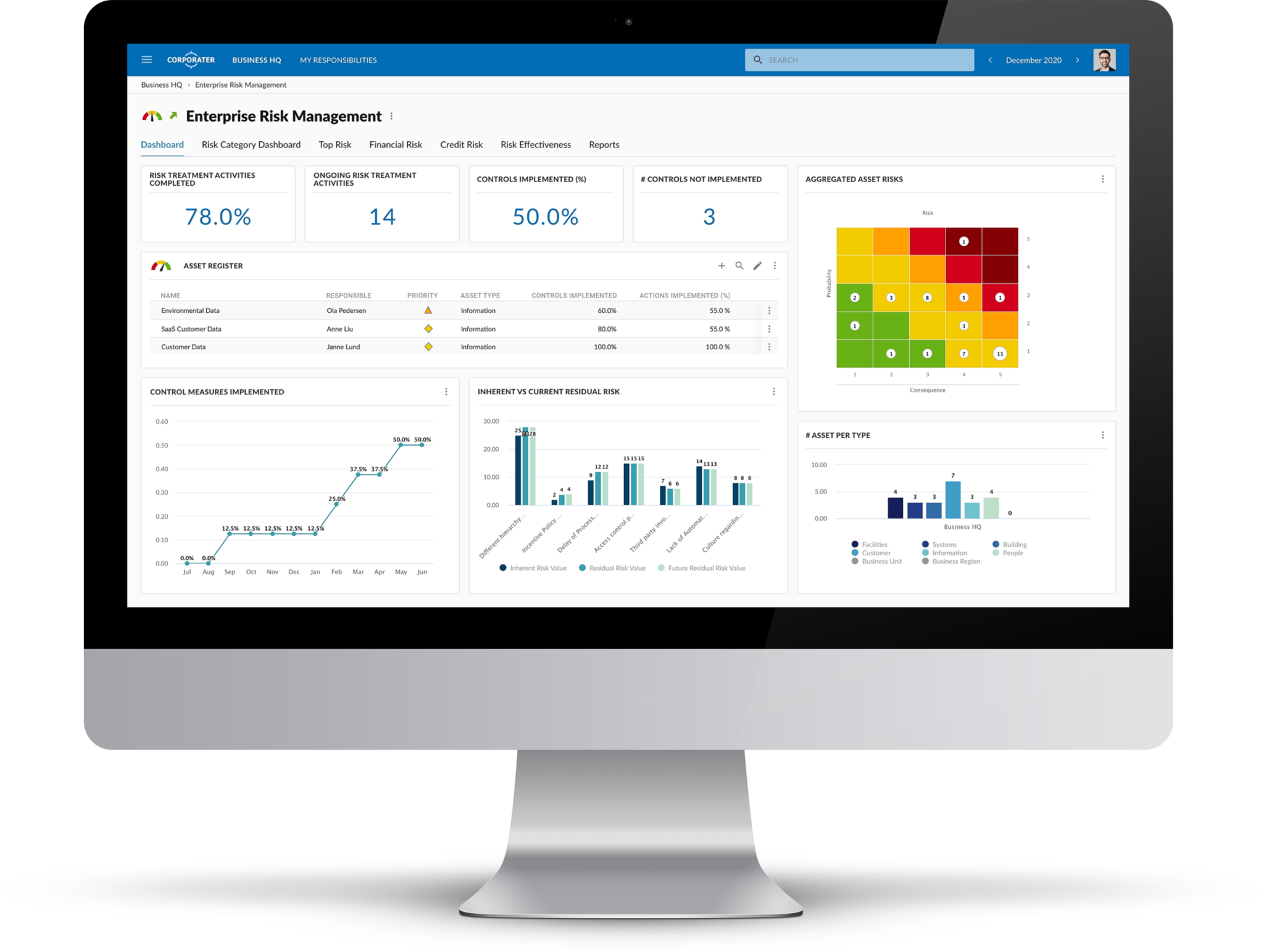

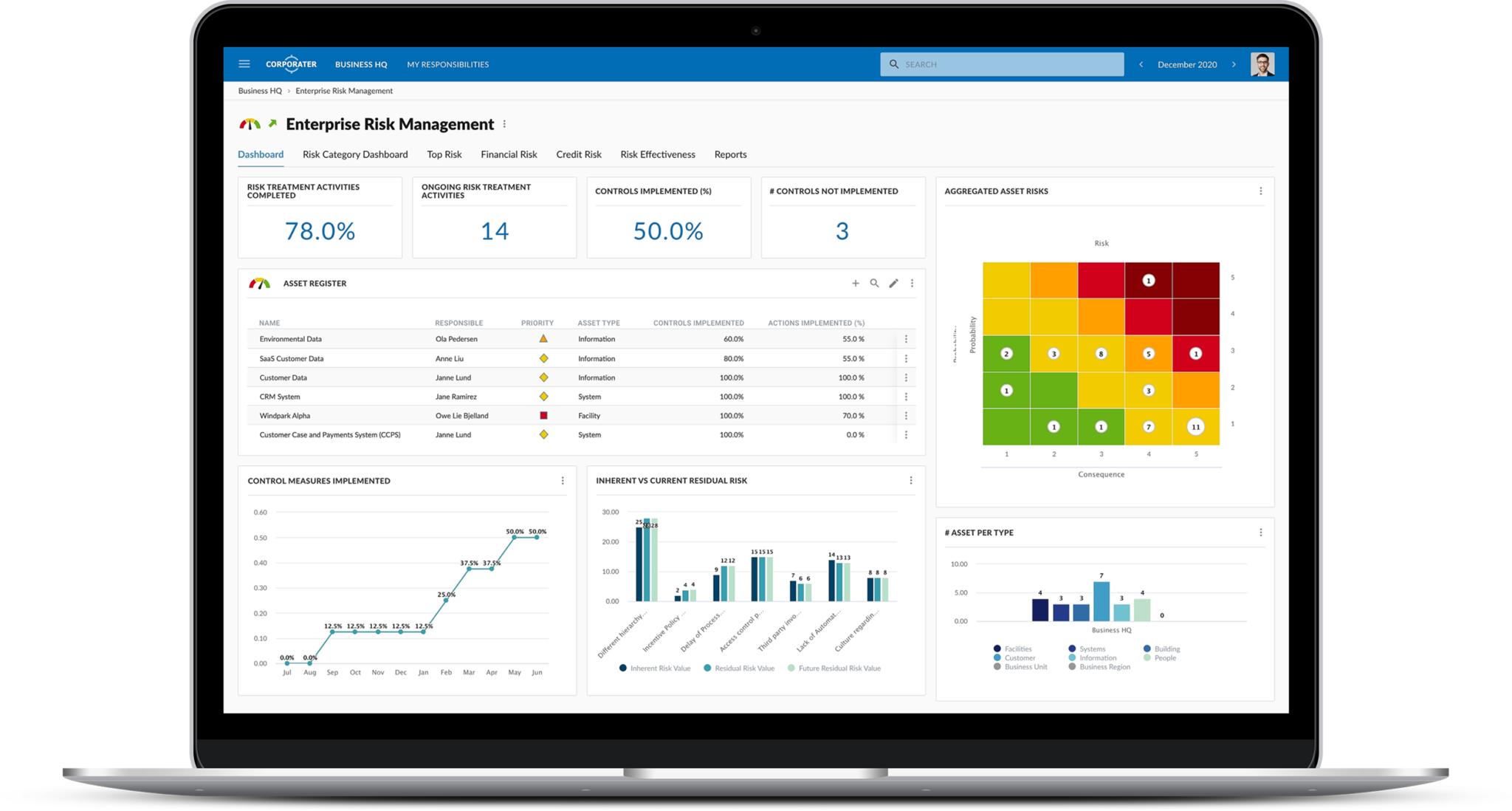

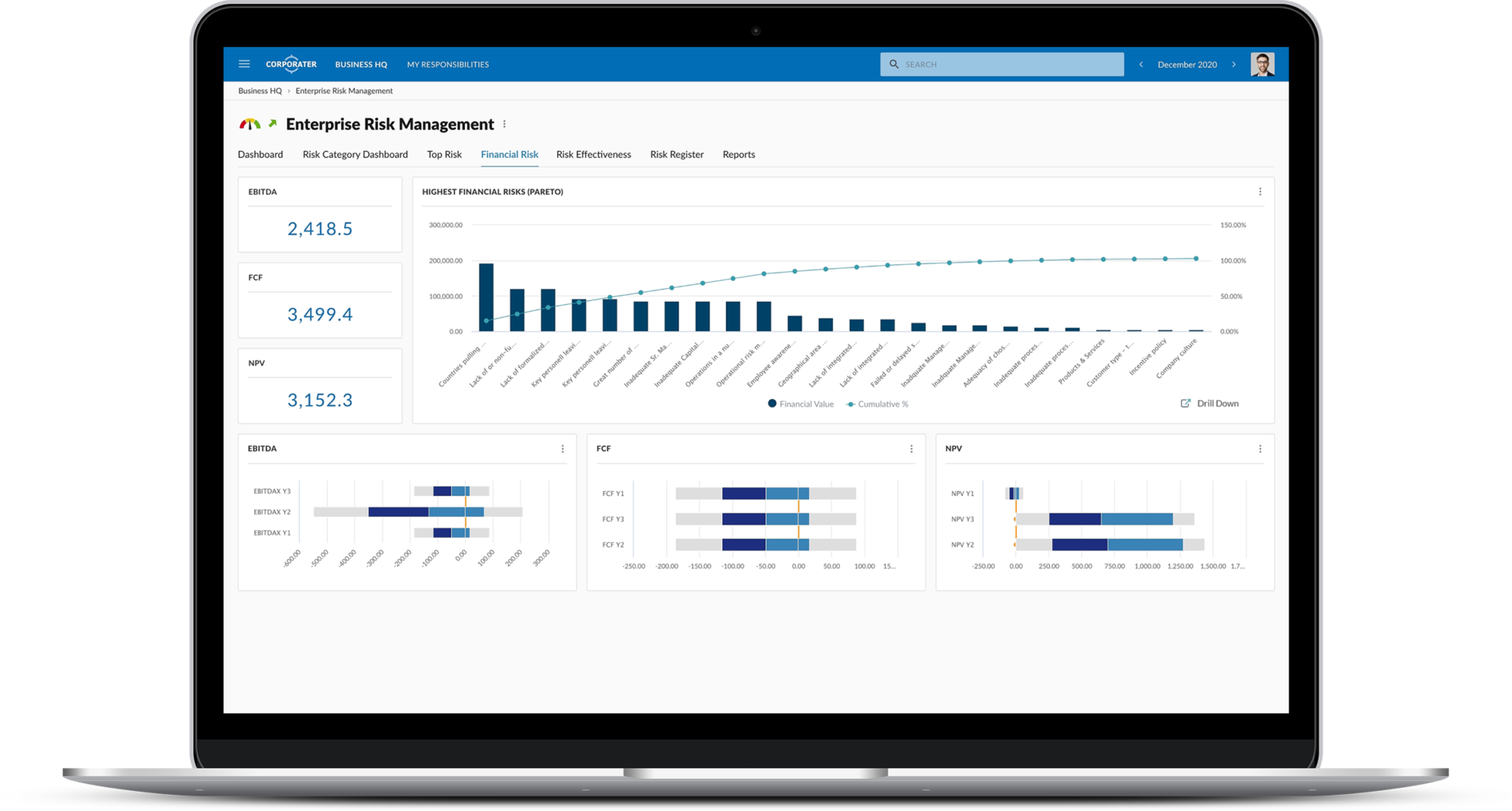

Strategically manage and mitigate risk across your entire organization. Built on Corporater Business Management Platform, Corporater Enterprise Risk Management (ERM) solution is an enterprise-grade digital tool that enables organizations to take an integrated approach to risk management, governance, and compliance. With Corporater, your risk managers can establish a robust ERM framework that allows them to consolidate all risk data into one central hub, monitor key risk indicators (KRIs) and risk exposure across multiple departments and business units, conduct risk assessments, manage various types of risks, and report on risk mitigation controls measures.

Experience the business impact of moving from unstructured data and disaggregated risk assessments to a multiuser, integrated platform that represents the organization’s risk profile in a single view.

Achieve an enterprise-wide risk oversight

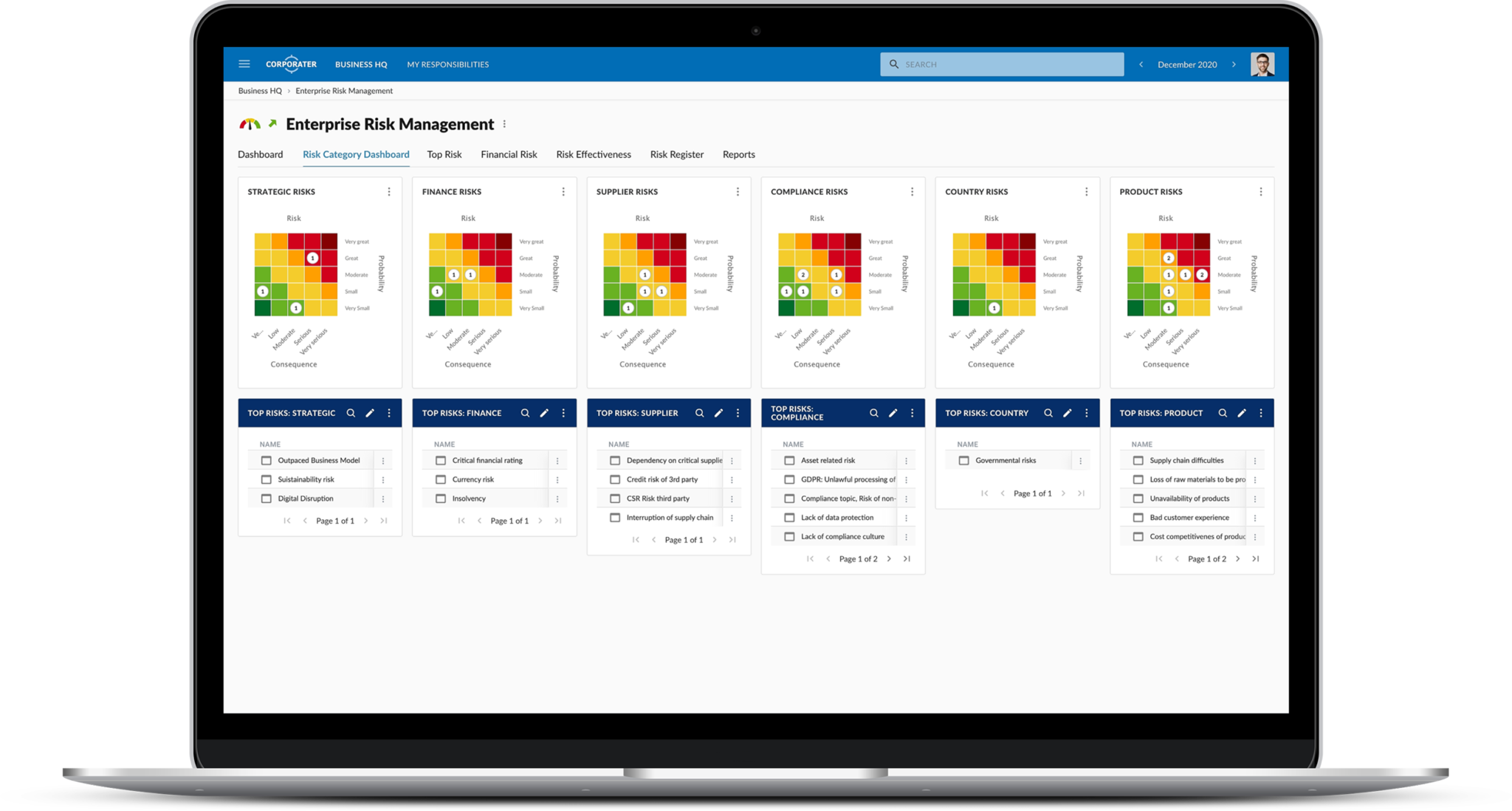

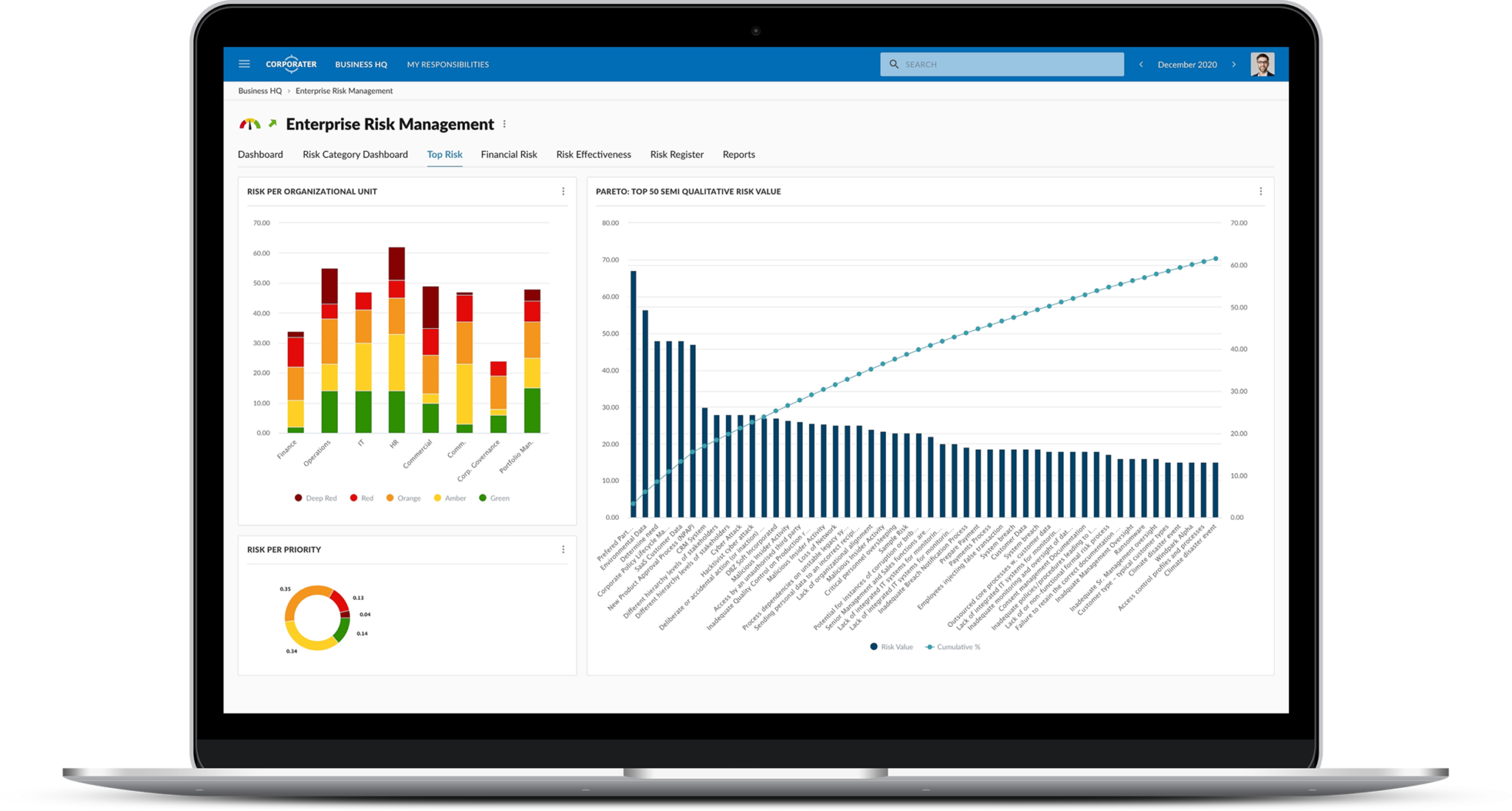

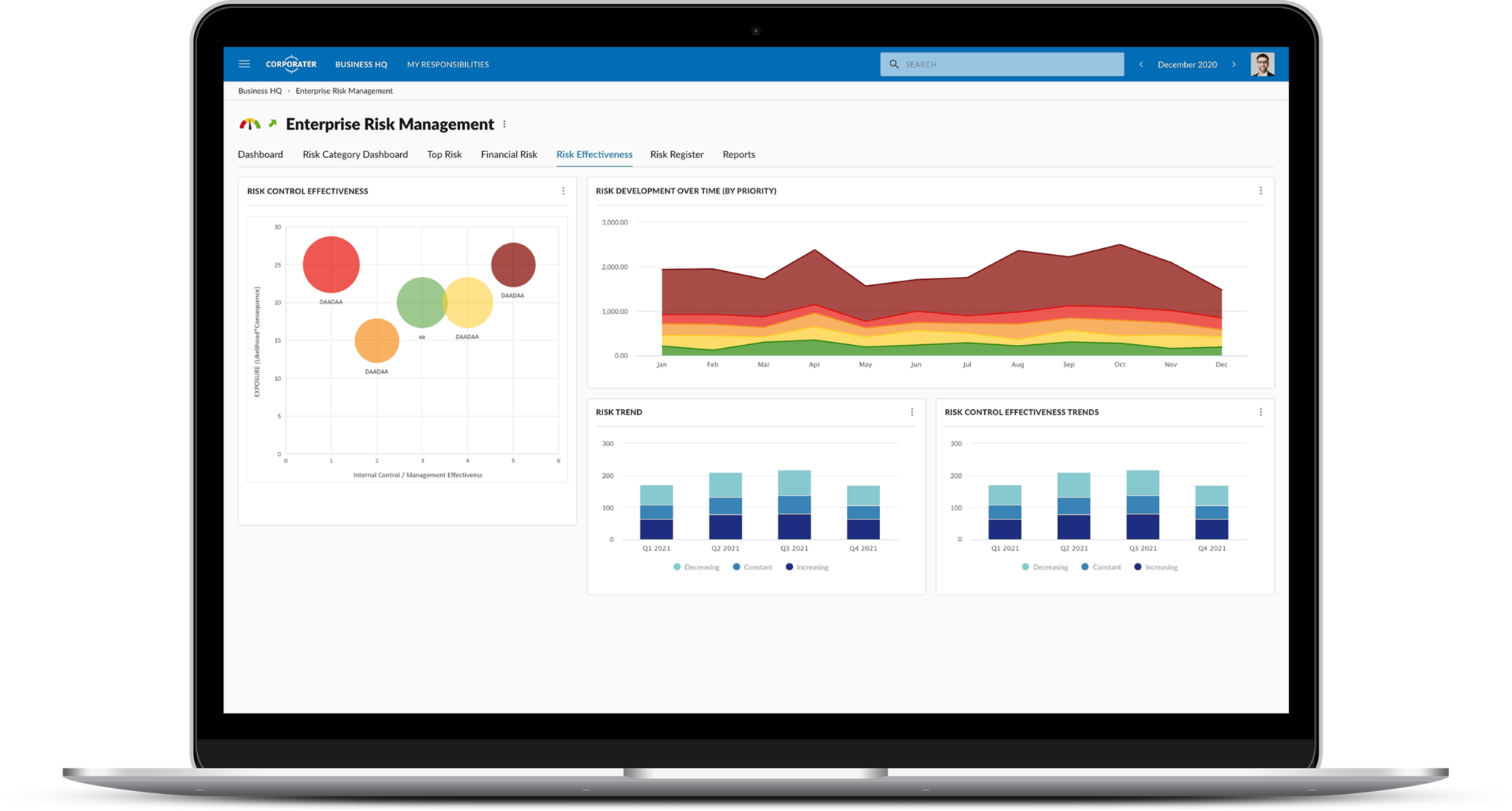

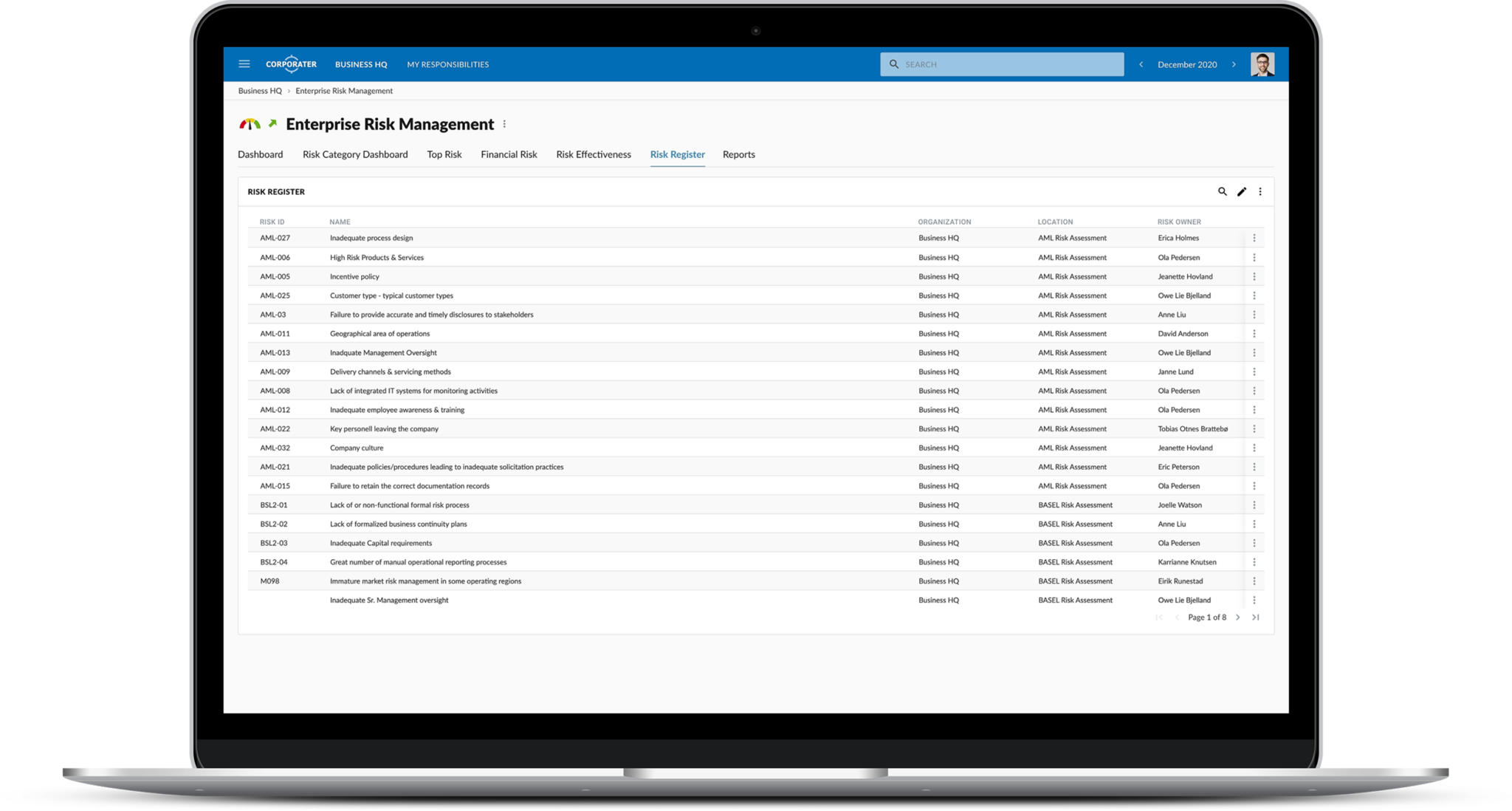

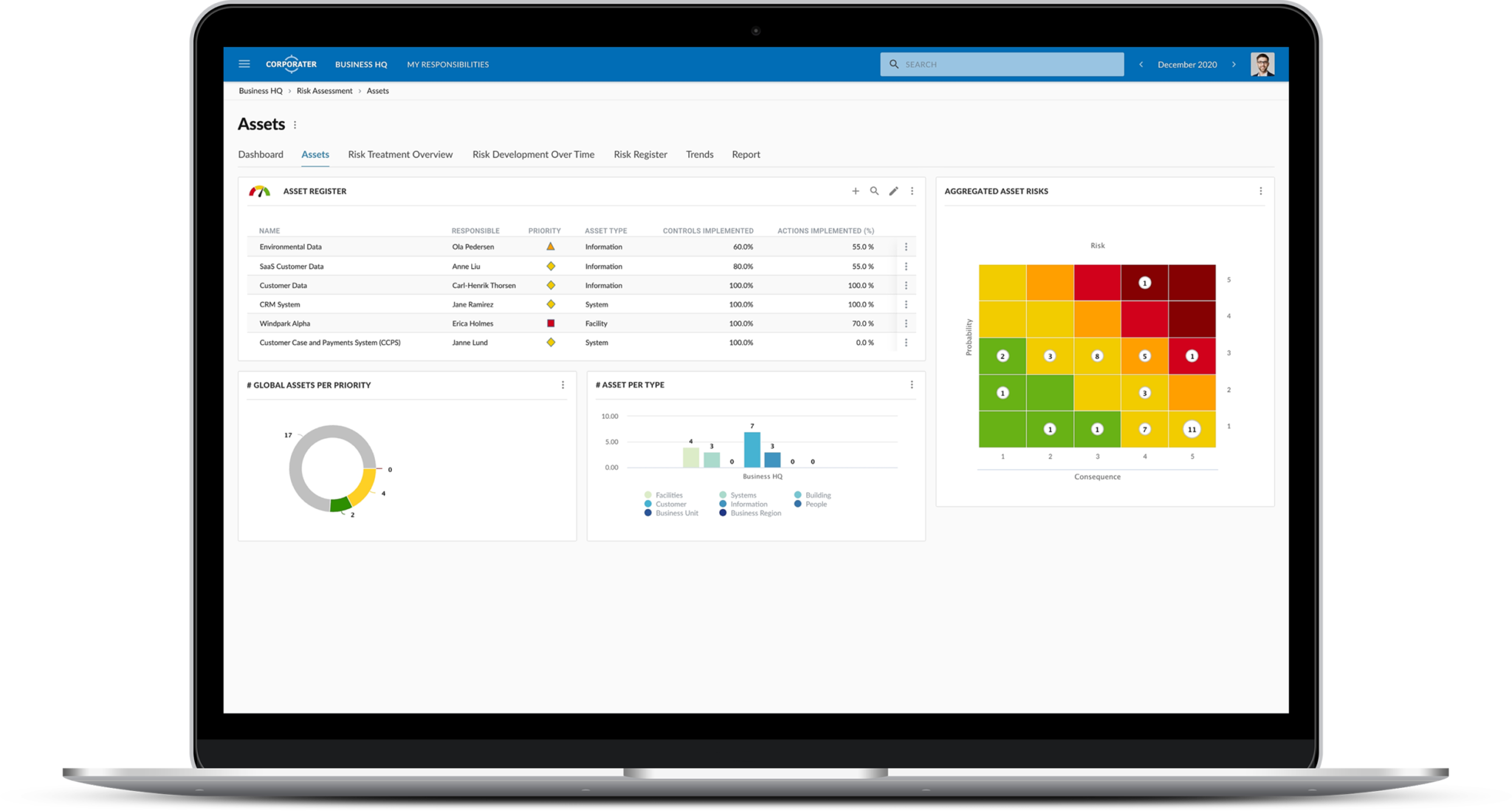

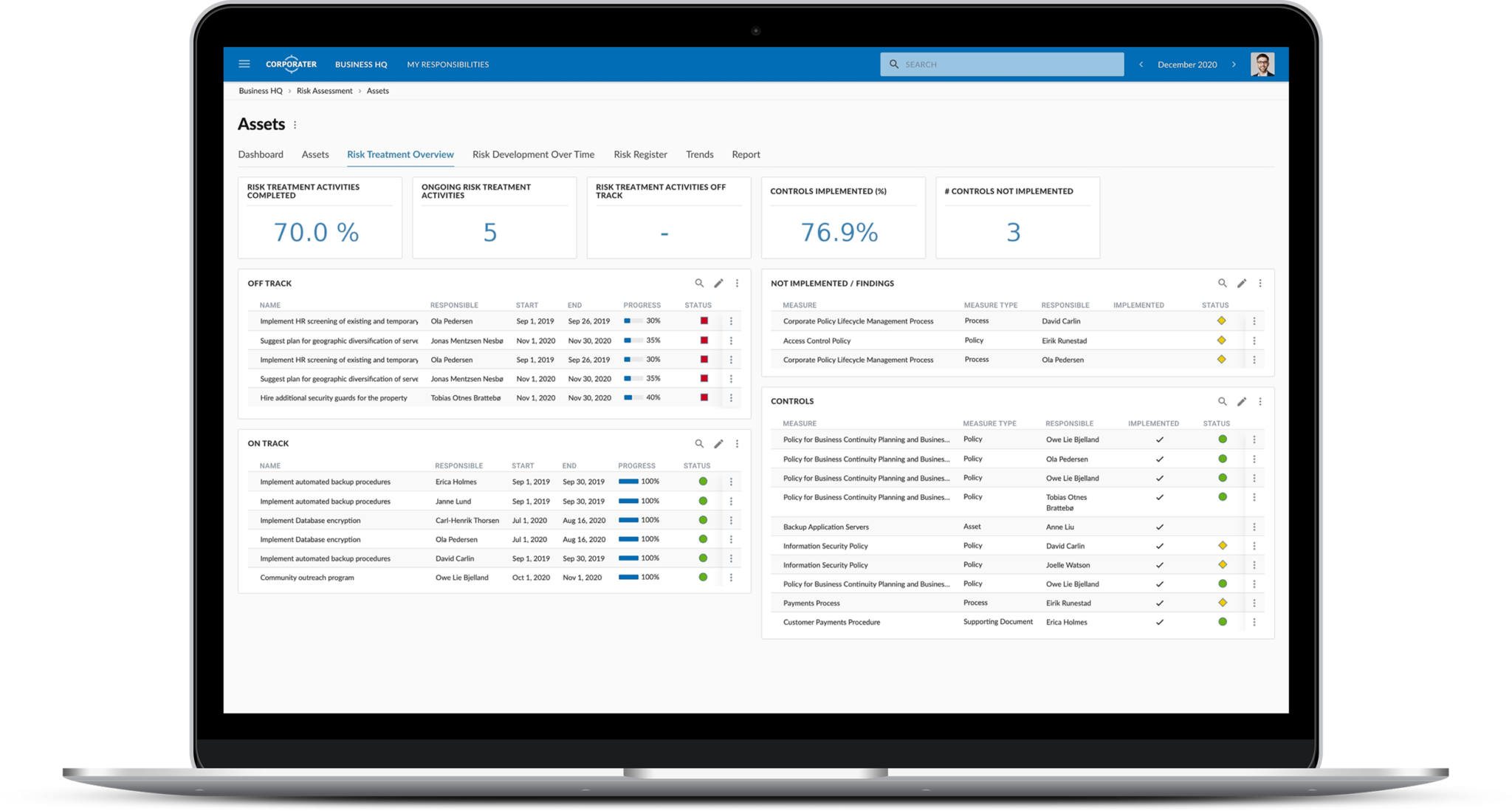

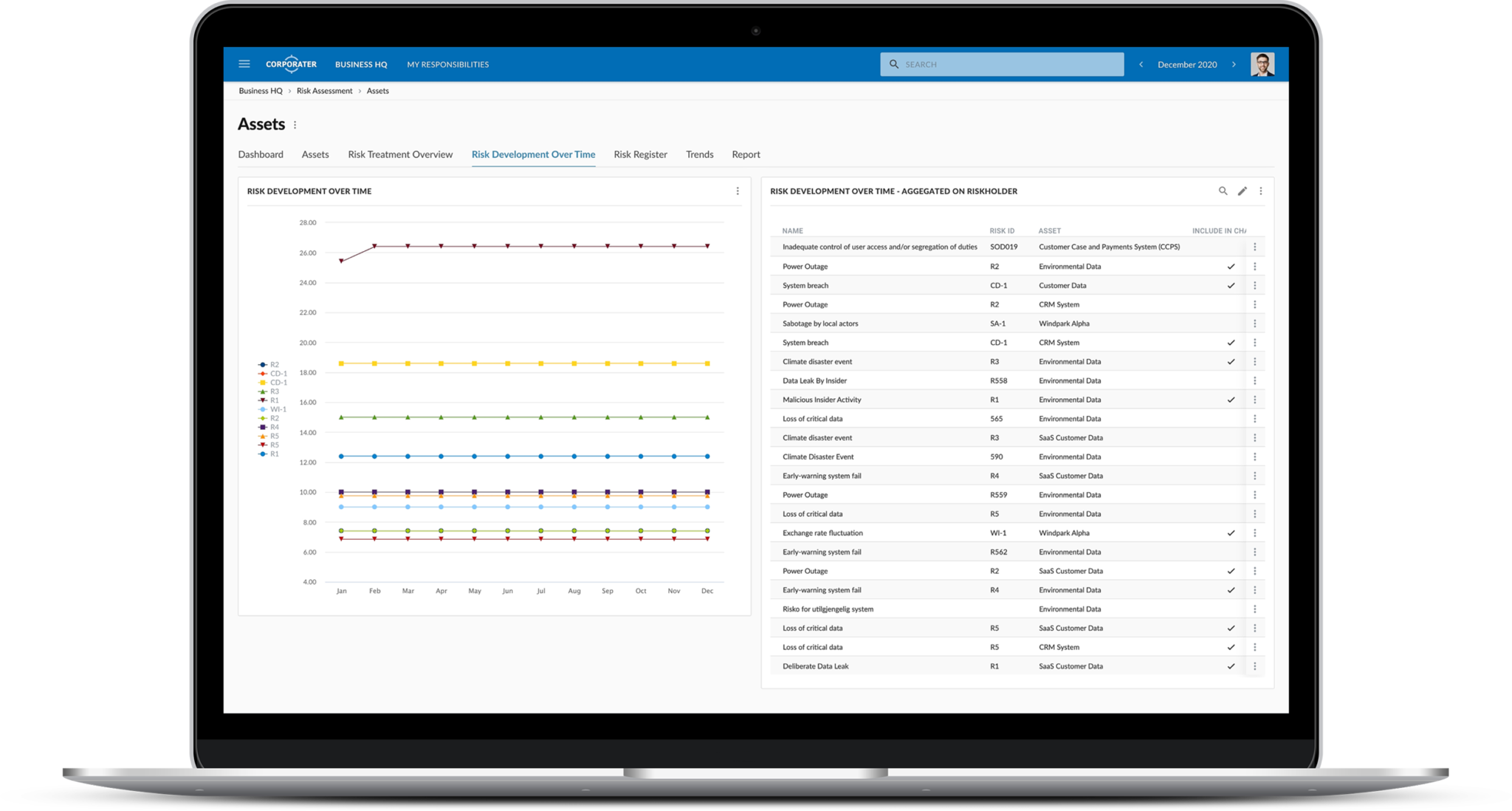

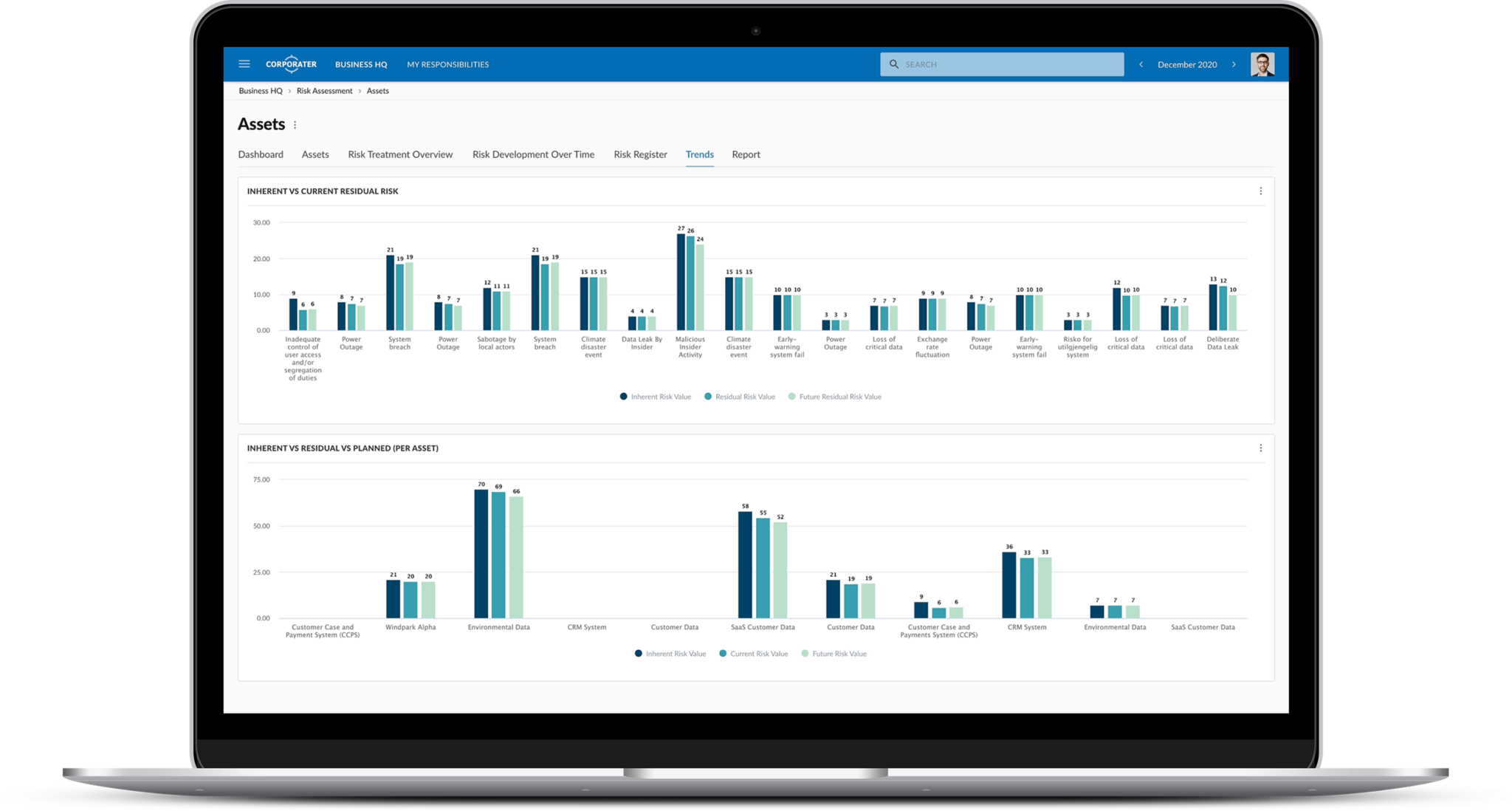

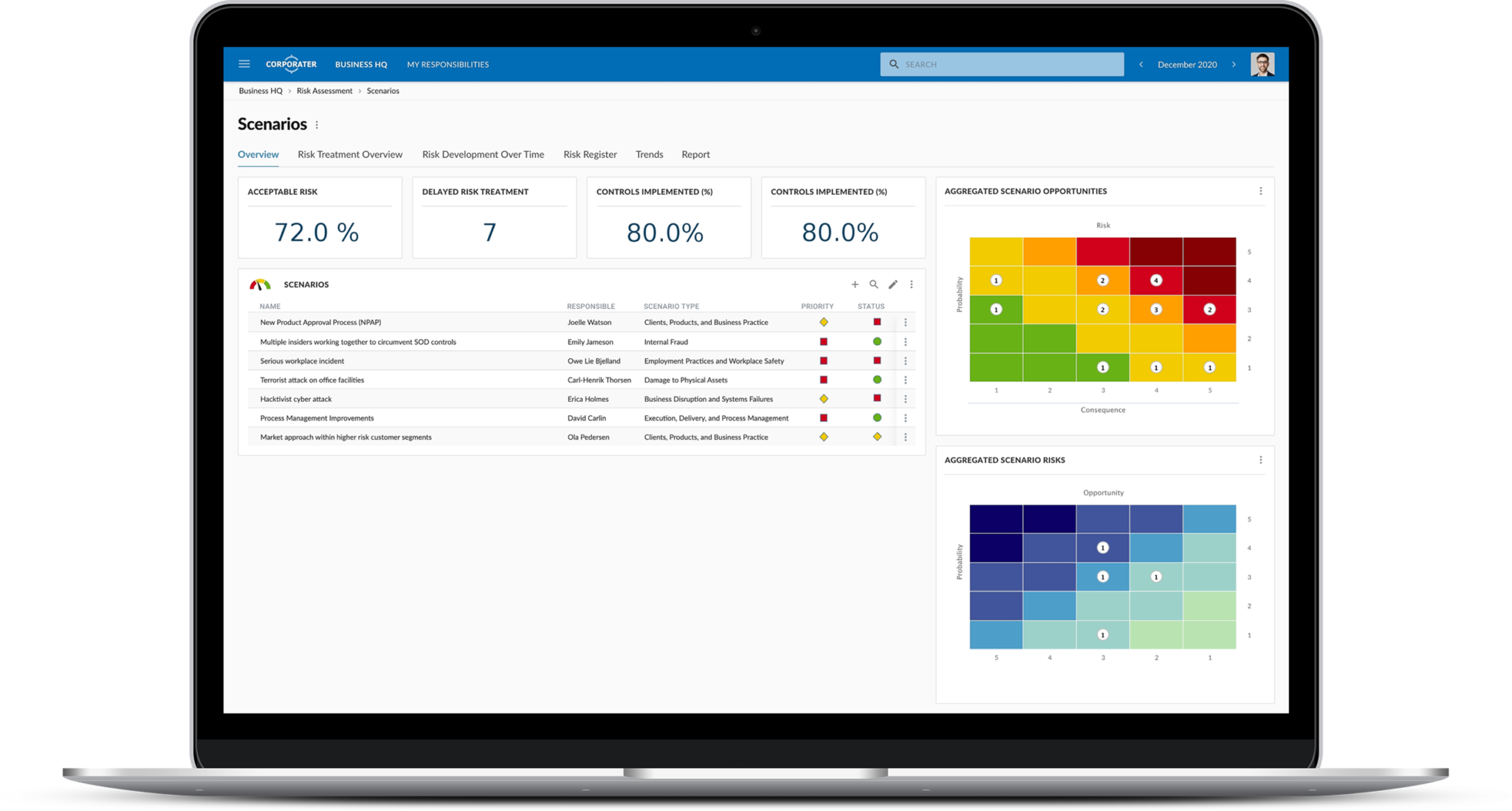

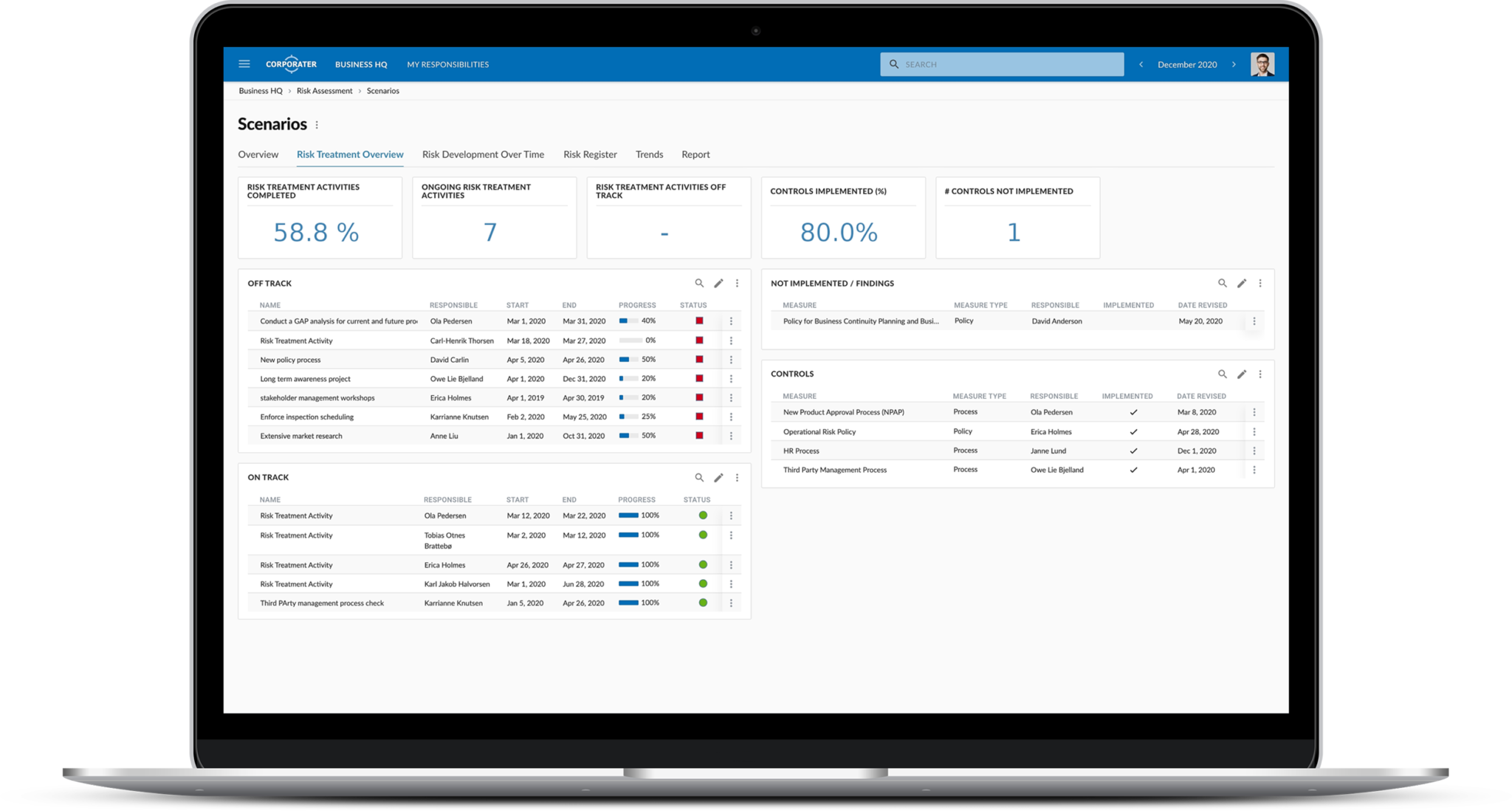

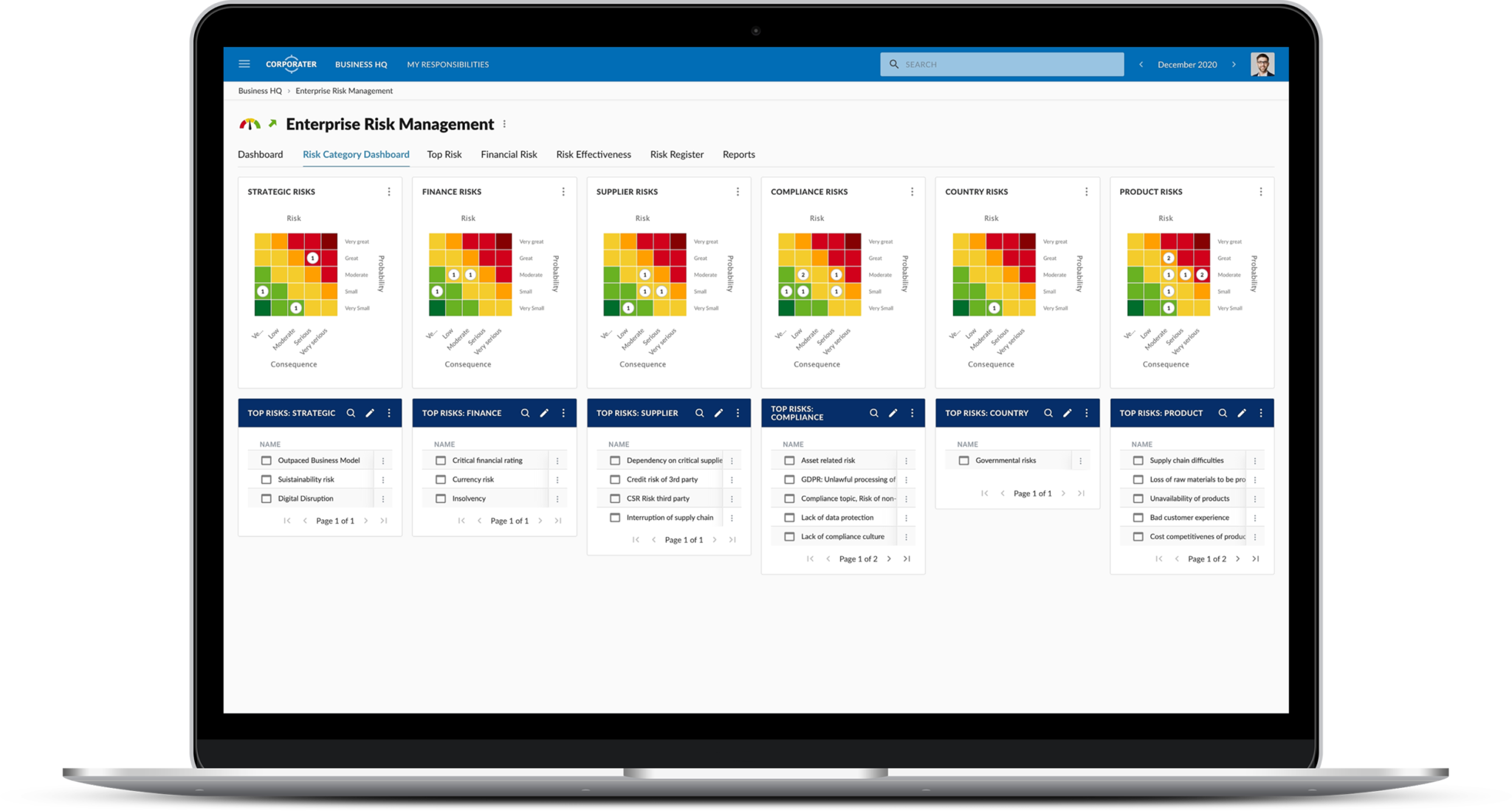

Achieve an enterprise-wide risk oversight and stay prepared for any risk that may affect your organization. Proactively identify and communicate risk across your organization, iteratively assess and prioritize risks, and set remediation plans into action. Configure custom executive and role-based risk dashboards to visualize risk data at various levels of your organization, conduct risks assessments, assign risk owners, and track completion of risk mitigating actions. Set up automated alerts and notifications to be notified about assignments and overdue tasks.

Efficiently manage and mitigate risks

Corporater ERM solution enables you to continuously assess risks and threats posed to your organization’s operations and objectives. The solution enables automated aggregation of risks up the chain and provides a systematic flow of information that aids in an efficient, risk-based decision making. Conduct risk assessments and keep track of risk treatments and controls across your projects, portfolios, departments, business units, divisions, regions, and countries. Manage KRIs against their set tolerance in the context of your strategic business objectives, and generate comprehensive risk reports for management and key stakeholders. Enable a streamlined and documented process that allows your organization to keep track of its evolving risk profile based on best practice methodologies such as ISO 31000 or COSO ERM frameworks.

Grow into the future with integrated GRC

Corporater ERM solution can be used as a point solution or in combination with other solutions to form a holistic Integrated GRC program. Built on Corporater Business Management Platform, your ERM solution can be extended to other business management areas such as compliance management, incident management, performance management, or internal audit management, all within the same system.