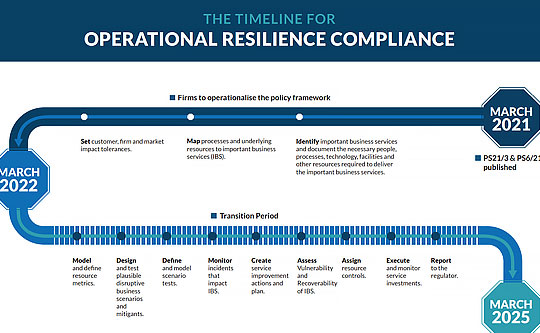

It has been a key priority for the Bank of England (BoE), Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA), collectively “the supervisory authorities,” to put in place a stronger regulatory framework to promote the operational resilience of firms and FMIs. The supervisory authorities published a joint Discussion Paper on Operational Resilience in 2018, setting out an approach to operational resilience. Next, the supervisory authorities published a suite of consultation documents “the consultations” in 2019 to embed this approach into policy. On March 29, 2021, the supervisory authorities published their final policy and supervisory statements “Operational resilience: impact tolerances for important business services.”

Under the consultations proposed requirements, firms and FMIs are expected to:

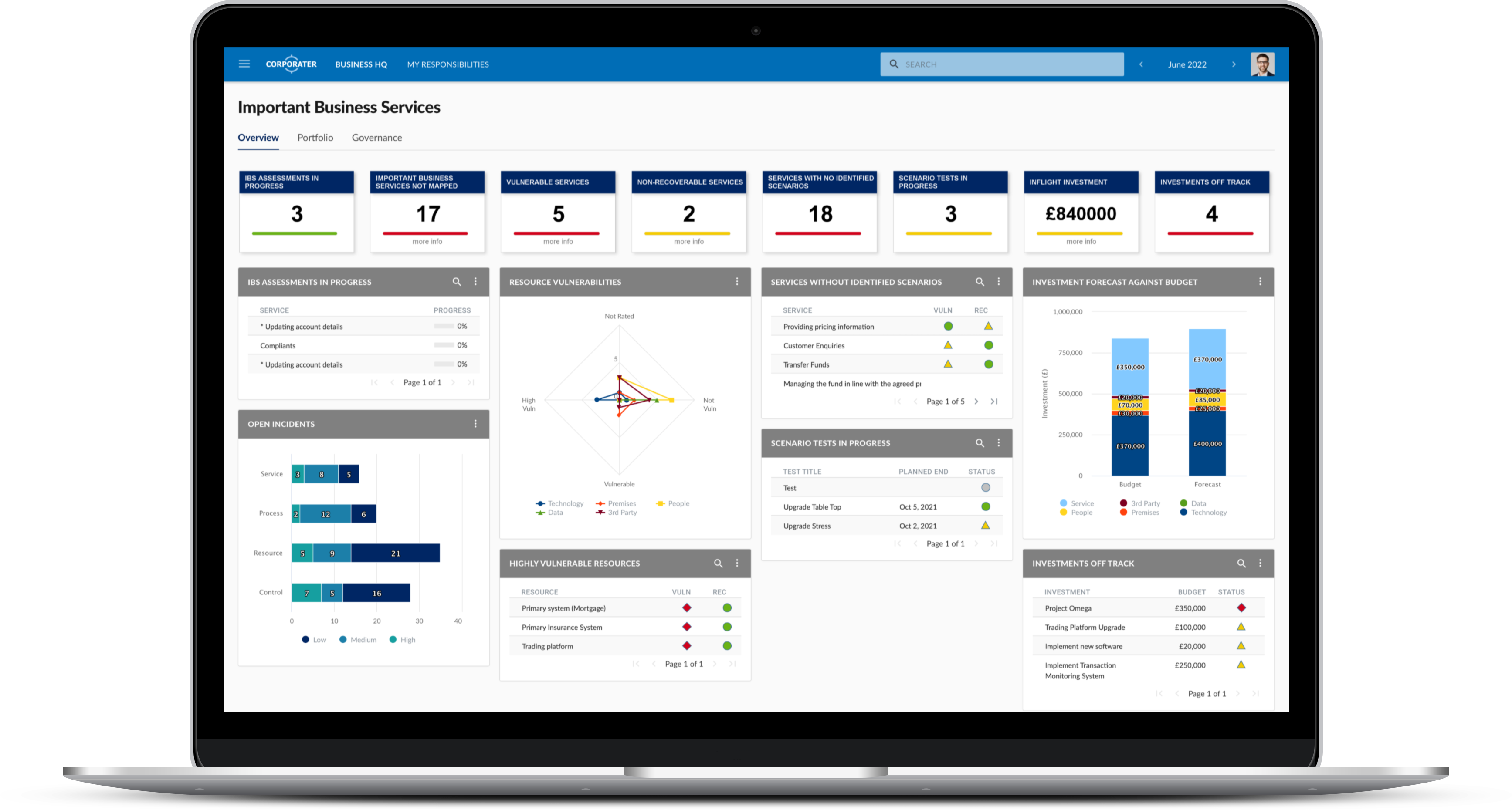

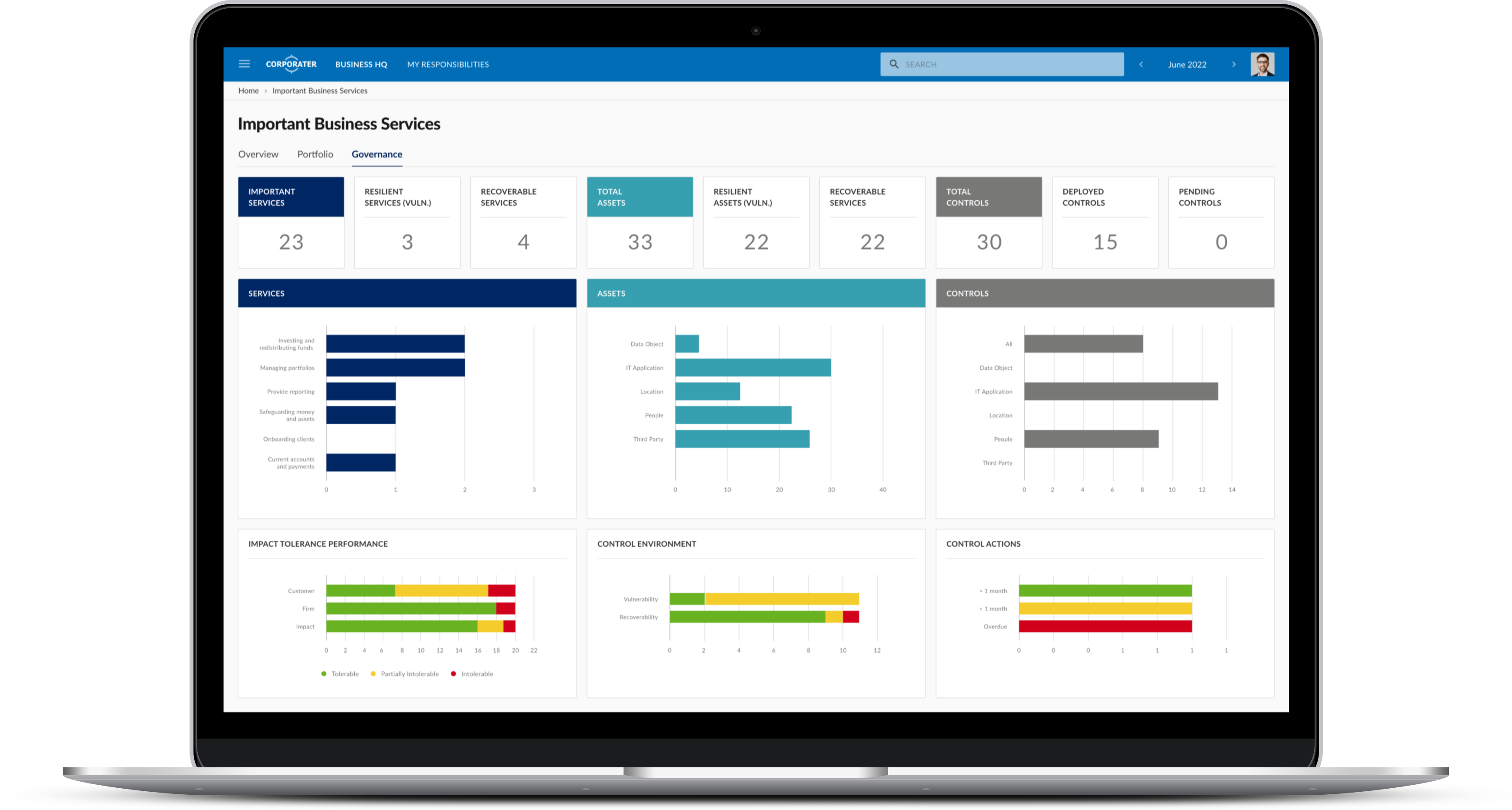

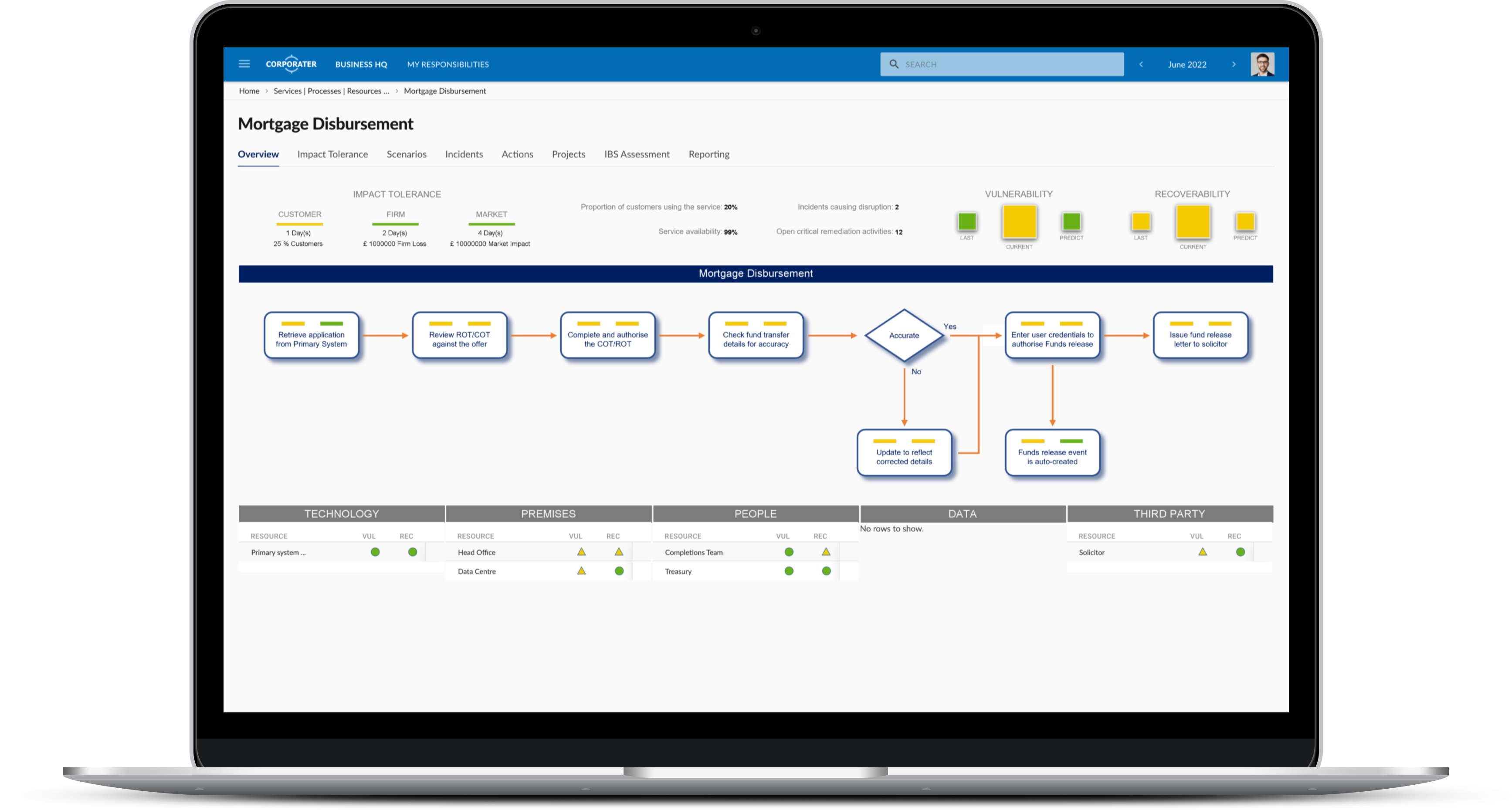

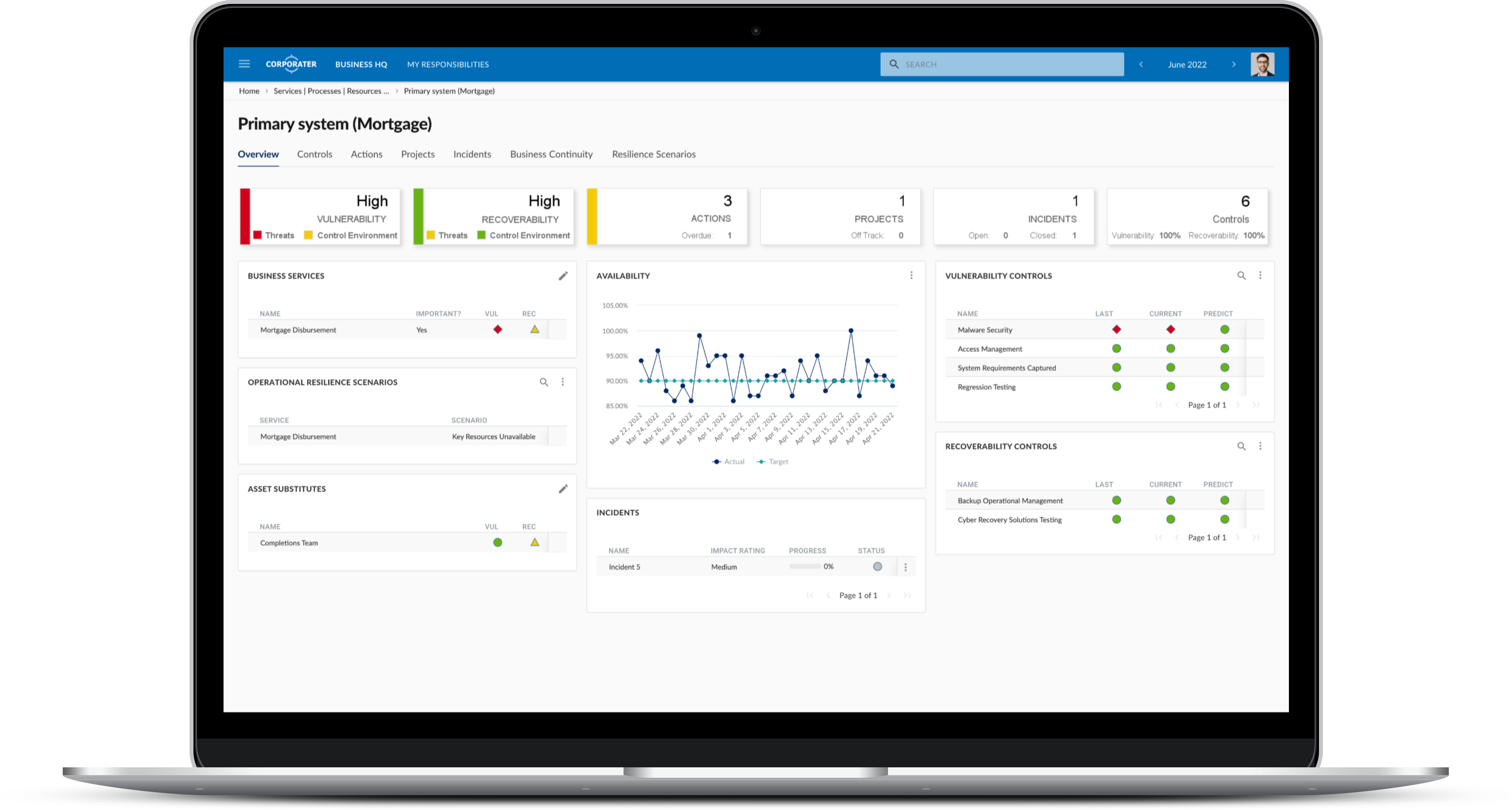

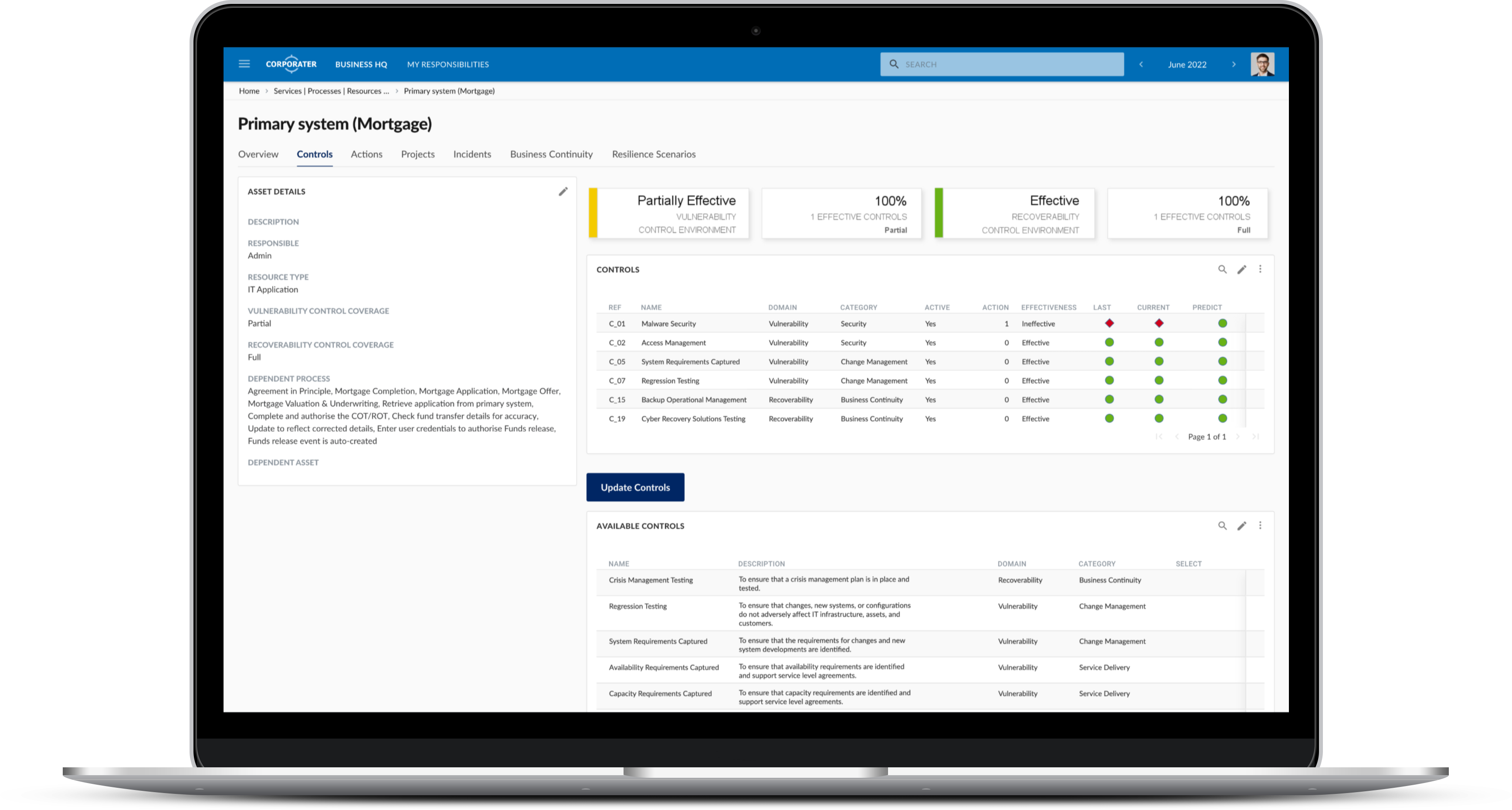

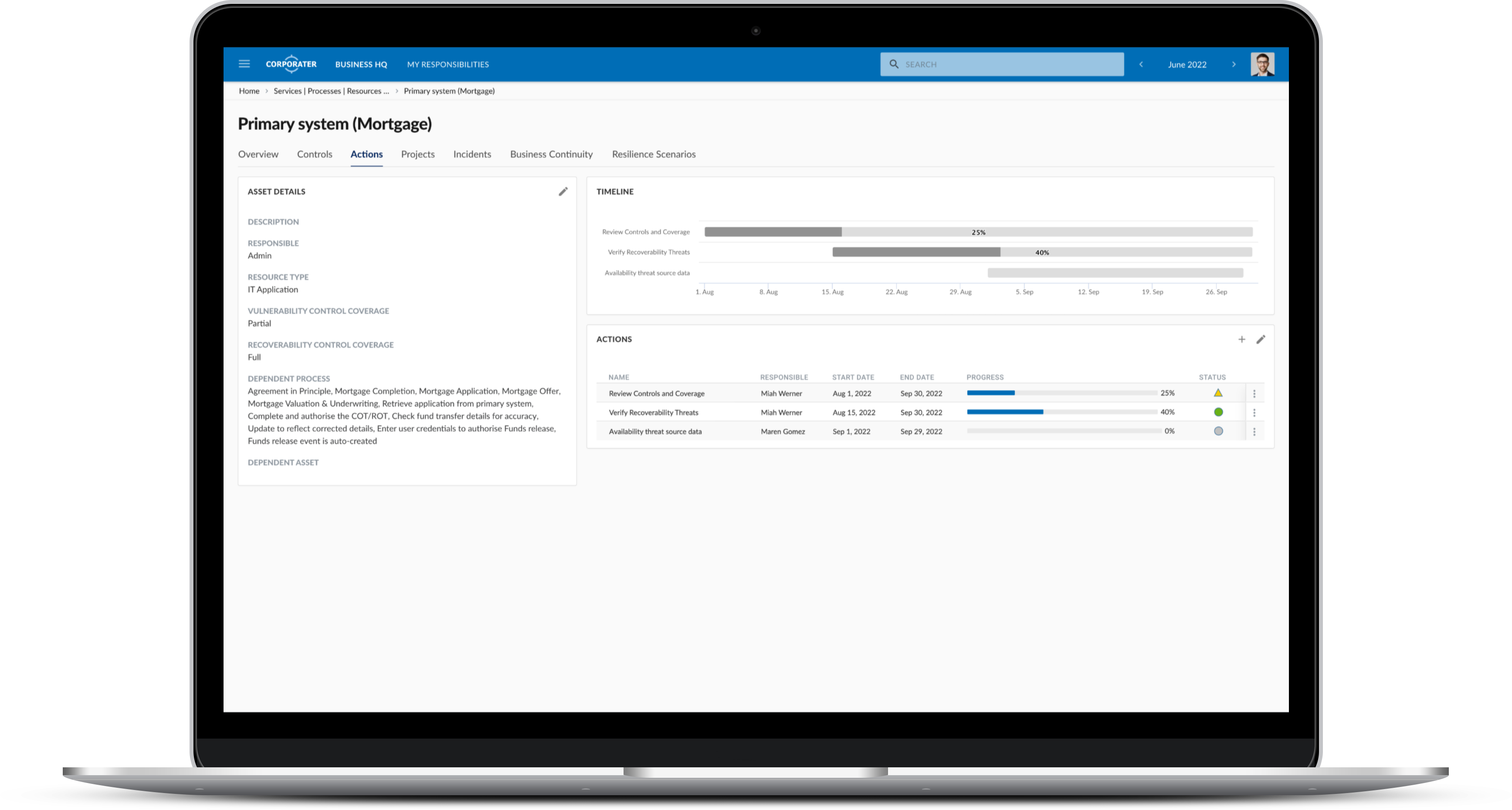

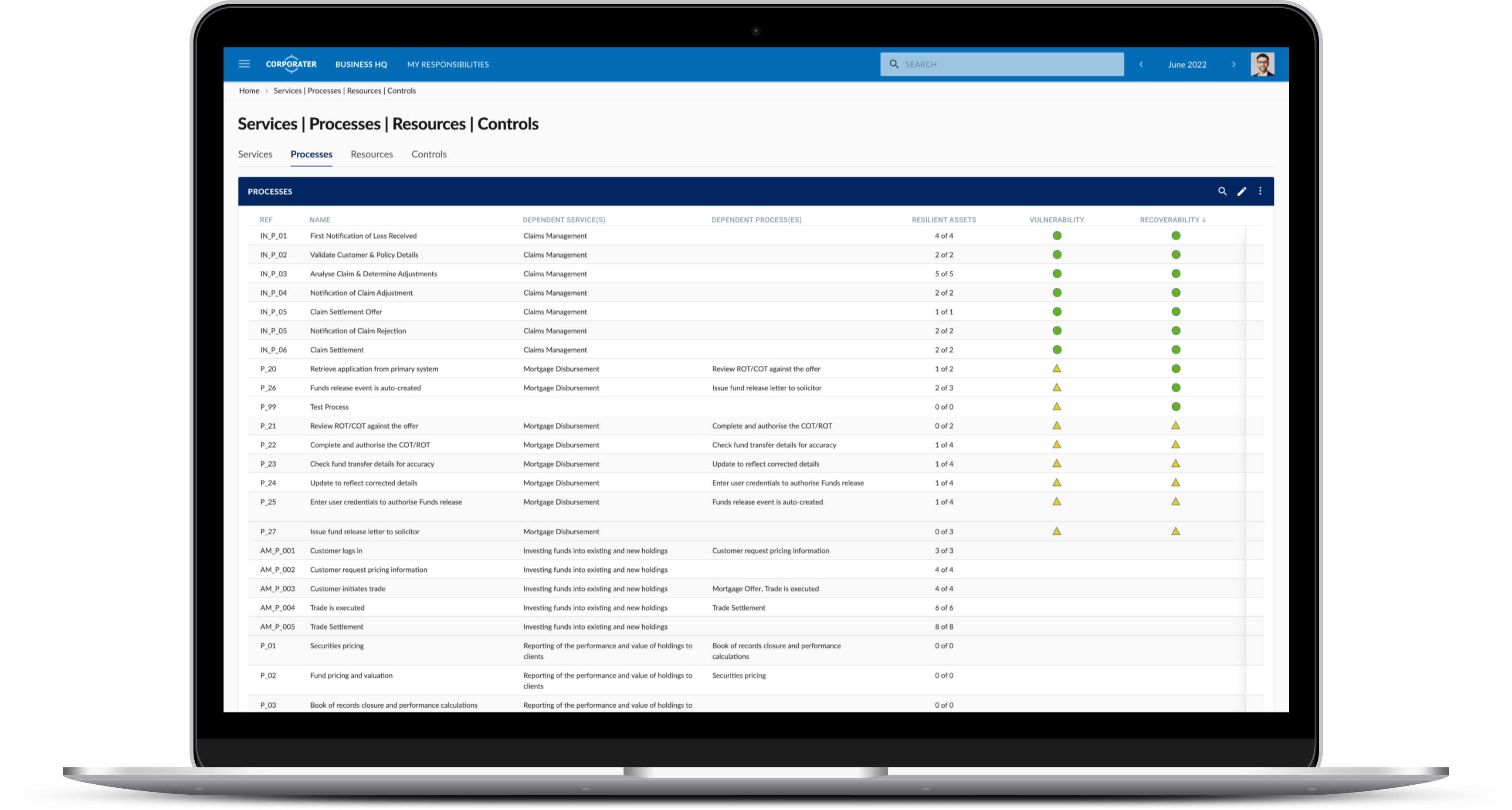

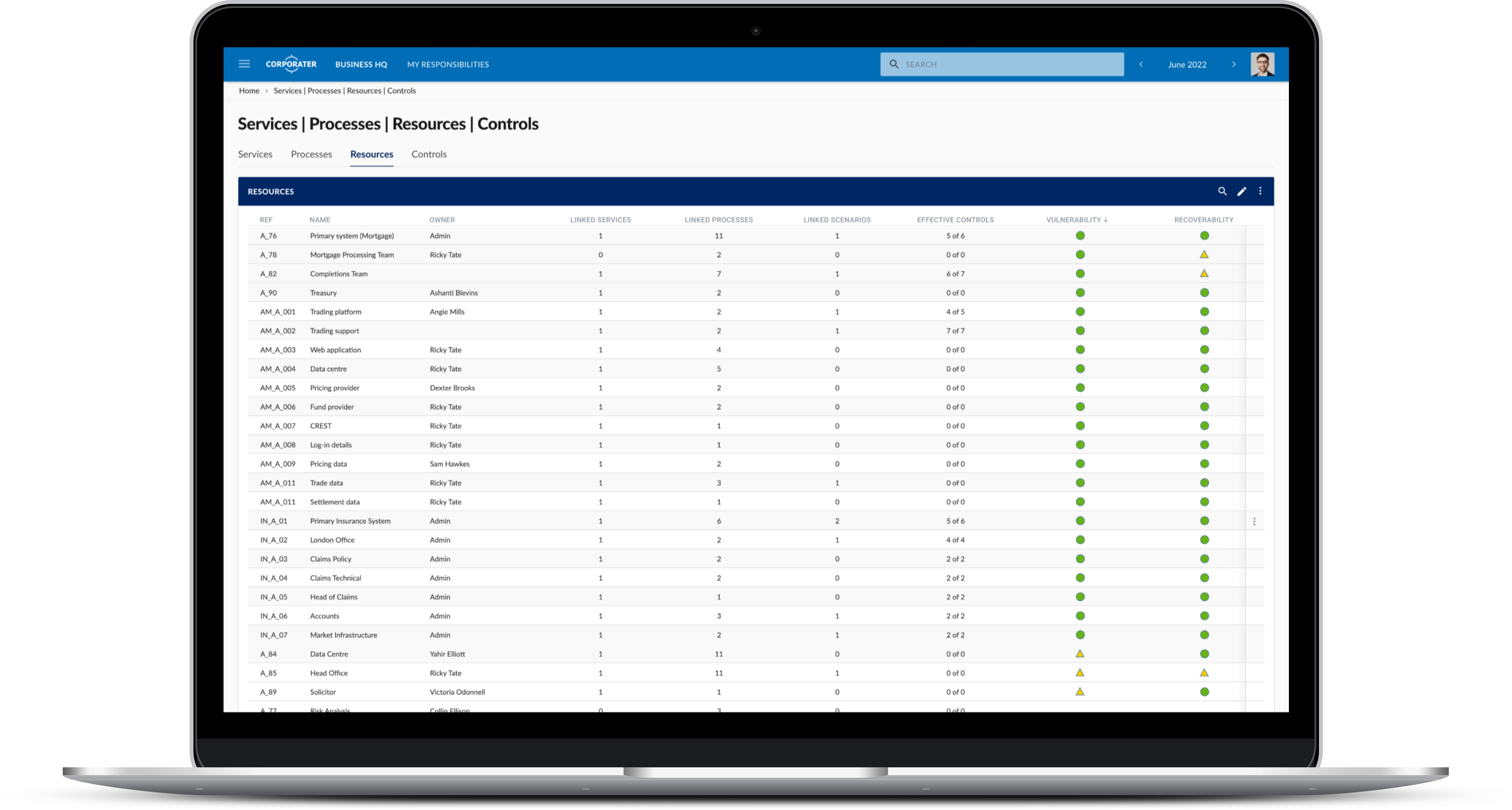

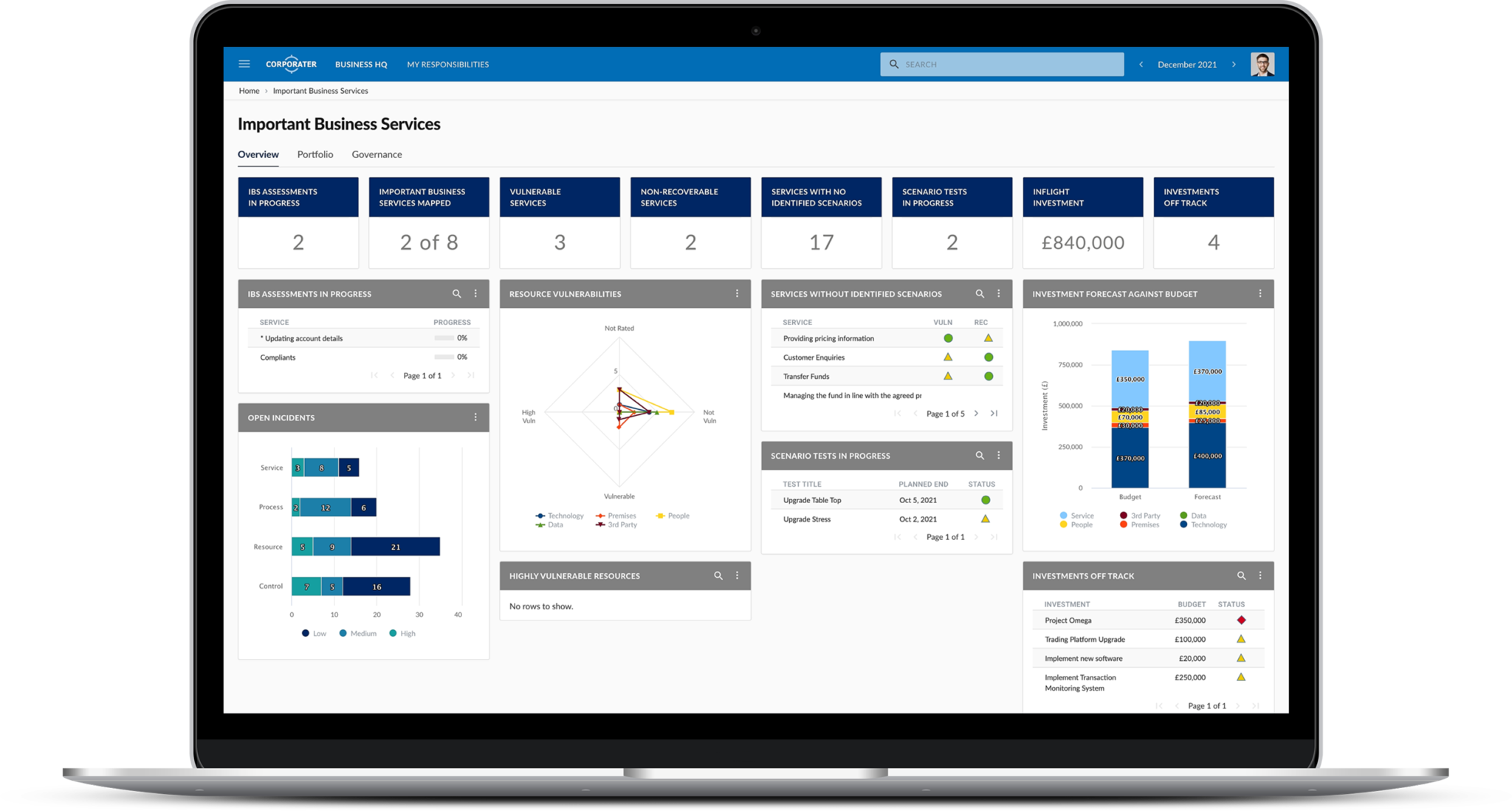

- identify their important business services by considering how disruption to the business services they provide can have impacts beyond their own commercial interests;

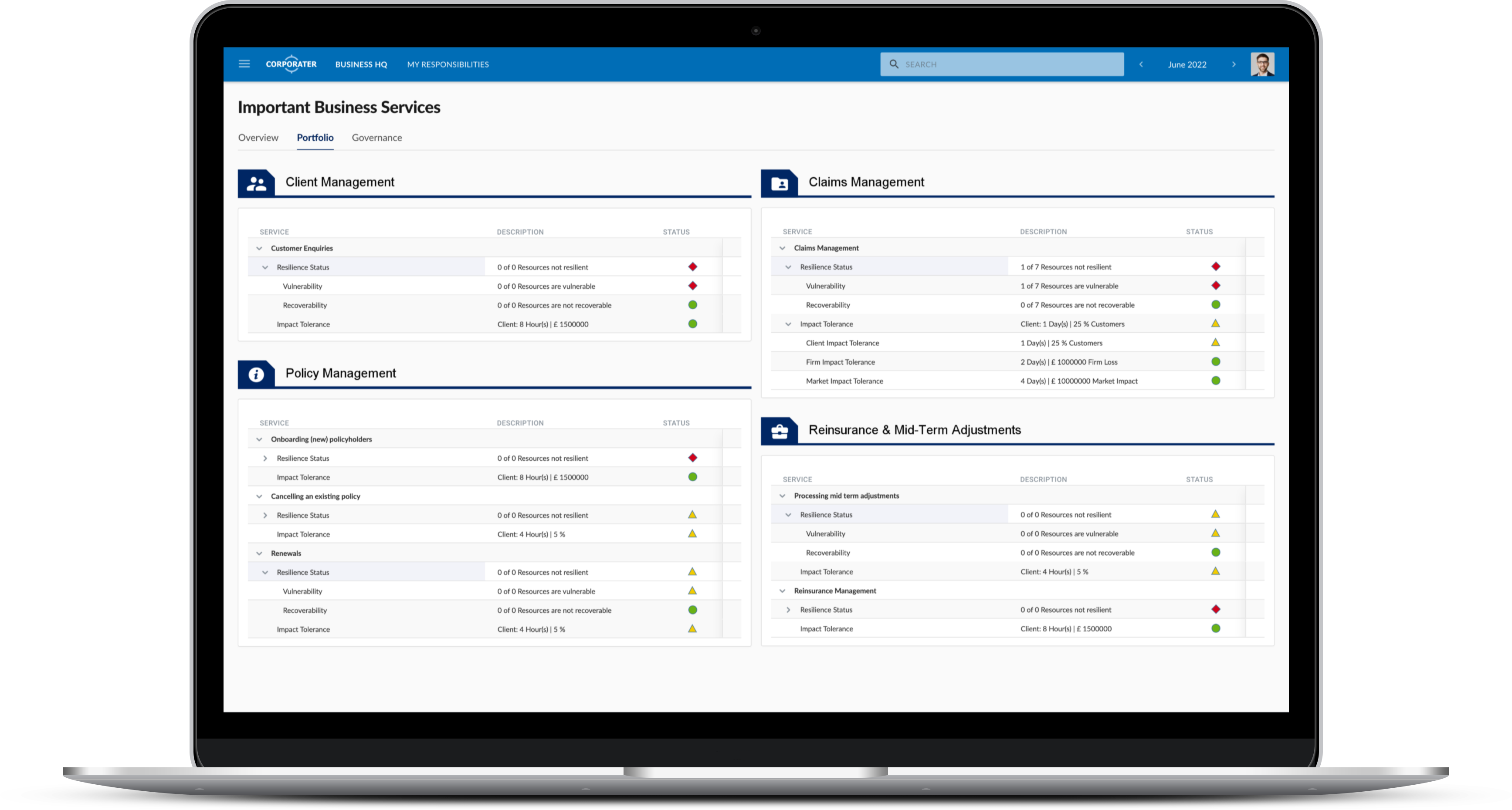

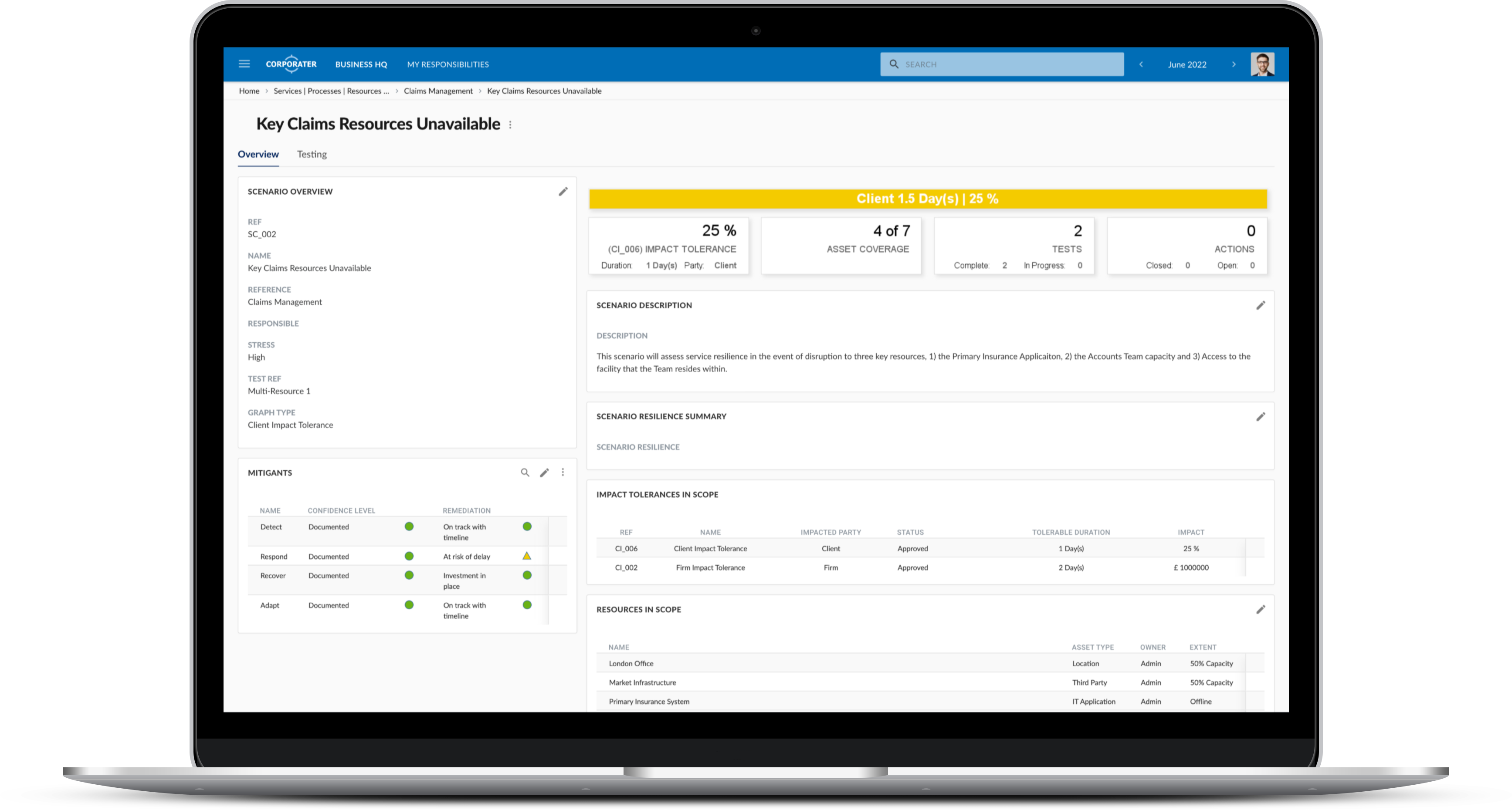

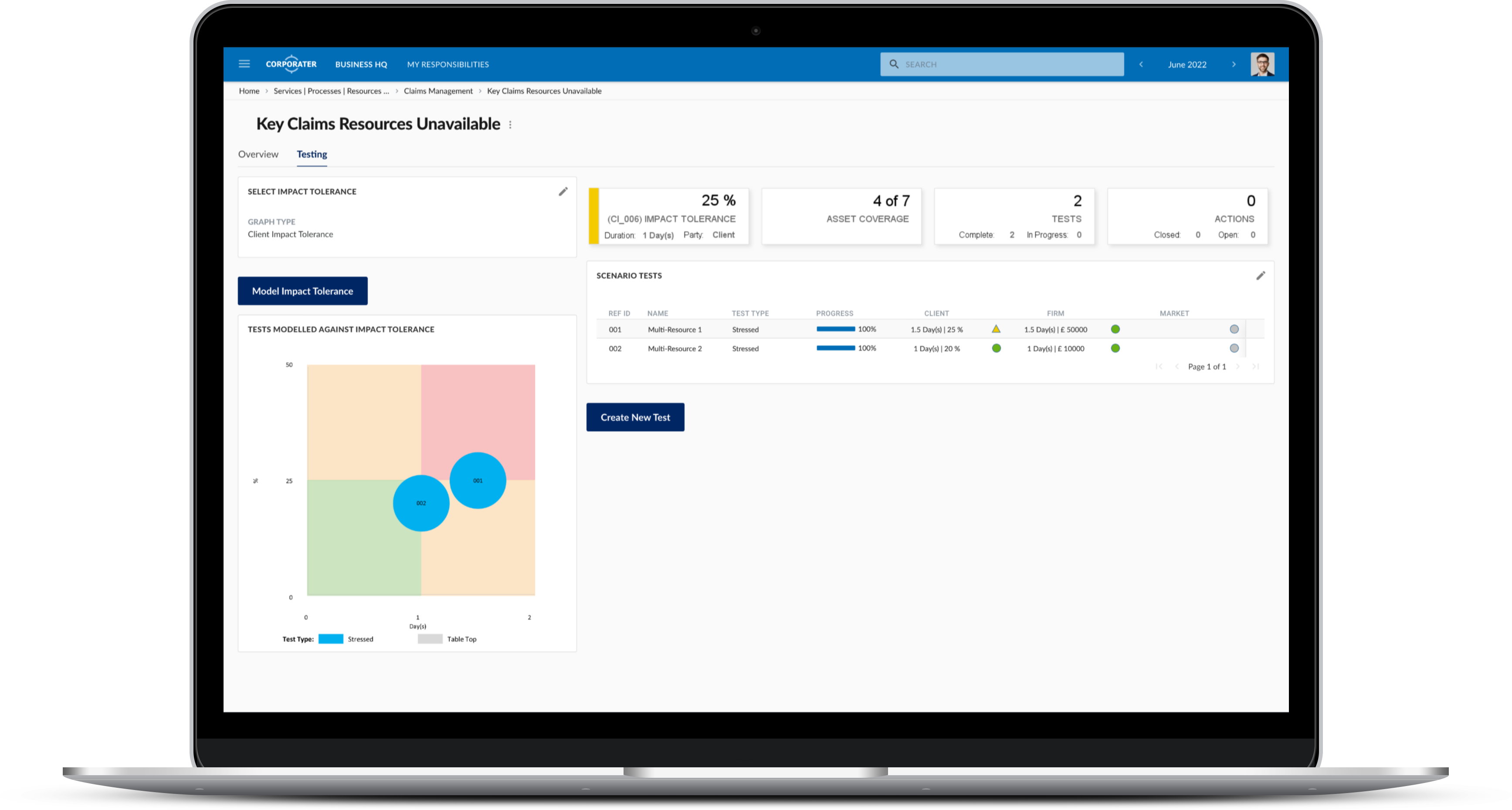

- set a tolerance for disruption for each important business service; and

- ensure they can continue to deliver their important business services and are able to remain within their impact tolerances during severe (or in the case of FMIs, extreme) but plausible scenarios.