A multi-angled perspective on growing enterprise compliance complexity wearing on day-to-day business operations and what it takes to align all three lines of defense by thinking from one end (user) to the other.

Introduction

Not only from personal first-line experience in sales but also from a multitude of discussions with compliance, risk, and audit leaders, I can attest that in large enterprises, compliance work often becomes fragmented across regions, business units, disconnected tools, and individuals following their own agendas.

This fragmentation creates three intertwined issues mainly: Process inefficiencies leading to frustration, a distinct lack of transparency leading to compliance blind spots, and a missing sense of purpose leading to a disconnect from compliance and company objectives. An effective enterprise compliance strategy must consider and align a multitude of perspectives under the same umbrella of obligations, processes and cultural awareness: From heavily involved first line staff like sales, supplier management, procurement, HR and operations, through compliance officers, risk managers and audit professionals up to board executives – all should and indeed do play a distinct role in a company’s compliance posture.

In practice, this means thinking beyond isolated training, policy attestations, excel-filings or audits and building a unified and integrated compliance management system that flows seamlessly across people, processes, and technology. Recent standards and frameworks emphasize this not only as a nice thing to have for organizations but rather something to strive for to operate a resilient and thriving enterprise. So why does it seem that so many companies fail to seek this truly integrated path and settle for a compliance point solution building yet another data and process silo?

A first approach to answer this is simple: There is an inherent disconnect in how the purpose of compliance management is perceived.

Allow me to elaborate and afterwards propose a first step in tackling the most prevalent challenges of today’s corporate compliance approaches.

Conflicting Viewpoints? Aligning Frontline and Compliance Perspectives

Frontline employees and compliance teams naturally see things differently – which is easily understood since they have different KPIs they are being measured on. A first-line manager (e.g., a sales or operations lead) is focused on meeting targets and running day-to-day activities efficiently. The compliance officer, by contrast, is tasked with ensuring that all those activities meet legal and ethical standards, which means meeting their own targets in a way. Without saying this contrast in itself is flawed, it still produces operative tension frequently: Line managers may view compliance requirements as bureaucratic roadblocks, hindering them to achieve their goals (new clients or partners to onboard for example), while compliance staff view any compliance-gaps as unacceptable risks, which would indeed lead to blocking the onboarding of a new partner/client more often than not. For example, a sales leader racing to meet their team’s quarterly target number might be focused on signing up new clients according to deadlines and therefore might be willing to accept the risk of showing a blind eye to a gap in an excel based compliance questionnaire, whereas a compliance officer is scrutinizing dozens of local regulations (consumer protection, anti-corruption, privacy, internal policies etc.) and matching controls to define if these urgent signings of new clients can be considered compliant or not. Without process integration – and I mean software-supported and cultural integration – the sales team might use outdated or even bypass procedures while the compliance team struggles to verify adherence, slowing everything down or exposing the company to potentially noncompliant activities.

The mentioned roles can and should be complementary if empowered properly. As several compliance stakeholders I have been in touch with have noted, the compliance officer must oversee daily operations so that the company complies with external laws and regulations and ensure that employees adhere to the company’s internal policies alike. While this statement holds theoretical value, it does not truly account for the entire RACI matrix of shared compliance responsibility.

“At its core, compliance is about people. Systems, procedures, and policies only carry as far as the employees understand and follow them.”

In some more advanced organization models, I have encountered a clear employer code of conduct that is given in plain language, emphasizing that the ultimate compliance responsibility rests with each one of us individually. In practice, a holistic compliance process often requires a digital, shared platform and precise language: Compliance requirements, applicability guidance, and supporting documents are built into the tools and workflows that business users already employ and like to work with. For instance, a centralized solution might automatically surface a relevant policy or checklist when a manager opens a project plan or a sales leader triggers account creation in the CRM. This keeps the first line empowered (they see only what is relevant to their role) while giving the compliance team enterprise-wide visibility.

Key differences in viewpoints can also be addressed through communication channels. A mature program provides multiple known and easy-to-use support paths – not just emails or PDFs hiding in SharePoint – so business people know where to go with questions. As a leading example, mature organizations’ compliance programs offer a 24/7 available, multilingual compliance support portal with chatbot functionality accessible via web and mobile for all employees and external registered partners with compliance-related questions or cases they wish to address. This ensures that a frontline employee who is uncertain about an ethical dilemma can get guidance quickly, either through direct self-service via the respective policy attachment the bot provides or through a transparent and integrated case created that then is covered by a case manager from the right geo location. This also helps to keep the compliance office informed of issues in real time.

In sum, integrating the first-line perspective and the compliance perspective means giving each side the tools and culture to collaborate efficiently and transparently, rather than merely checking boxes in hindsight.

“An outstanding integrated compliance management system will additionally, over time, help the organization to see compliance as an integral part of strategy.”

Day-to-day Compliance Execution Challenges

Even with the right mindset, general availability of processes and support paths, daily corporate compliance execution becomes tougher by the day. Real-world compliance activities often span many systems, databases, knowledge clusters, and teams – legal, HR, IT, operations – and cover multiple jurisdictions. The most common pain points are also the hardest to tackle, as they usually proliferate despite being addressed. Let me explain from the end-user’s perspective what this means based on examples:

- Siloed Information: When teams use disconnected systems and data sources, it’s hard to get a unified view. For example, global payroll system providers regularly warn that fragmented regional systems (different vendors or spreadsheets in each country) lead to inefficiencies and a higher risk of non-compliance, since reporting is cumbersome and processes are inconsistent. Trying to remediate this by implementing a unified payroll system as a result of such warnings can account for some initial risks of non-compliance in the payroll process itself, but doing so usually steps short when the broader scope is in spectrum: Effectively most of the times this unified payroll system just becomes another information silo in the broader scheme of IT infrastructure and disconnected data between payroll-involved business units in different geos.

In summary: If the end-to-end process and it’s risks of failure is not accounted for, a globally unified system can only heal so much from a compliance perspective. Similarly, if one team stores payroll policies in a document library that is just hyperlinked in the payroll tool, that the end-user has no access to, and another tracks HR payroll training in a separate LMS, no one (including the risk owners) can easily see the overarching compliance status across the enterprise and locations.

- Rapid Regulatory Change: Compliance leaders report that keeping pace with change is a major struggle. In one survey, 39% of compliance, legal, and privacy executives said their organizations need strategies that continuously adapt to new regulations, noting that potential legal implications increasingly often concern all parts of their companies from first to third line1. At the same time, non-compliance costs are rising as regulations proliferate. Gartner highlights that as complexity grows, legacy, siloed compliance tools become too unreliable for leaders to trust. In practical terms, local teams may still be manually updating spreadsheets or alerts every time a regulation changes locally, rather than having a unified repository that automatically flags new obligations.

What is an often-prescribed immediate remedy? Regulatory content providers and consultancies are engaged to provide Gap assessments between one regulation and a new or updated one, providing recommendations to heal or rectify these gaps, and highlighting potential negative outcomes of non-compliance. This then trigger long and tedious organizational change and tool implementation projects, which all try to run after the new regulation rather than trying to align their company strategy from top-down with regulatory implications on achieving their overall objectives. This causes organizations to rethink governance rather than patching the gaps where absolutely needed. In practice, the Digital Operational Resilience Act (DORA), put to the test in the German banking sector, is a good example of how the broad vision of a more resilient financial sector is operatively just another Excel-nightmare for most affected companies. I will not go into the details as it would lead too far. In the case of the broad directive of ICT Incident Management and regulations on reporting critical incidents fulfilled by manually filling a multi-page Excel form and sending it via email to the BaFin MVP Portal for reporting purposes2, it reveals the gap of operative reality checks from the regulators’ perspective that would require solutions to go much further than just following the regulatory wording as closely as possible. It would need them to think the process through from one end of all implications to the other, and also to consider the connection of the overall company objectives to the ever-evolving regulations – a challenging task to accomplish by any means.

“A clear, integrated, and intuitively usable compliance management system should provide the right amount of relevant compliance guidance in an easily understandable, easily applicable, and recipient-tailored fashion.”

From the not-outspoken corporate perspective, trying to comply with new regulations is therefore linked to the dangerous idea of waiting until a published regulatory non-compliance hits someone bigger than themselves. Then it’s easier moving in reaction to prevent the same from happening to themselves with the minimum amount of effort required, which will leave the operative staff in a constant limbo of short-term workarounds and hastily patched-together ad-hoc reports in their day-to-day operations.

- Fragmented Processes: Many companies struggle with inconsistent processes across geographies and departments, which should not be big news at this point, and of course, this also applies to corporate compliance aspirations. Without a commonly applied framework adapted to reflect company obligations and strategy through adequate governance, each region might implement policies, processes, and tools differently, creating even more friction in cross-departmental collaboration. There are many industries that are struggling with this specific issue for a multitude of reasons, but a German example that is often pinpointed is the healthcare industry. Most healthcare compliance studies, with participants from large hospitals, healthcare OEMs, and service providers, describe the landscape of compliance programs as fragmented, manual, and very slow in adapting to change, with only a few digital elements in place, which indeed happen to make things worse rather than better. Small compliance teams are stuck between juggling multiple responsibilities and struggling to effectively manage compliance day-to-day in areas of complex external regulation and internal manual documentation labor. In German healthcare cases, especially, compliance activities tend to be ad hoc and reactive.A recent example would be the task of maneuvering GDPR in combination with the “Digitale Krankenakte” (translating to digital medical record). In the hospital business in Germany, it is everyday practice to partially work with digitized patient information that most hospitals even struggle to derive benefits from when transporting data from the first floor to the second, not even thinking about external patient data exchange with specialized doctors for a second look, or even health insurers. Only majorly overhauling the way data is leveraged through clearly governed compliance processes and digitized workflows could enable substantial and sustainable benefits for all three lines of defense.

Standardizing policies, engaging the board, and appointing dedicated compliance officers with clear responsibilities is only a first step of many. Adding a company-wide compliance governance and digitizing relevant processes end-to-end, harnessing relevant data needed for day-to-day compliance work, is the part of the change that is almost always the bigger struggle, without taking into account external and often conflicting obligations.

- Misalignment of the Three Lines: The three lines of defense model is increasingly under critique as experts point out that it does not clearly account for the impact third parties, governmental bodies and regulators tend to have, but for most of the used examples it is hard enough to align the classic three lines under the banner of cooperation. Without clear integration into common processes and the right interconnection between business units, processes, assets, risk frameworks, and company objectives, the three lines of defense can even work at cross purposes. Risk experts I speak to note that walls can form between business units (first line) and risk/compliance functions (second line), which furthers the gap toward audit (third line), leading to resistance and dysfunctional practices on one side and over-auditing on the other. In worst cases, risk functions get bogged down by auditing rules instead of managing them, and business units ignore compliance advice as interference or hindrance in achieving their goals. The result can be severe; for example, the German Online Bank N26 scandal3 illustrated what happens when internal controls and compliance oversight break down or are systematically ignored, leading to over 9 million Euros of fines for the rising FinTech back in 2021.

A truly integrated approach, on the other hand, can ensure that all three lines are looking at the same data and that controls are built into workflows, so everyone is playing on the same team, rather than against your own peers. Even more effective than uniting all three lines under the banner of regulatory compliance awareness would be to align GRC functions under the purpose of all doing their part to help the company achieve their goals, and upkeep business-prosperity and growth, which would in the same breath make them more relevant to board directives.

The Human Element: Usability, Support, and Culture

At its core, compliance is about people. Systems, procedures, and policies only carry as far as the employees understand and follow them. Two critical areas are the usability of compliance processes and fostering a compliance culture:

- Intuitive User Experience and process integration: All employees, but especially the first-line staff, should encounter compliance guidance as a natural part of their work, not as a hindrance. User interfaces should make it easy to find the right policy, check the status of a required training, attest a control’s effectiveness, or know what approvals are needed based on the end-user’s role and responsibility in the company.For example, rather than emailing multiple-choice quizzes and important updates via the shotgun method, an effective compliance management system might pop up tailored and recipient-group-specific brief reminders about relevant laws, policies, or regulations when, e.g., a sales executive attempts to create a prospective account in the CRM that is on a sanctions list. When compliance is integrated into everyday business applications and processes, people are far more likely to encounter compliance activities as an integral part of their everyday life rather than a nuisance at the worst timing. Even better if the compliance management system and its correlating digital execution do not overload employees with functionality or paths to stray from. A clear, integrated, and intuitively usable compliance management system should provide the right amount of relevant compliance guidance in an easily understandable, easily applicable, and recipient-tailored fashion.

- Clear Engagement Channels: Employees must know exactly where to go with questions, cases/issues, or concerns. Leading compliance programs make these channels visible and accessible. Usually, a first start is a code of conduct that explicitly provides direction on whom to consult for questions and concerns. An additional step could be to provide a hotline with general availability for support. But most of the time, larger globally active companies achieve the best return on investment by establishing end-to-end clarity and by establishing a web-based engagement channel that should follow the same guardrails as stated above (integrated into everyday processes, easy-to-use, easy-to-understand, and tailored to actual role relevance). Without such clarity in an engagement channel, an employee who spots a potential policy violation may waste time guessing whether to call HR, email legal, file a form, or even dare to call a hotline with their concern. In contrast, a unified, integrated compliance management system provides the necessary input and guidance right where employees need it to be or at least offers a central portal to start from for all compliance matters relevant to respective roles and points queries and anonymous reports appropriately, ensuring nothing slips through the cracks.

- Compliance Culture: A bold statement is that a compliance culture is built through engagement, process integration, and usability, not just checkbox training. We have talked about process integration and usability before. So, what role does engagement play? ISO 37301 (the international compliance management standard) highlights embedding compliance into organizational activities and values. This translates to leaders emphasizing the importance of ethics and compliance, of course, but also encouraging feedback and empowering employees to do the right thing even if it’s not strictly the minimum legal standard. Training should connect rules to real cases in the company’s business, and employees should receive acknowledgment when they act with integrity. When compliance becomes part of how we do things around here, staff are more likely to participate actively. In practice, a compliance management system can support this by tracking engagement (anonymous surveying of employees on ethical climate, monitoring hotline or portal usage) and giving management dashboards on culture indicators that they can leverage to steer engagement in the most needed directions.

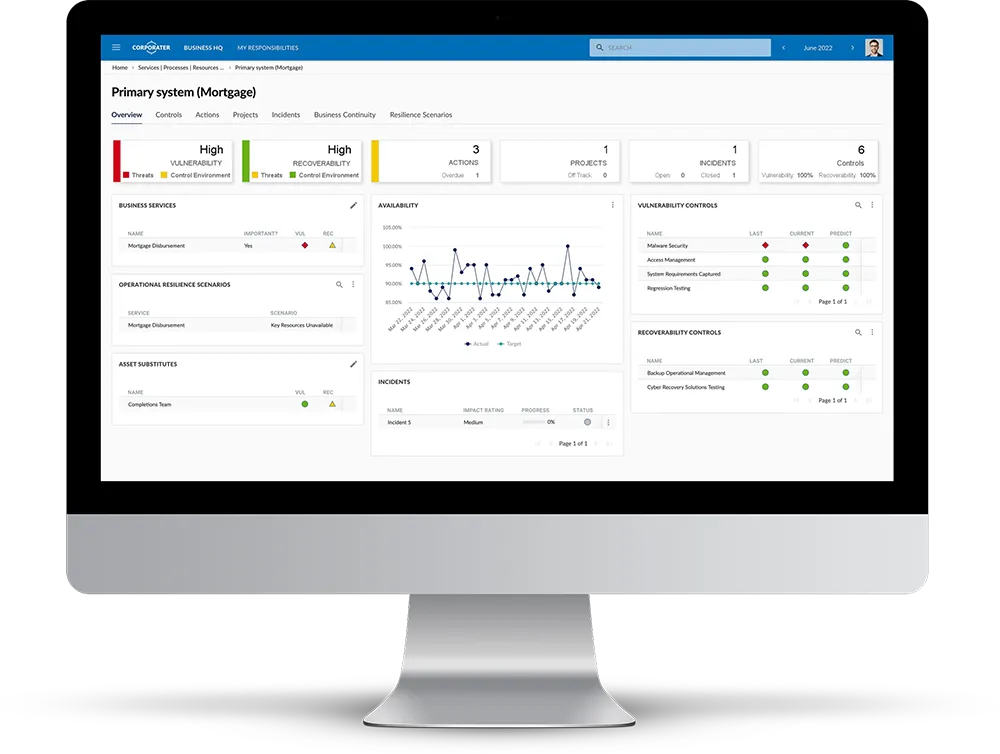

Operational Resilience Quick Demo

Beyond mere Checklists: The Spectrum of Modern Compliance Management

End-to-end compliance management should ideally cover every phase and component of compliance. Most companies struggle to account for most of the depicted points below. In a modern enterprise, enabling these is a challenge that most readers here will be aware of. The below listing tries to summarize the complexity of today’s companies’ compliance requirements:

- Regulatory Obligations Mapping: Beginning from the outside in, centralizing all external requirements (laws, standards, industry codes, contracts) and mapping them to internal controls, risks, and weaving them into governance and strategy is just the first point many companies struggle with. A unifying compliance management software can help to automatically alert the right teams or stakeholders when a new regulation appears or an obligation changes, preventing gaps between what is required and what is implemented. But still, the ever-changing regulatory landscape is a hurdle to begin with, not even speaking of creating the necessary organizational change management that usually has to follow a significant change in regulation to bring it to adoption.

- Policy Management: This aspect, viewed holistically not only entails hosting all internal policies in one place but furthermore linking them to the obligations they cover, providing functionality like version control, policy retirement, release or update workflows to policy managers and the right amount of access, visibility, and awareness to relevant stakeholders. Employees ideally see only the policies relevant to their role, reducing confusion and creating an easy-to-follow path when help is needed.

- Risk and Control Frameworks: There is complexity in this aspect alone, worthy of several separate books but I will leave it at this short section: Defining key compliance risks and controls in one system and mapping them to business processes, assets, org structures, external regulations or standards and people should be a priority when consider significant compliance management system improvements. This is so that the first line knows what risks they own, the second line knows which controls to monitor, and everyone knows about the interconnectedness of risks, controls, and compliance in accordance with the overall company strategy and how this interconnectedness is related to that. This ties compliance to overall enterprise risk management rather than treating it as separate silos.

- Training and Awareness: Automating training programs with user-friendly content and reminders is something that most companies have already found their way of implementing. These (learning management) systems usually track who has done which training and automatically follow up or remind them if they are behind on their assigned work. They sometimes even adapt to new roles being taken on by employees as part of the joiner, mover, leaver process, or get updated to reflect new rules and policies, ensuring employees learn exactly what applies to them.What could be the next step further to this would be the actual integration of learning/training content into existing controls frameworks and tracking effectiveness accomplished by compliance awareness training. Imagine being guided on a short, engaging training course when looking for important compliance information or seeking help. Imagine frequent anonymized surveys checking the learning content’s relevance per location and department. Even though trainings and awareness are a low-hanging fruit, combining them with existing processes, frameworks, help channels, and engagement of employees is something usually falling flat once a company’s LMS is fed with just enough of obligational colorful comic figure-enhanced training videos and questionnaires.

- Incident and Case Management: As mentioned before, a single point of access for compliance-related help should be a key concern for large enterprises. Capturing compliance issues, cases, or tasks (audit findings, violations, whistleblower reports, etc.) in a central place from which all workflows start is considered a suitable strategy for unifying compliance work and establishing self-service functionalities in the same breath. Workflows assign responsibility for investigation and remediation, and a case can be traced from discovery through resolution with full visibility on actions taken and people responsible. This end-to-end chain links back to policies, controls, and risks so learnings can be applied broadly and evaluated at scale via reports showcasing trends to tend to.

- Monitoring, Audits, and Metrics: This part especially benefits from a unifying software platform that covers a broader spectrum of GRC capabilities and thrives on full data availability throughout the enterprise. Some analysts highlight that establishing a digital twin of your organization for coverage of the mentioned essentials can be a viable option to evaluate. When it comes to running continuous monitoring of controls and scheduling audits within the same platform, often there is a variety of software vendors that can help but very few can reduce the risk of implementing more data-feeding silos without delivering actual end-to-end benefits operationally. Ideally, dashboards of Key Compliance Indicators (KCI) should show (near) real-time status (e.g., % of contracts reviewed, overdue trainings, open incidents, etc.). It is even better if intelligence from trends, or cluster issues, is recognized by pattern and trigger remediation tasks automatically if a KCI breach is detected (remember tying back the LMS to the compliance software?). Crucially, captured metrics should also be tied to the business context and company objectives so managers can prioritize what to focus on. For example, a rising trend in a certain type of incident would automatically trigger a review of related controls and their effectiveness.

- Reporting, Performance Tracking and Governance: Producing consolidated reports for executives, boards, and regulators on demand is one thing, even for companies still managing risks, controls, and compliance via Excel – it is just time-intensive and prone to error. Tying the delivered developments, trends, aggregated compliance data to controls, risks, and the overarching business objectives is taking it to another level of relevance. A truly integrated way of approach would be to not only aggregate data across regions and departments and giving an up-to-date, single source of truth but also making these aspects an integral part in striving for the goals a company has set to achieve on board level.This could enable faster and more dedicated decision-making ultimately: One global management dashboard can show where the biggest compliance gaps or improvements are in near real time, what top risks are related, how compliance trends impact the business and how respective treatments will help the company to get back on track to achieve their objectives, rather than each function sending separate reports and then leaving the forgettable numbers without actionable insights or recommendations.

- Culture and Communication: Embedding culture-building activities, such as regular ethics surveys, newsletters on lessons learned, and board-level oversight tied to new directives. A good compliance management system supports these by collecting feedback from relevant and/or impacted groups rather than spraying surveys, consolidating statistics, and evidence of tone-at-the-top. An outstanding integrated compliance management system will additionally, over time, help the organization to see compliance as an integral part of strategy (as mentioned by linking compliance performance to business KPIs and control frameworks as well as visibility to actionable treatment plans).

“Training should connect rules to real cases in the company’s business, and employees should receive acknowledgment when they act with integrity.”

In sum, a thought-through end-to-end compliance management system aligns regulatory requirements, internal policies, training, incident handling, monitoring, and reporting into one cohesive framework, ideally supported by a GRC platform that enables cross-departmental, cross-regional process integration and interconnection of collaboration between lines of defense. Such a dream-state compliance management system transforms compliance from a series of isolated checkboxes (awareness courses, controls testing, occasional audits) into a continuous, transparent, and business-relevant process. As one industry analyst explains, a compliance management system should incorporate defined workflows and roles so that all of these interconnected parts of the business are brought together to solve compliance issues. This integrated model resonates with global best practices: for instance, ISO 37301 (2021) is explicitly designed to help organizations establish, implement, evaluate, maintain, and improve such a compliance management system across the enterprise.

Standards and Research Insights

No such article as this could go without referencing key standards and studies to underline the need for this integrated view:

- ISO 37301 (2021): The international compliance management standard functions as a blueprint for building an effective compliance management system. It covers everything from organizational context and leadership commitment to planning, support, operations, performance evaluation, and improvement. ISO 37301’s goal is to help organizations maintain a culture of compliance by embedding it into business activities. It states clearly that companies of all sizes can use it to develop or improve their compliance management system. In fact, ISO 37301 is described as the leading international standard for constructing and maintaining an effective compliance management system, offering a certifiable framework that integrates compliance obligations with internal processes. Hence, it has been referenced or alluded to multiple times within this article.

- COSO ERM and Compliance Risk (2017, 2020): The COSO Enterprise Risk Management framework emphasizes that compliance objectives are fundamental to internal control and risk management. The COSO ERM framework defines risk management as the culture, capabilities, and practices integrated with strategy-setting, meaning compliance must be woven into strategy and performance. COSO’s guidance on compliance risk explicitly connects compliance practices to governance and performance outcomes. It underscores that compliance functions should collaborate with all business units and manage ethics as a core business component, not as a back-office task. In practice, COSO encourages taking a holistic, risk-based approach to compliance – matching what ISO advises and what practitioners seek.

- Gartner and Industry Research: Analyst surveys are consistent: the complexity and pace of compliance issues demand better integration. Gartner’s 2024 survey found that compliance professionals believe that regulatory changes will affect the entire enterprise and that legacy, siloed tools are increasingly inadequate. Other thought leaders similarly recommend conducting GRC maturity assessments to identify and break down silos. One summary of Gartner trends4 notes that organizations see clear benefits when they simplify and centralize their GRC processes (citing a McKinsey study showing 30–50% improvement in decision speed) and warns that legacy systems must be replaced and siloed data must be broken up and made available in process overarching manner. (In short: it’s hard to manage compliance and risk effectively when data and processes are scattered.)

Putting Theory into Practice: Scenario Analysis

To make this more palpable, consider how employees experience compliance in specific crucial situations and how their experience could be improved:

- Global Product Launch: A business unit’s product manager is tasked with rolling out a new product to international markets. Without compliance integrated into her work, she has to e-mail local offices for each country’s requirements, seek relevant policies in a SharePoint folder and wait for spreadsheets of legal obligations as responses to her outreach. This is slow and error prone. With an integrated platform, however, she could see an automated compliance shopping list: For example, the system knows she is operating in Germany and flags EU GDPR (DSGVO) compliance needed and special third-party supplier due diligence required (LkSG) upfront. The compliance team can populate that checklist centrally, so local teams automatically align to standards and get highlighted relevant action points or checkmarks when they need it. Thus, the manager and compliance officer share one view of what needs doing, reducing back-and-forth and ensuring no market is overlooked.

- Reporting a Concern: An employee suspects a vendor bribery scheme. In a fragmented environment, he might spend hours searching intranets or employee handbooks to find the right people to report this to – getting conflicting answers from HR and Legal along the way, added to by outdated policies found in the intranet. Leaving out the delay in the process, this also brings uncertainty and doubt for the employee wanting to tip off. In an integrated system, he would simply log into a compliance portal, click Report Issue, follow the form, and the case would workflow instantly to the correct investigators. Training and policy documents (accessible from the same portal and interlinked with the LMS) would emphasize that making such a report is expected behavior and aligns everyone under the goal of achieving company objectives, not something he needs to fear. This transparency encourages prompt action and demonstrates commitment to ethical standards, aligning with COSO’s emphasis on open communication.

- Compliance Metrics: The risk committee meets quarterly to review their local dependencies’ compliance health. In one scenario, the compliance officer spent weeks gathering reports: cross-checking training logs, incident reports, and audit findings from different business units, then manually creating charts and diagrams showcasing trends and numbers. Important details could be missed. In a unified platform, all data flows into real-time dashboards, which in turn can have audience-adequate report generation capabilities. The committee chair can instantly slice data (e.g., by region or risk area) and ask questions on the spot. This breaks down walls between lines of defense: everyone is looking at the same live metrics. The outcome is faster decision-making (as Gartner and McKinsey point out) and a clearer focus on where to improve.

“Everyone is looking at the same live metrics. The outcome is faster decision-making and a clearer focus on where to improve.”

Conclusion: Finding the Right Software Platform to Support your Compliance Management System

Finding an adequate and scalable software platform to support your compliance management system aspirations is not the solution for everything – but it surely is a good start to cover most of the above-mentioned in one blow if you do it properly. While there is a multitude of options to choose from, I would recommend one currently standing out in the enterprise GRC world:

The modern compliance landscape and swiftness of change with compliance implications make it clear that point solutions will not cut it anymore. Senior leaders and compliance teams, just like first-line staff, need end-to-end, integrated tools so that compliance is not a disjointed laundry list, but rather a smoothly embedded process that fits their day-to-day work like a glove. As one analyst survey warns, organizations must find scalable, easy-to-manage compliance solutions that keep up with rapid change and do not have companies and departments constantly running after upgrades and custom-coded adjustments to their already non-integrated set of solutions.

Now, why would I not recommend a stand-out solution in the end, while I am at it? Corporater, with their business management platform (BMP), offers precisely this type of GRC software with the best of both worlds between enterprise standardization and unique configurative flexibility. Corporater’s no-code platform provides a single UX and single data model for governance, performance, risk, and compliance, and helps companies to abolish toggling between half a dozen tools and throwing around Excel sheets as far as their mail can reach. Corporater lets you configure compliance management system requirements on their platform and solutions through their building blocks to be able to interconnect policies, controls, risks, frameworks, org. structures, processes, assets, and workflows once and apply them across your enterprise, even supported by their own BPMN 2.0 engine (auditors love a good process map by the way).

The result is a consistent, user-centric experience: frontline employees see exactly the policies and tasks they need in their own language, compliance officers have a unified dashboard of obligations and incidents and executives receive holistic reports on control effectiveness based on near real time data while all three of the latter benefits from Corporater’s reporting capabilities, forms and surveys as well as advanced simulation engine. In short, Corporater can unify all aspects of compliance management on one platform, delivering an intuitive, end-to-end solution that aligns people, processes and policy and ultimately delivers a solution that fits your organizations’ internal and external requirements to the dot rather than imposing a software that wants you as a customer to change to it accordingly.

Corporater is a Representative Vendor in the 2023 Gartner® Market Guide