Operational risk is a certainty for every organization. Every organization faces it. It concerns people risk, process risk, systems risk, external events risk, legal and compliance risk, and it can occur at any level or position within an organization. The challenge becomes how do you manage operational risk effectively?

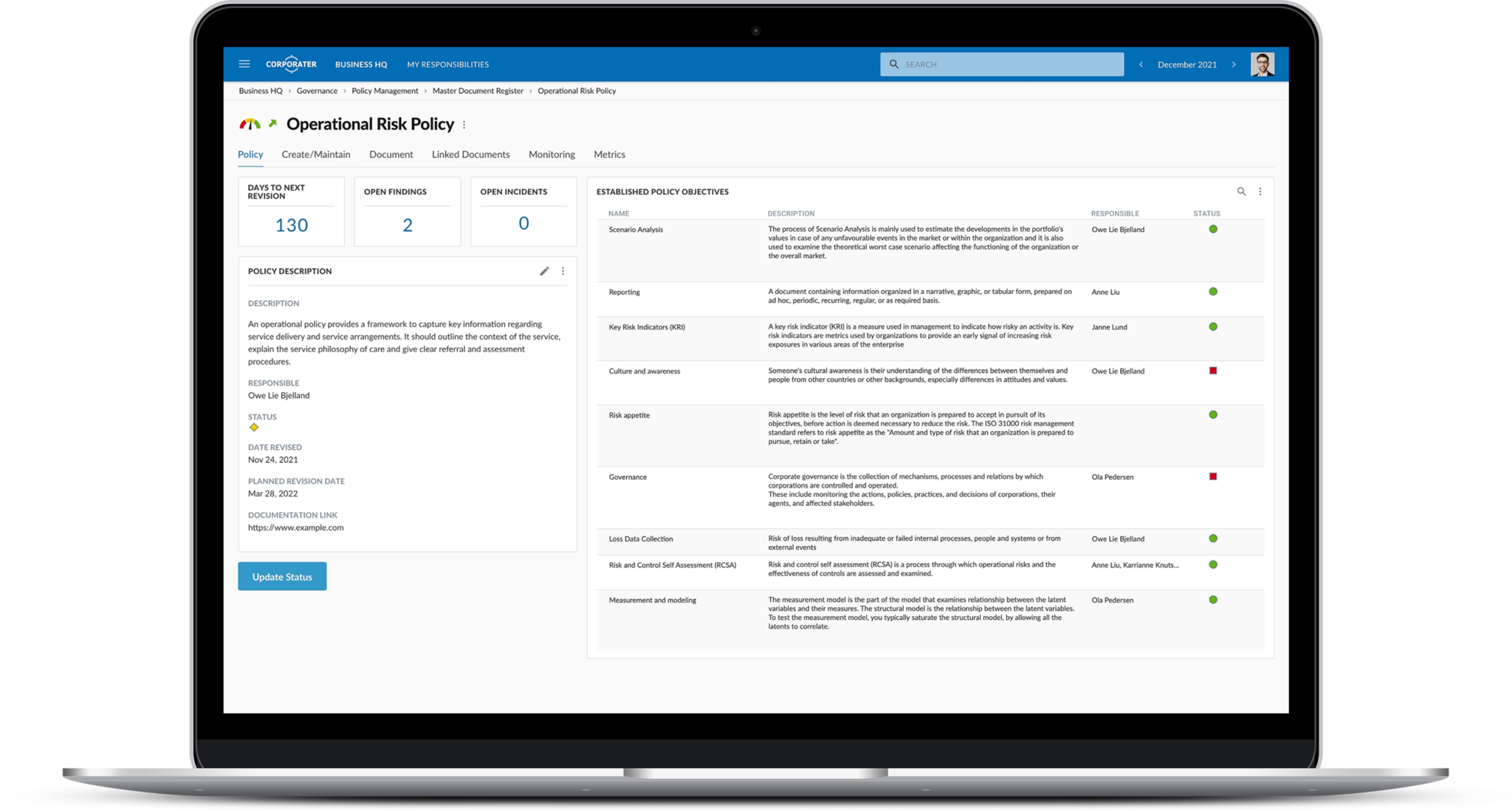

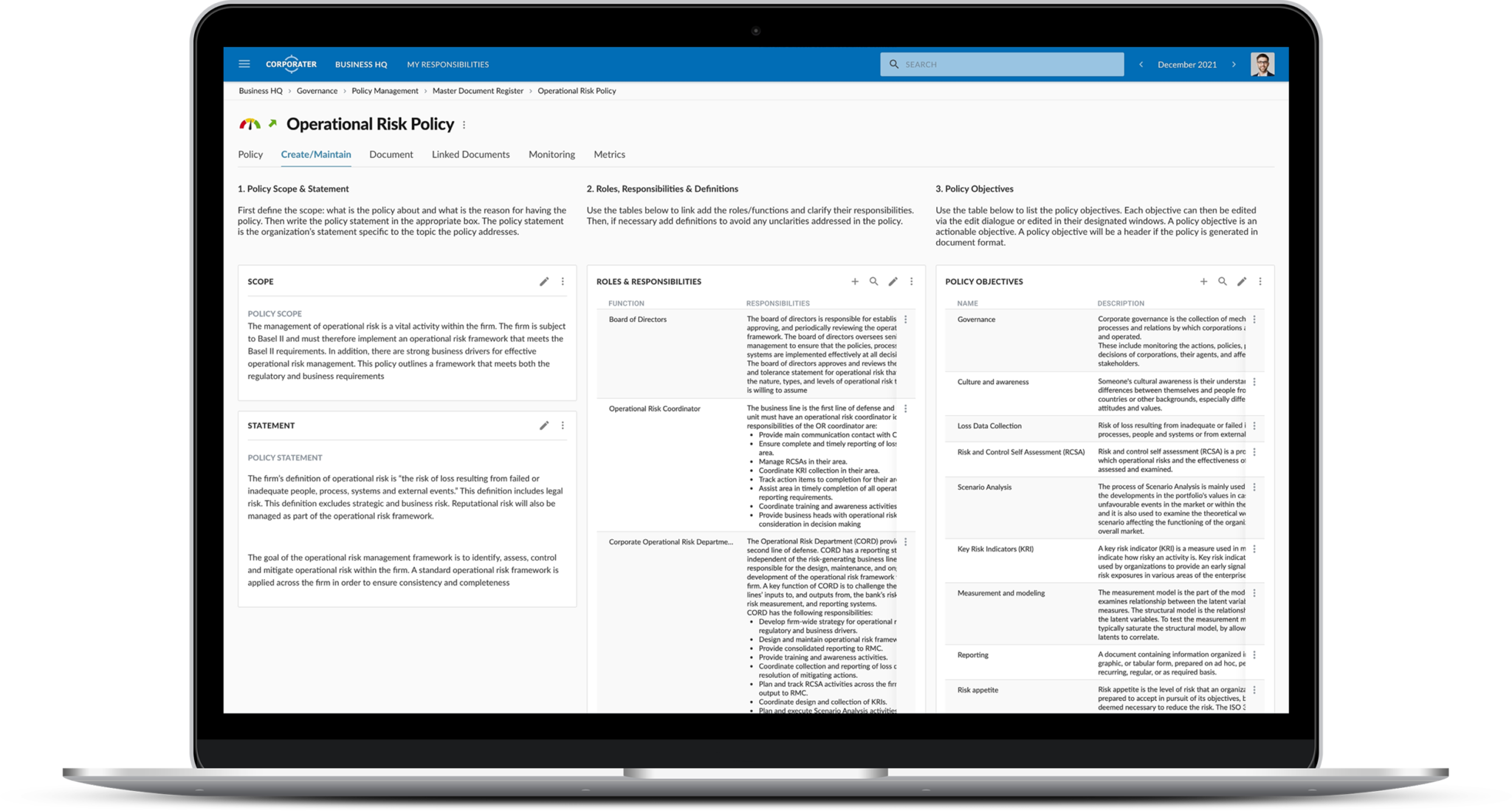

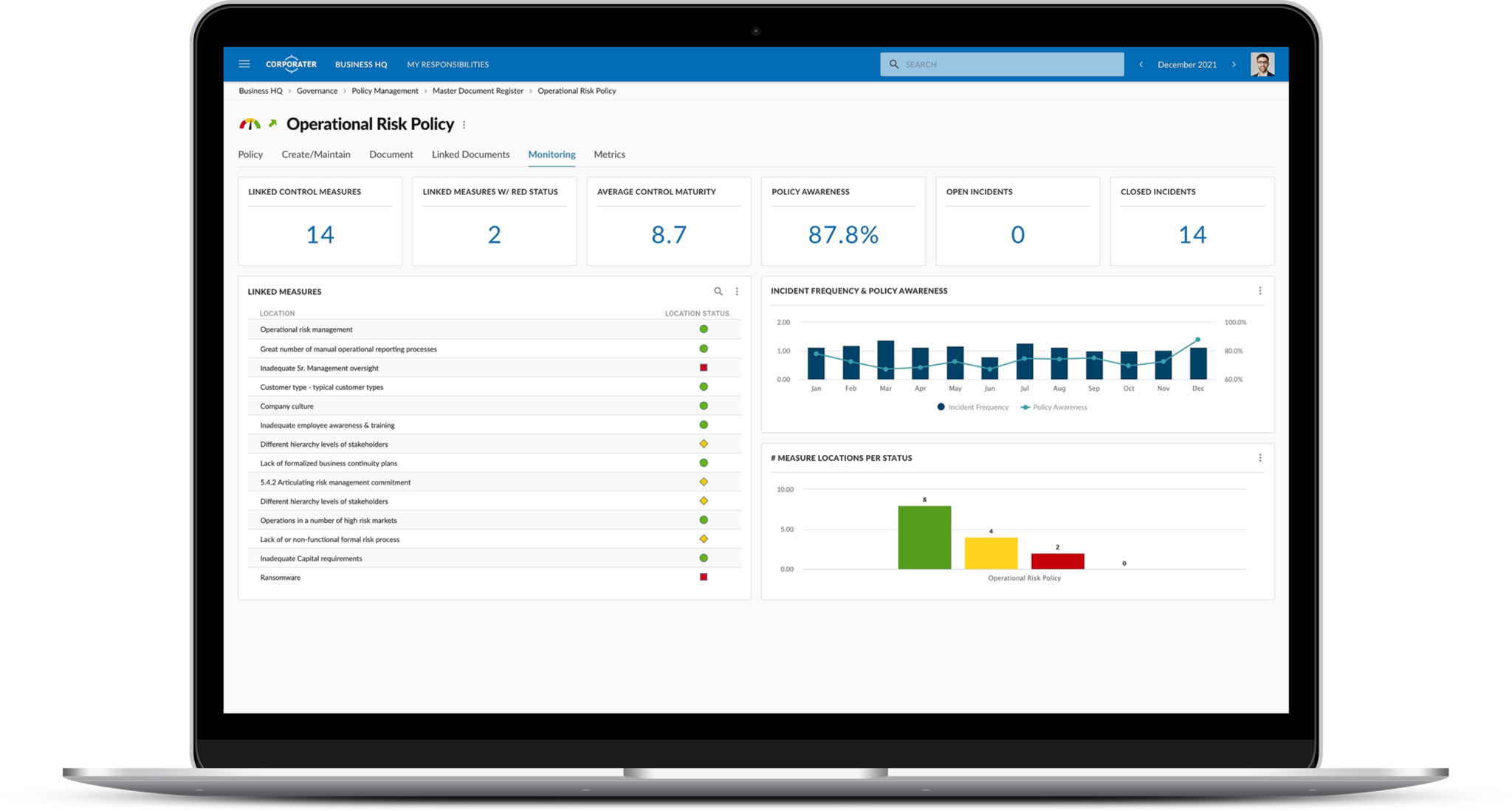

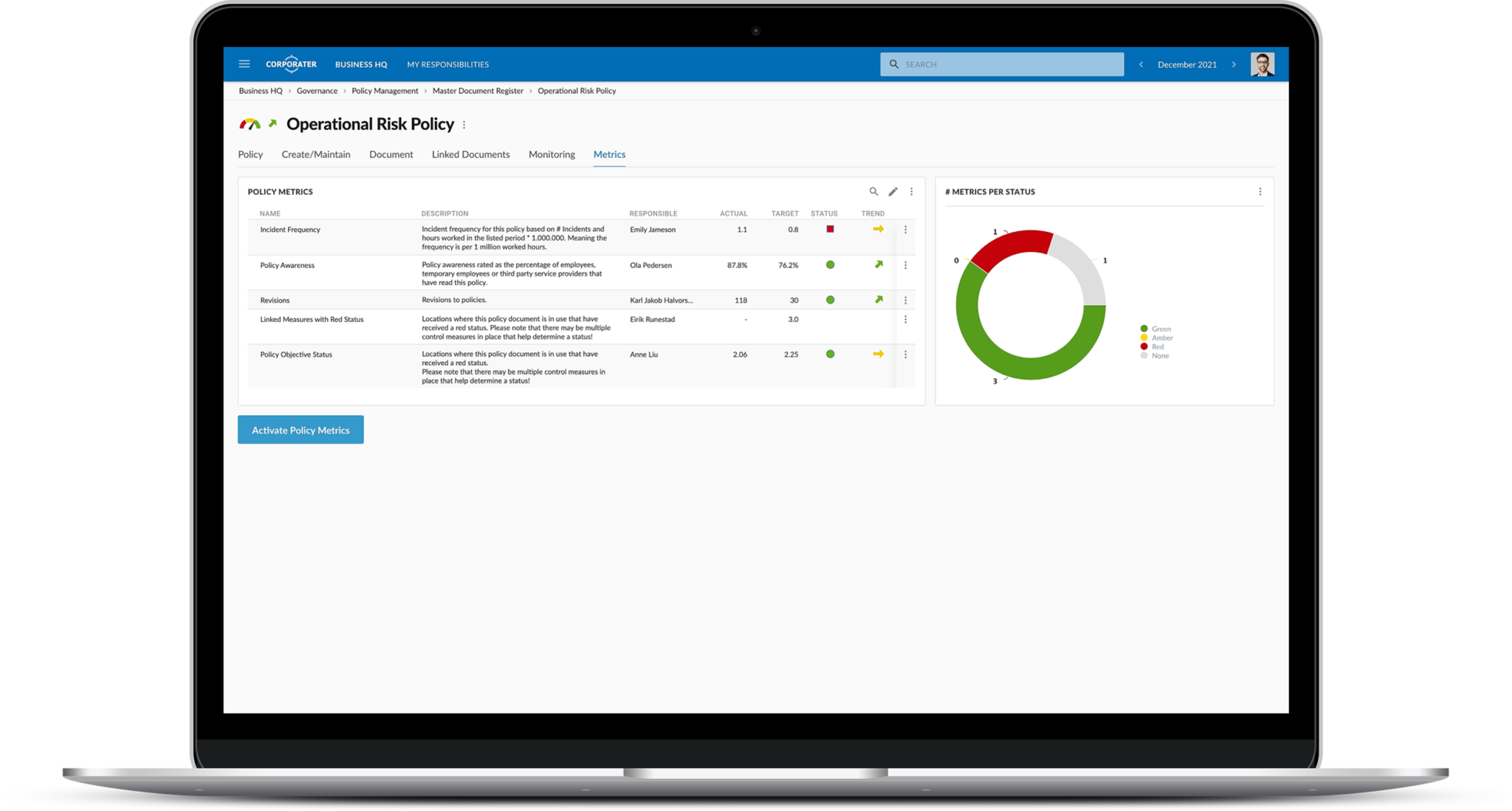

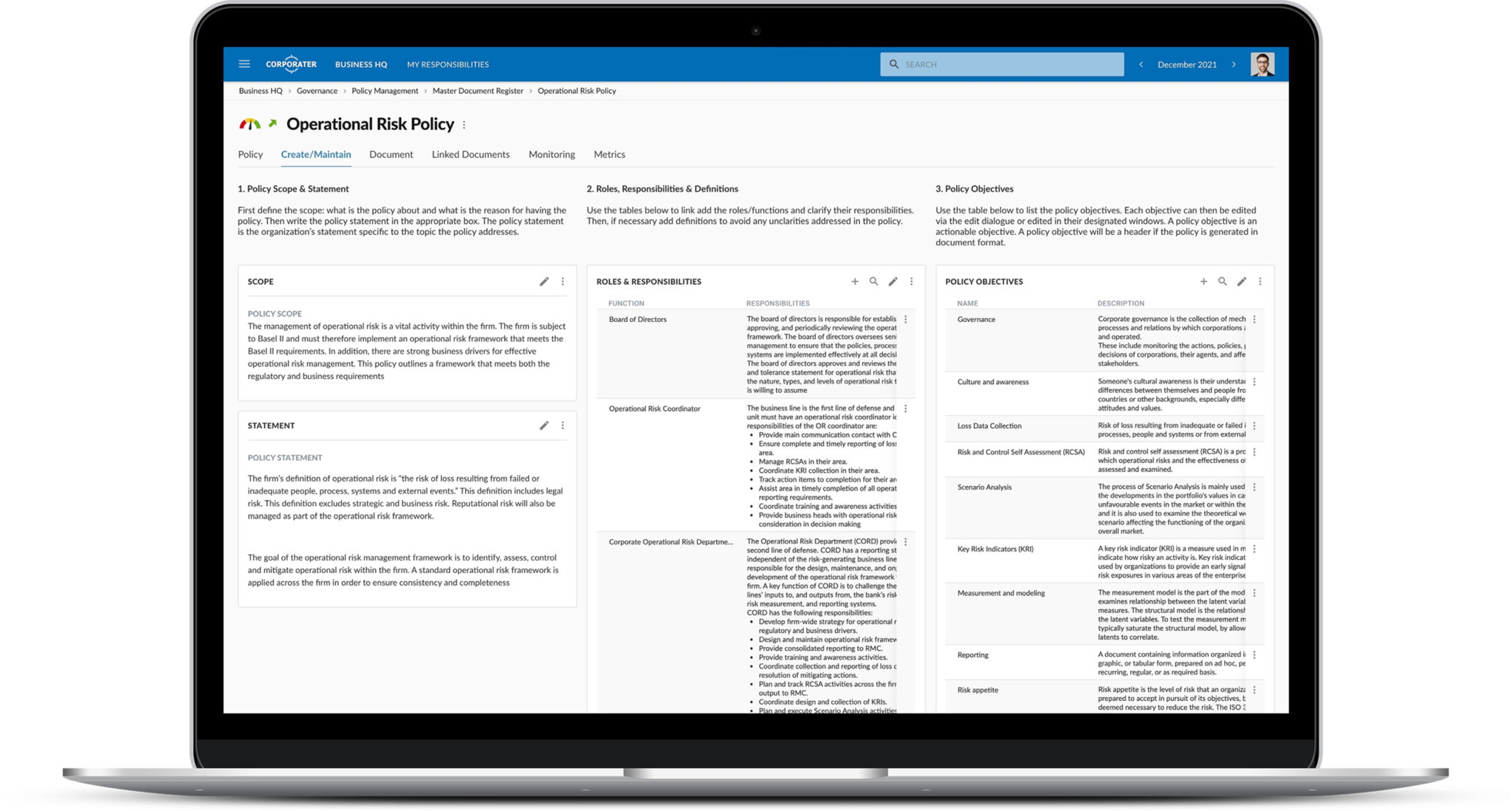

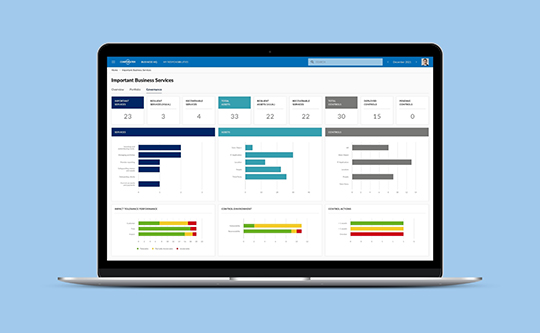

Corporater Operational Risk Management software is an enterprise-grade digital tool that enables organizations to proactively identify, assess, and address operational risks across all departments and business units. The solution provides a comprehensive set of tools that enables CROs, compliance officers, and risk managers to manage risk based on risk framework of their choice – use ISO 27005, ISO 31000, COSO ERM, or a hybrid. Achieve a holistic oversight of operational risk, automate risk management processes and workflows, conduct risk assessments, monitor compliance with laws and internal policies, and generate risk and compliance reports.

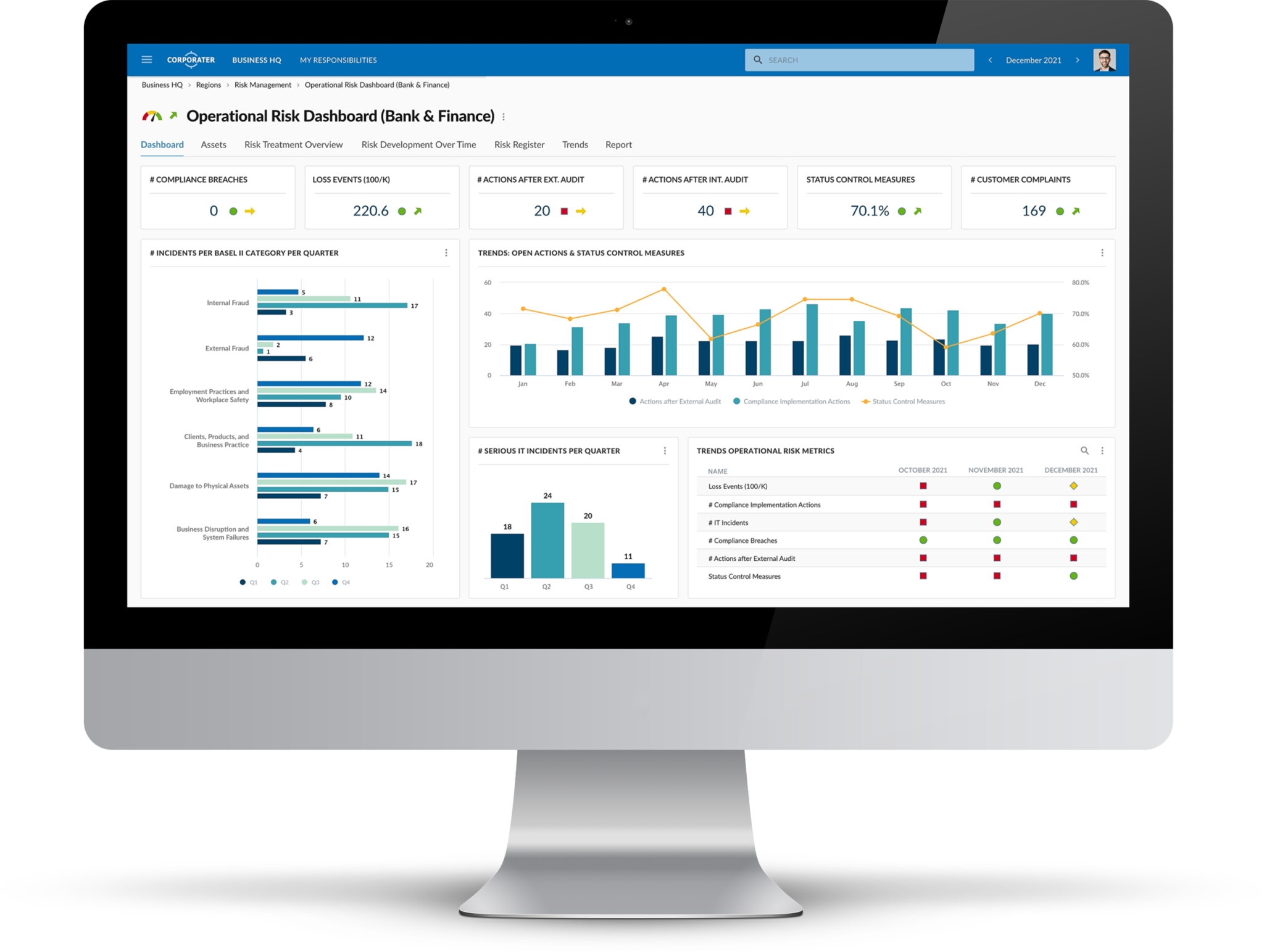

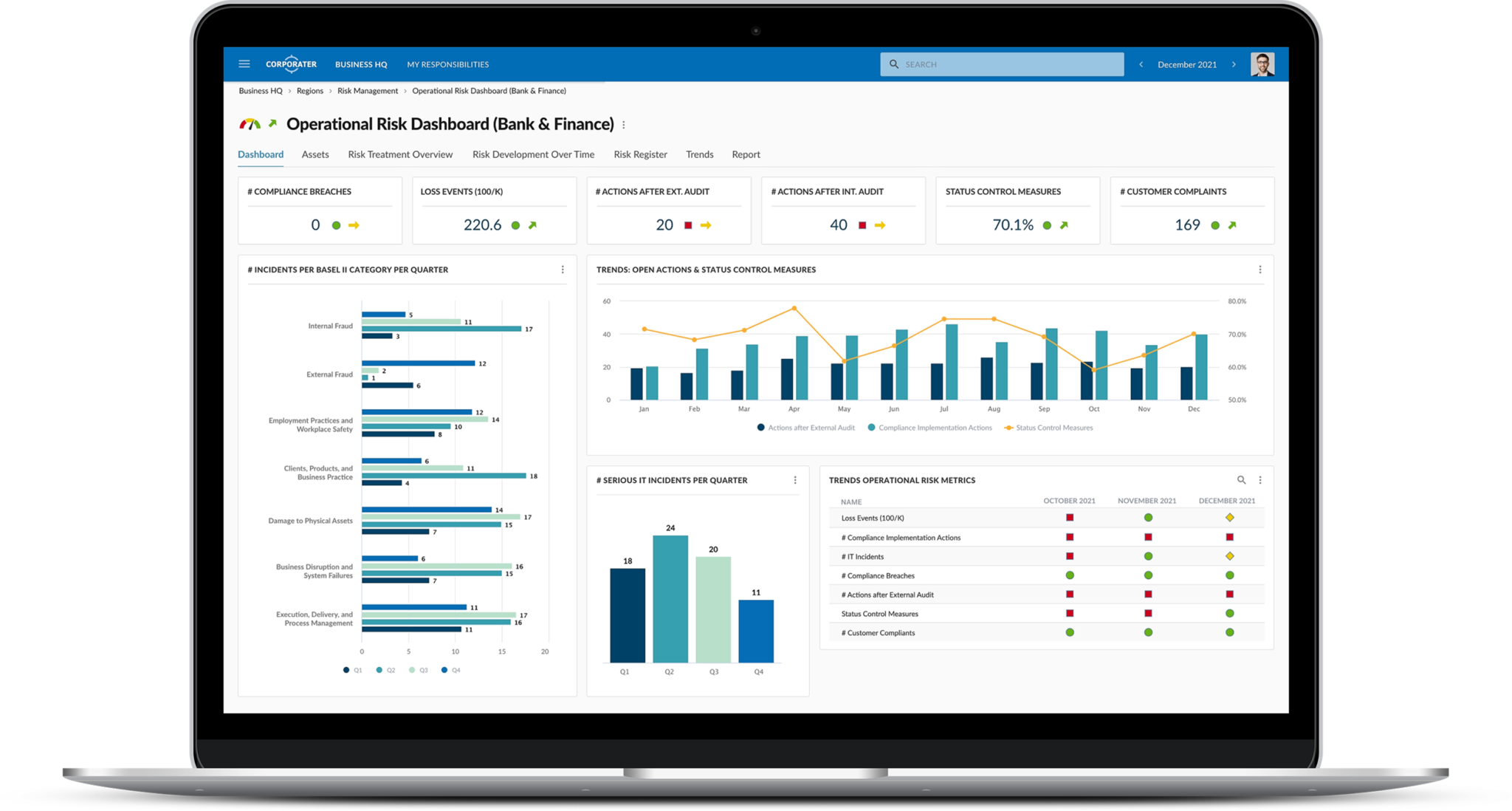

Operational Risk Management for Banking & Finance

Corporater Operational Risk Management solution for banking & finance helps the financial industry to prevent and proactively manage the risk of loss resulting from inadequate or failed internal processes, people, and systems, from external events, or from non-compliance.

Take control of the siloed NFR information chaos: provide oversight, enable collaboration & awareness, ensure information integrity, consolidate risk reporting, and achieve an efficient and compliant programme. Replace your Excel sheets with a professional IT system that will help you take your prudent risk management programme to the next level, and provide your organization with the ability to tell the same story.