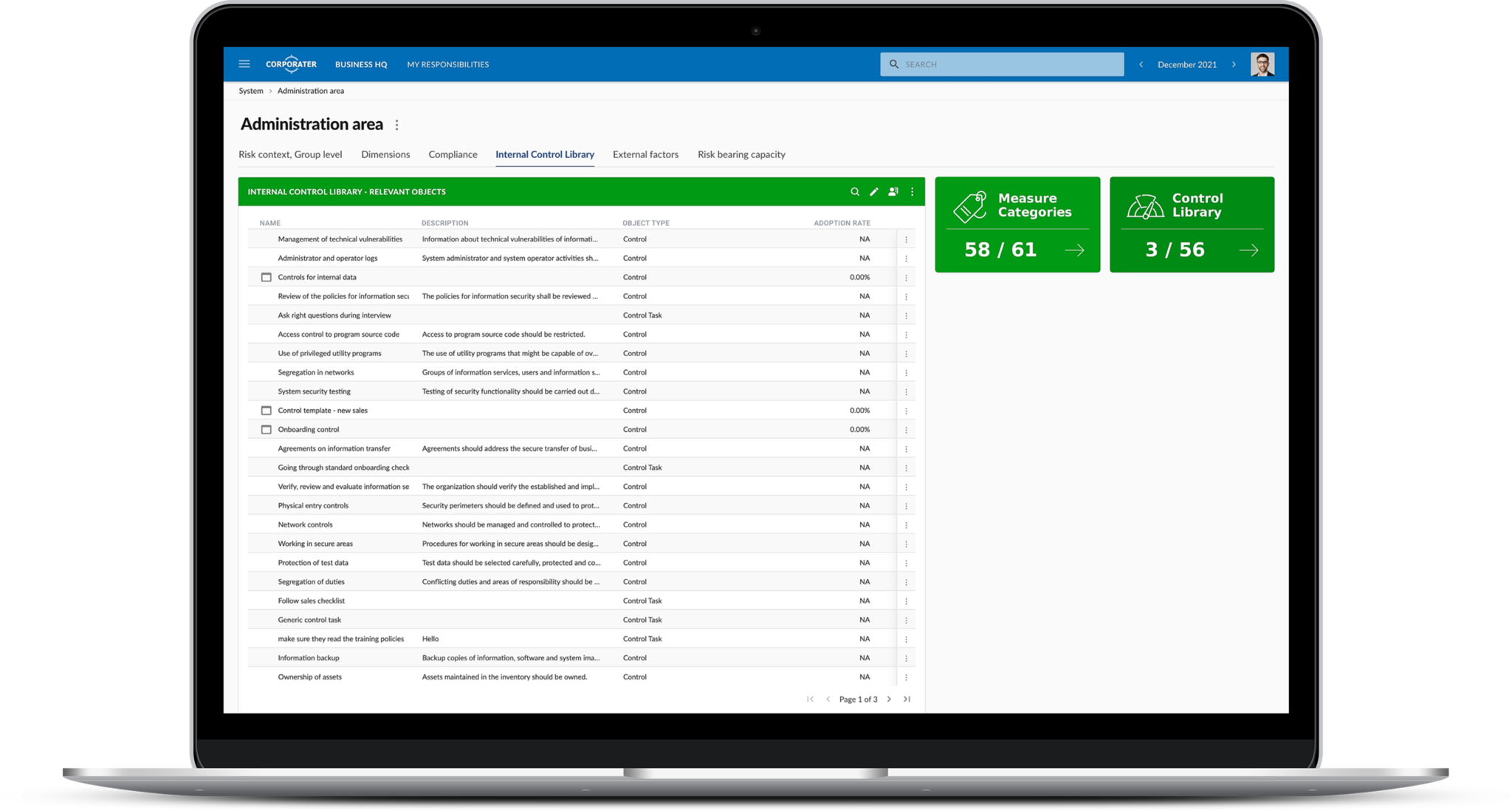

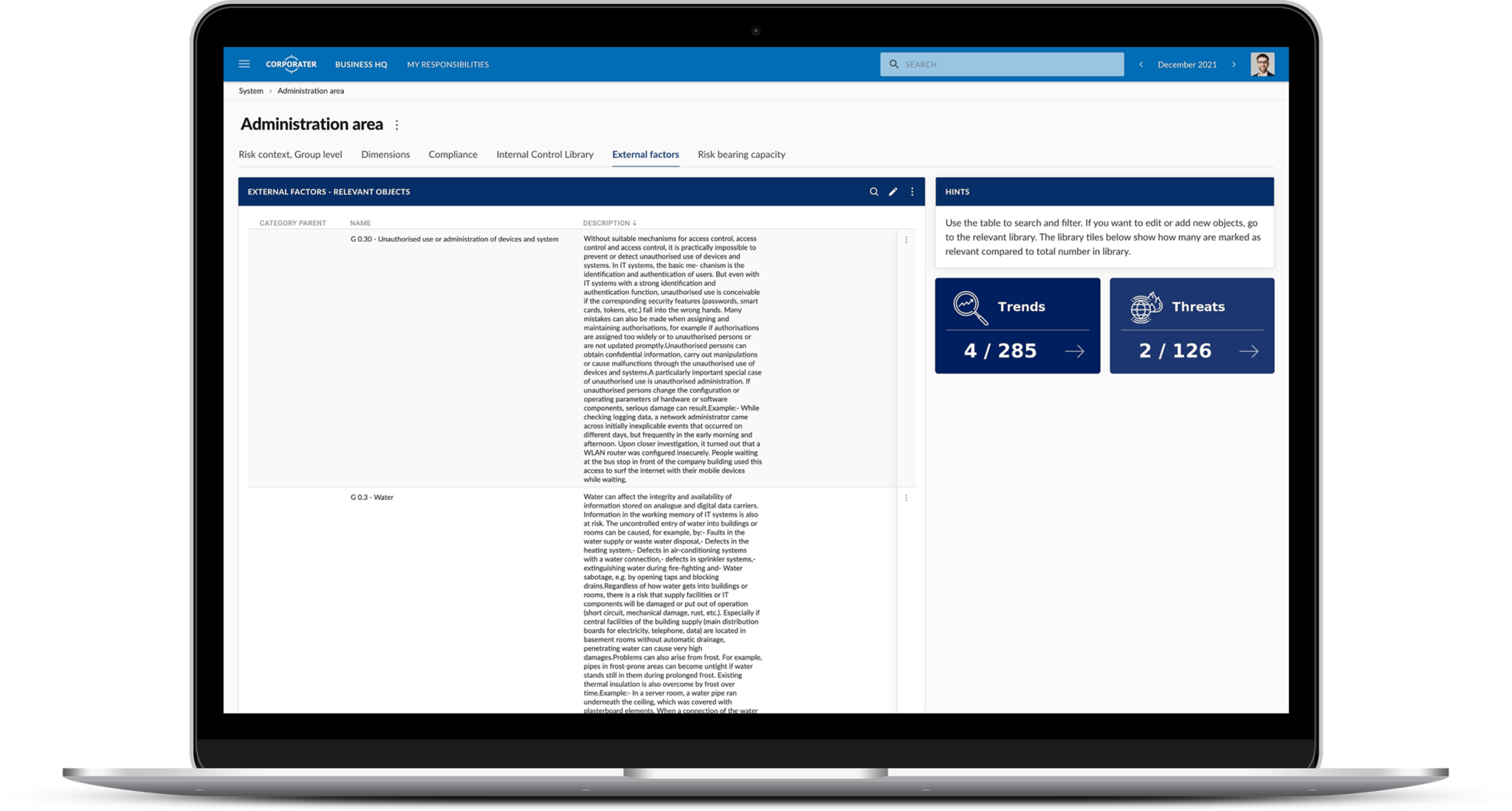

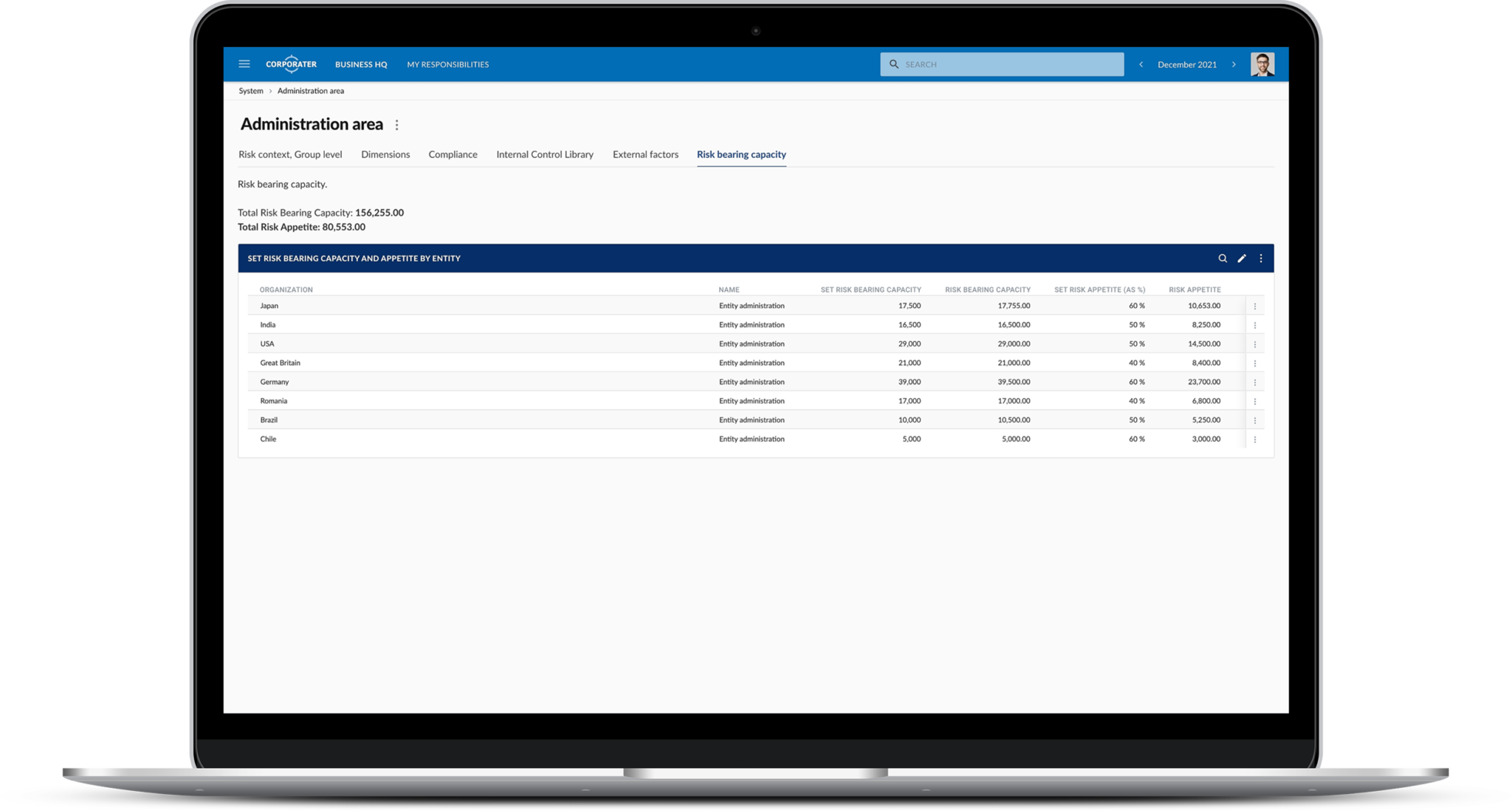

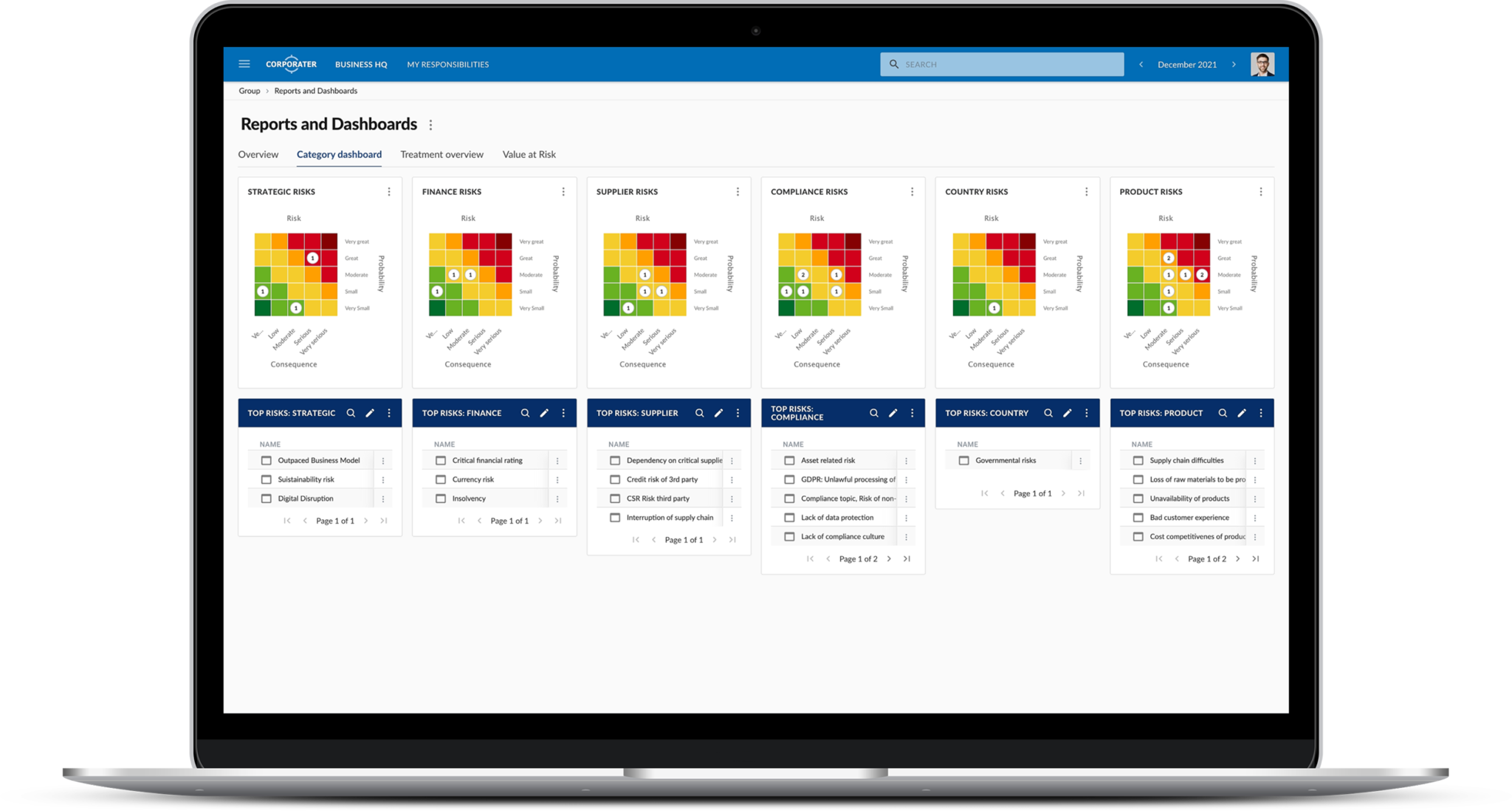

The solution functions as an integrated system where users can identify, analyze, evaluate, communicate, and carry out regular risks assessments and set up stronger controls on risks. It includes an early risk warning system (Risikofrüherkennungssystem) designed specifically for risk identification, risk assessment, and risk communication. The solution also comes with Monte Carlo simulation functionality, which enables CROs and risk managers to estimate the probability for loss according to the Value at Risk methodology – both on the individual risk level and on aggregated / consolidated scenarios.

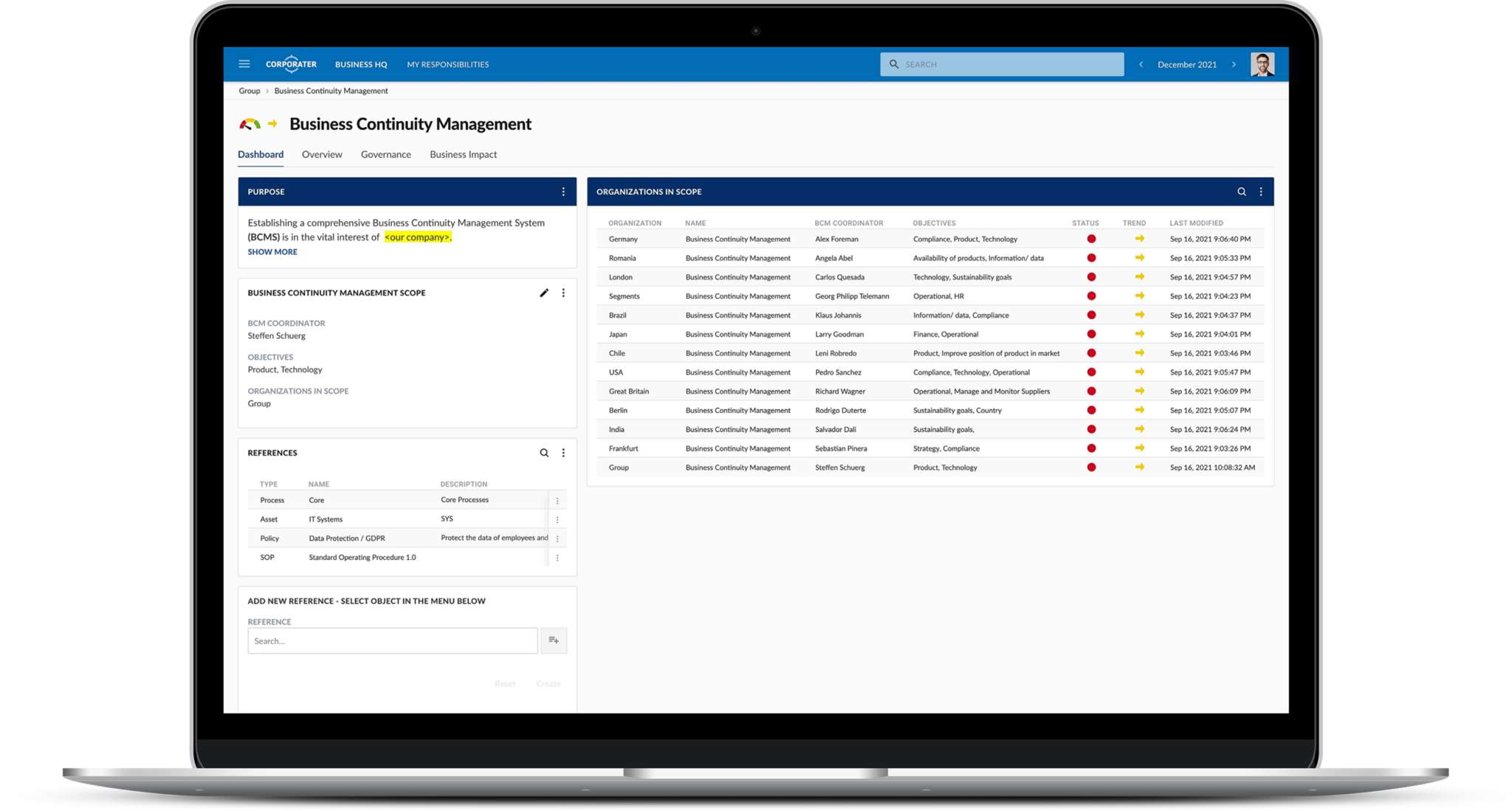

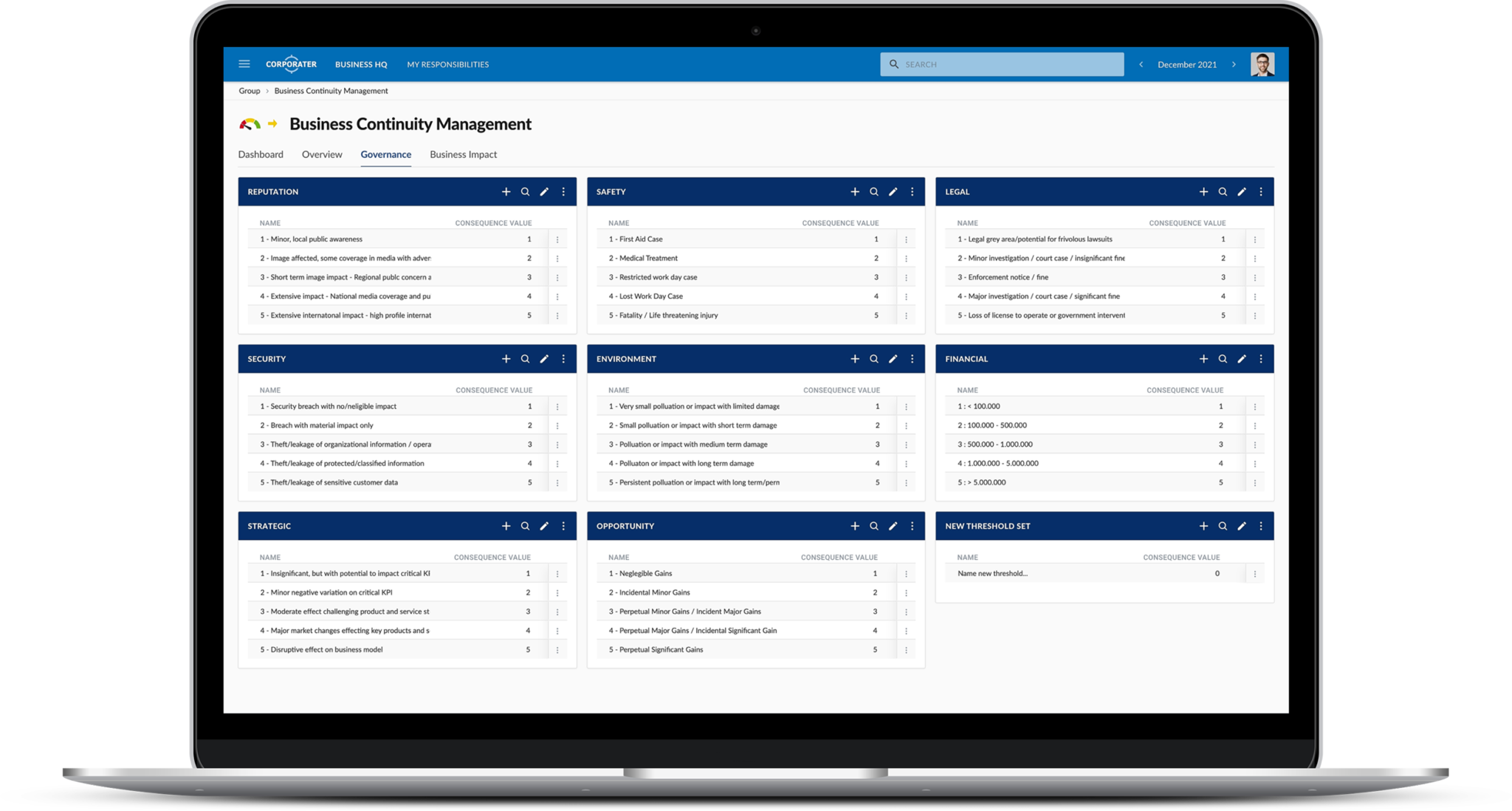

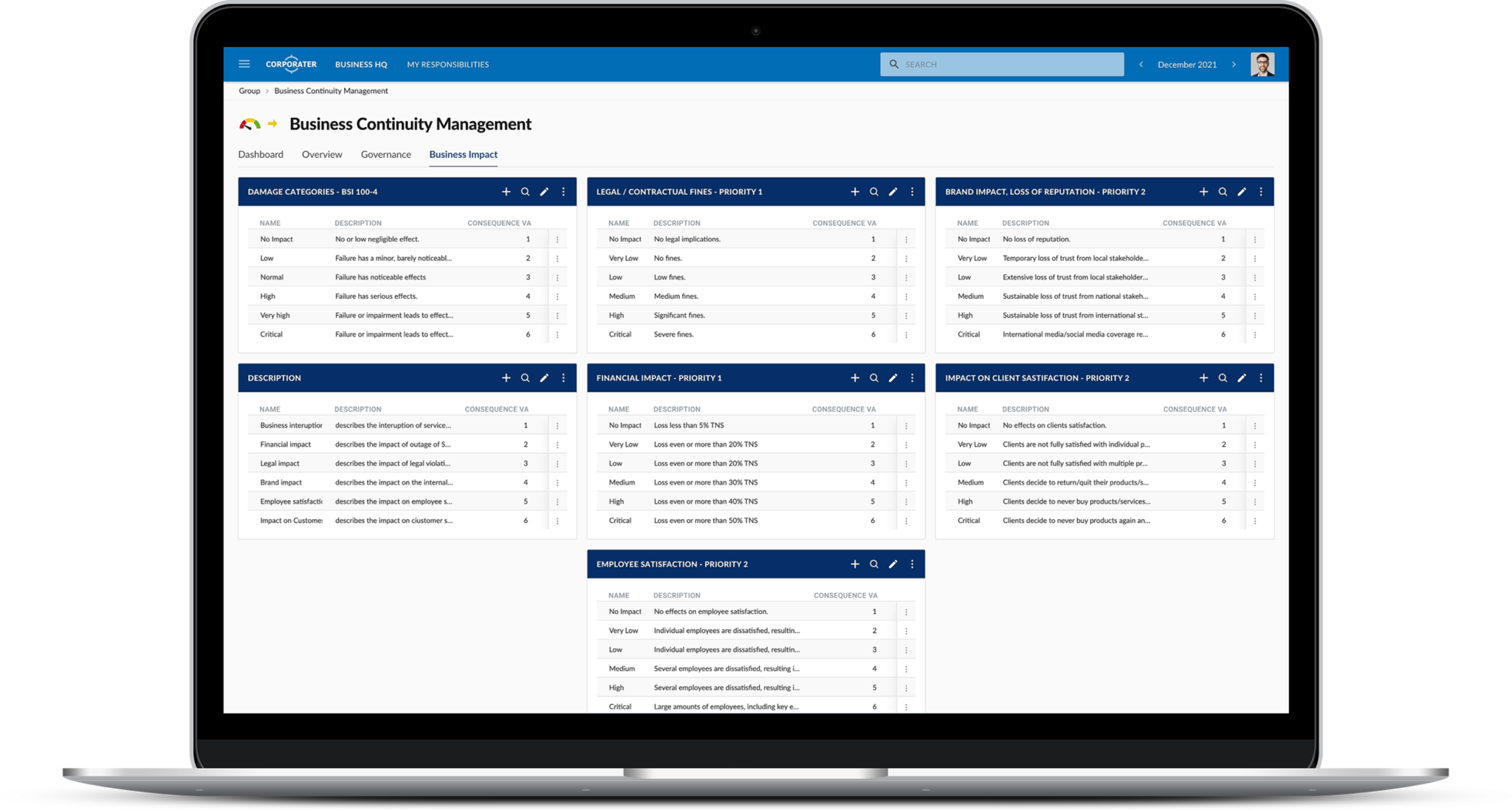

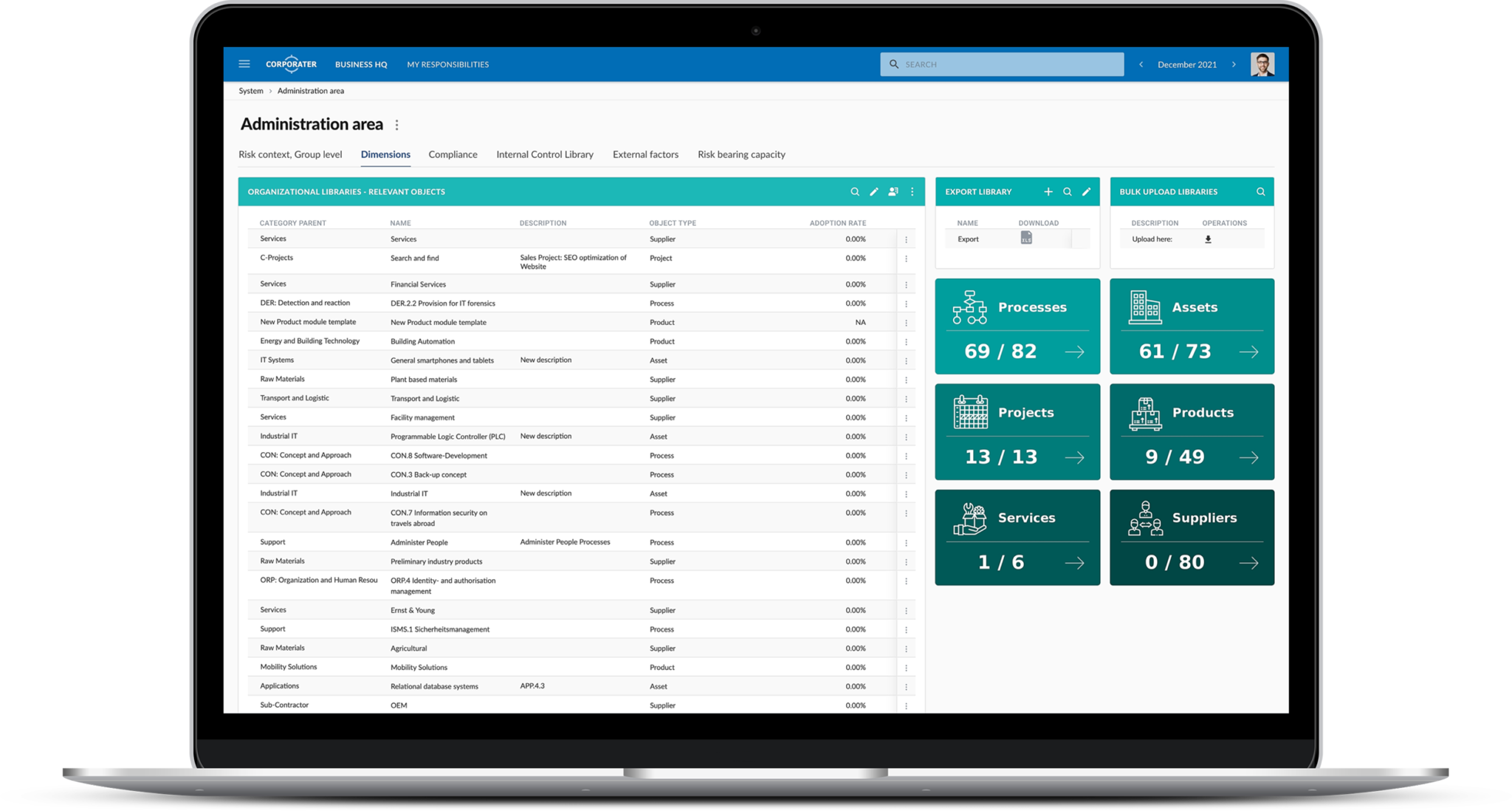

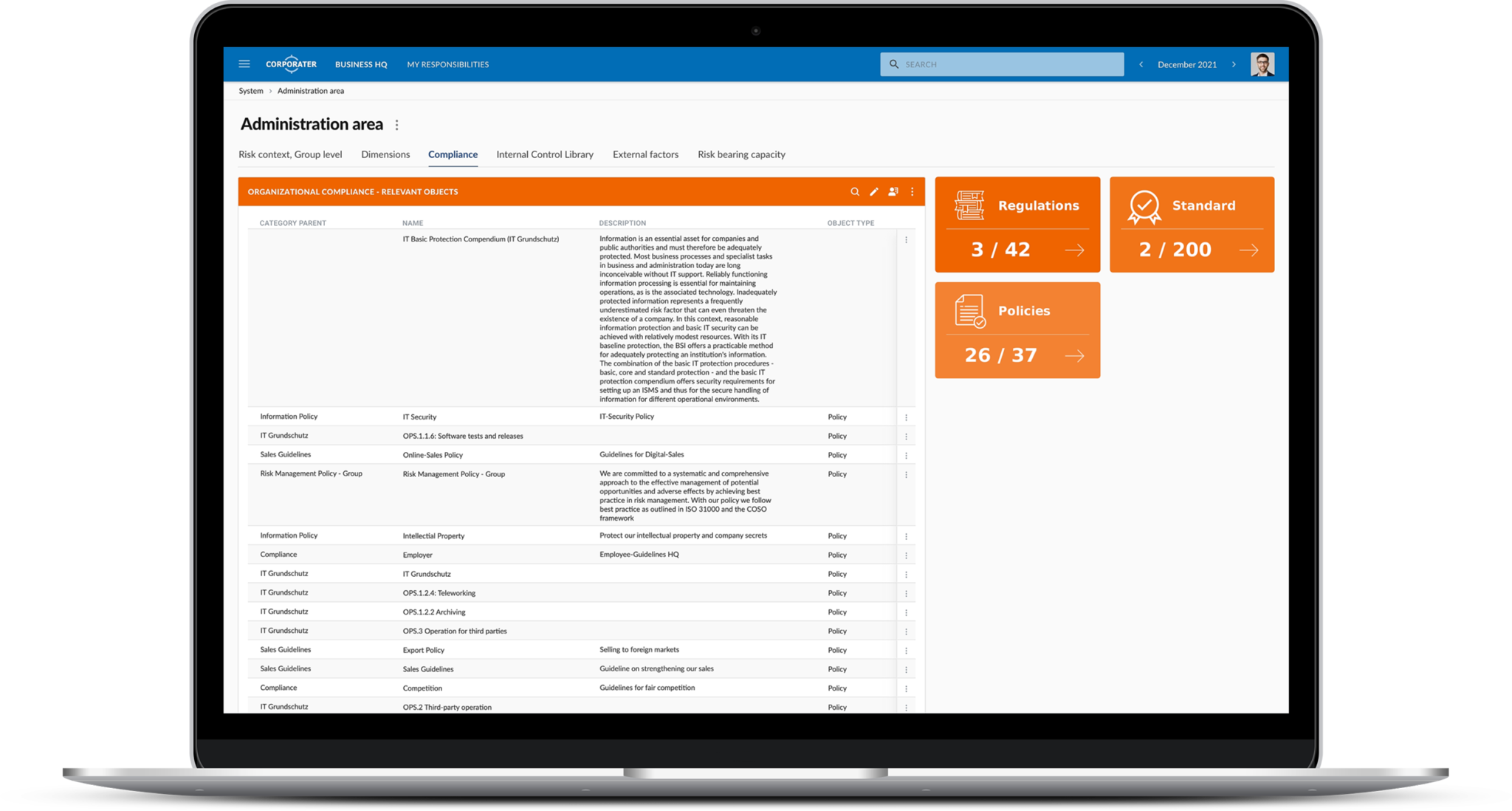

Corporater Risk Management solution for IDW PS 340 n.F. audit standard can be used as a point solution or in combination with other solutions to form a holistic Integrated Risk Management program. Built on Corporater Business Management Platform, the solution can be also further extended to other business management areas within the GPRC domain, such as compliance management, performance management, business continuity, or internal audit, all within the same system.