TRUSTED. SECURE. SCALABLE.

Manage Risk Holistically with Confidence

Corporater Business Management Platform Trusted by Top Organizations

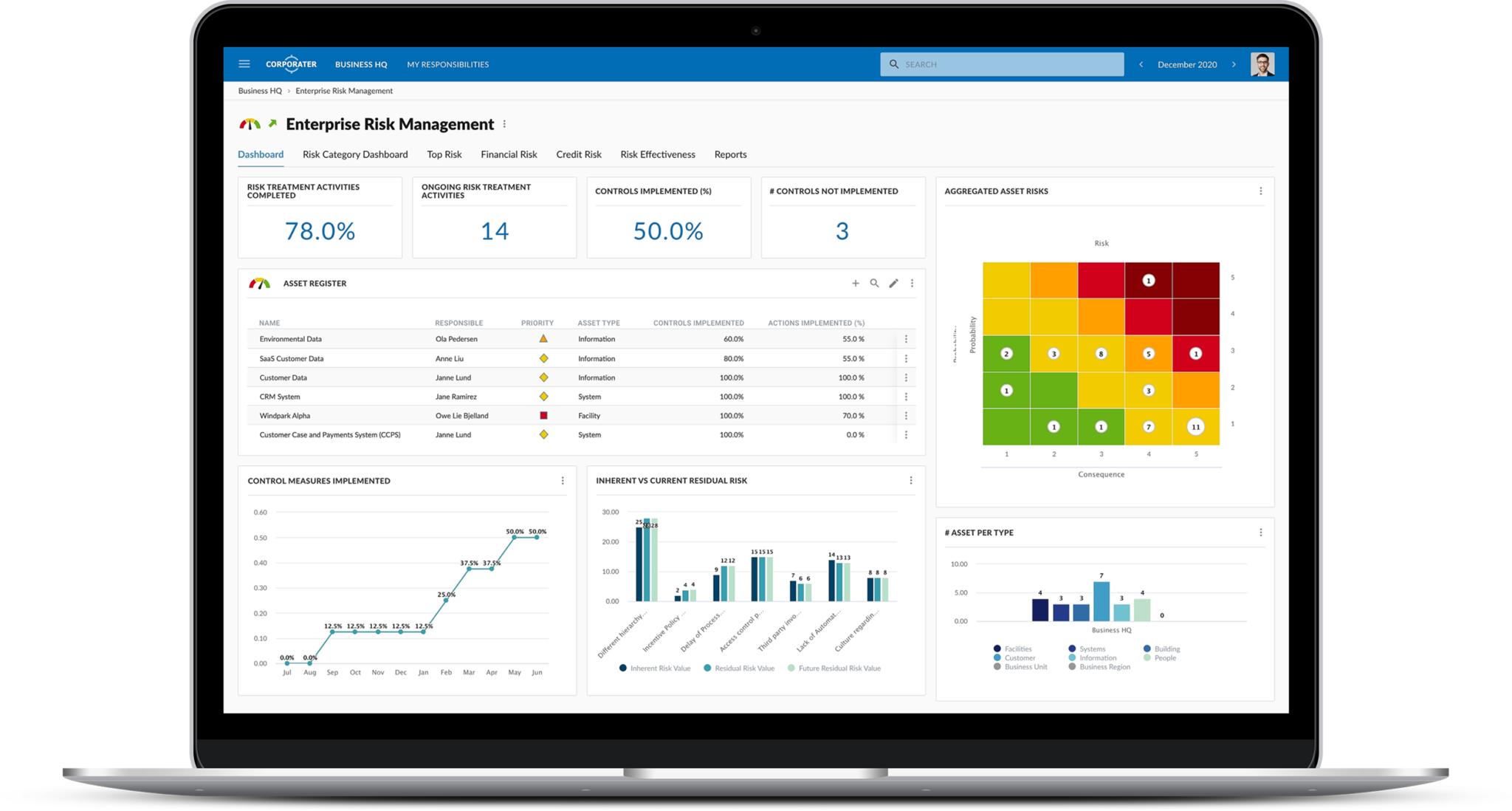

Corporater ERM Software

Corporater Risk Management software offers an integrated and holistic approach to digital and data-driven risk management to help organizations achieve a more realistic risk profile and better data for risk-based decision making and problem-solving. As a highly flexible solution, it can be used with a variety of frameworks, including ISO risk frameworks.

Corporater helps organizations to verify adequate controls for regulatory compliance, information security, vendor performance, business continuity management, performance, viability, security, and data protection. Comply with the NIS2 Directive using Corporater’s comprehensive InfoSec features. Ensure cybersecurity and data protection in line with EU directives.

Organizations can use Corporater to gain greater visibility into third-party relationships and reduce threats related to the use of third parties (vendors, suppliers, partners, contractors, business channels, etc.) as well as data privacy, on a single platform.

Key Benefits

Move to a collaborative, integrated environment that enables a unified risk register and bridges the communication gap.

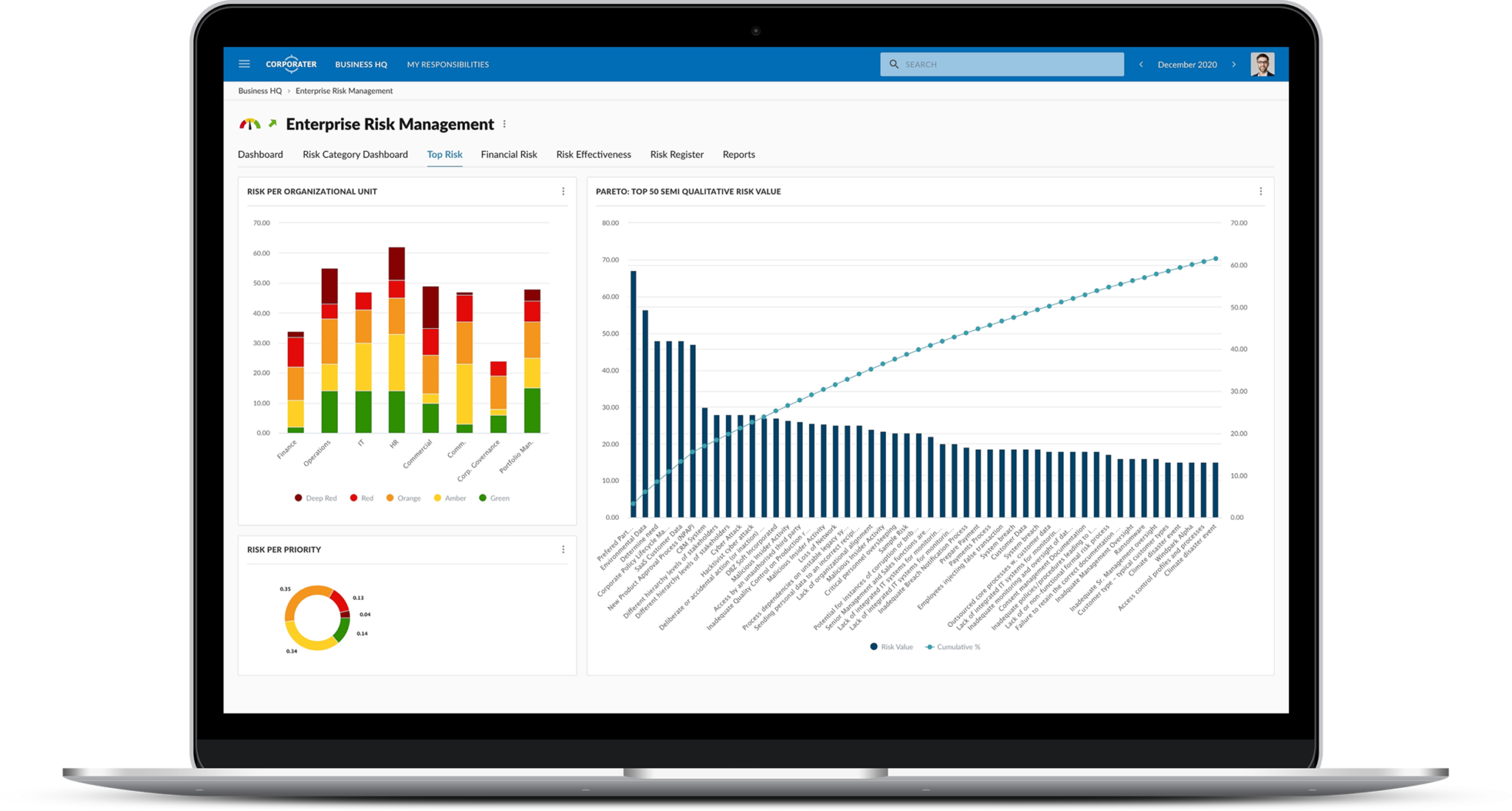

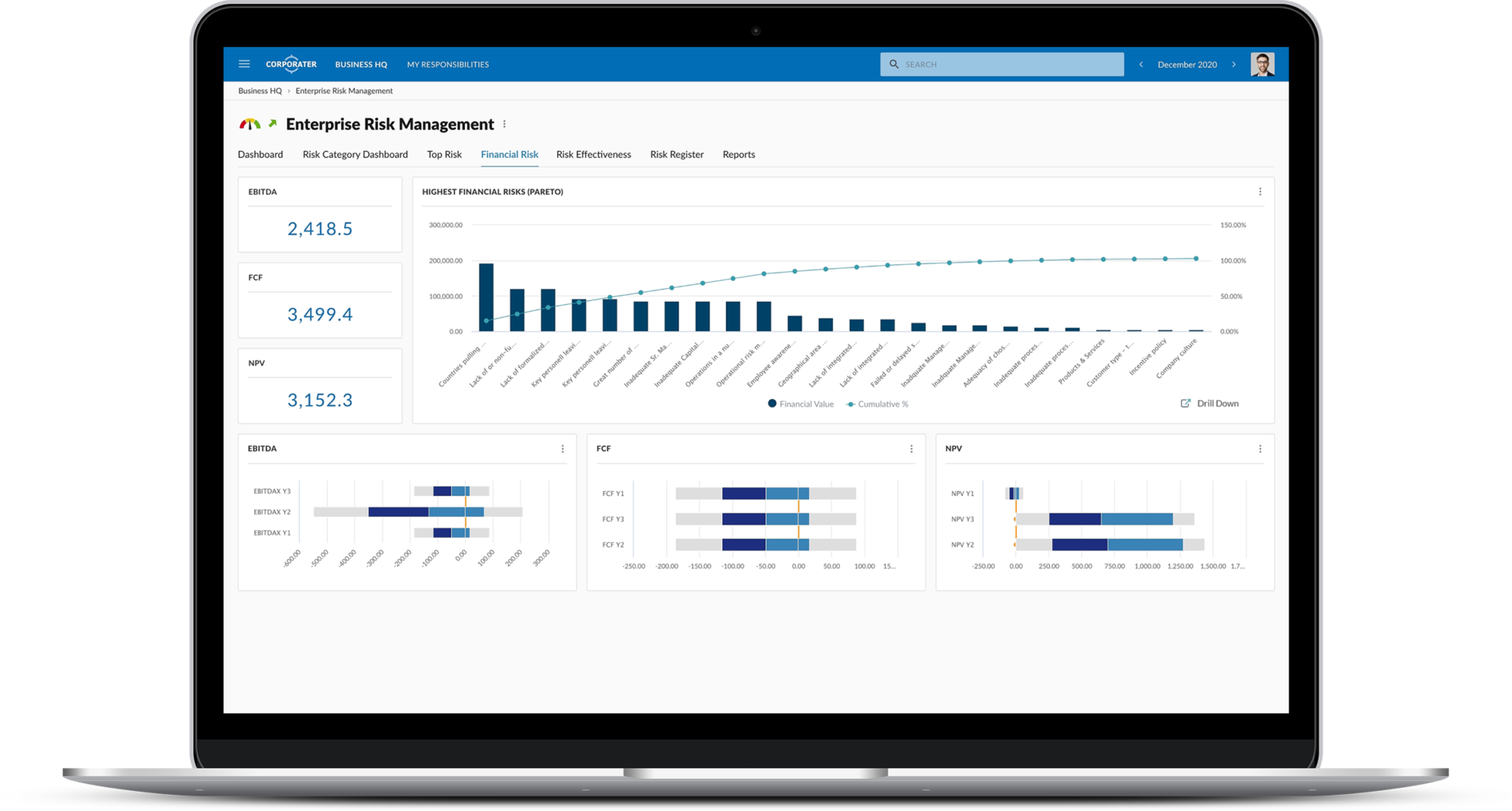

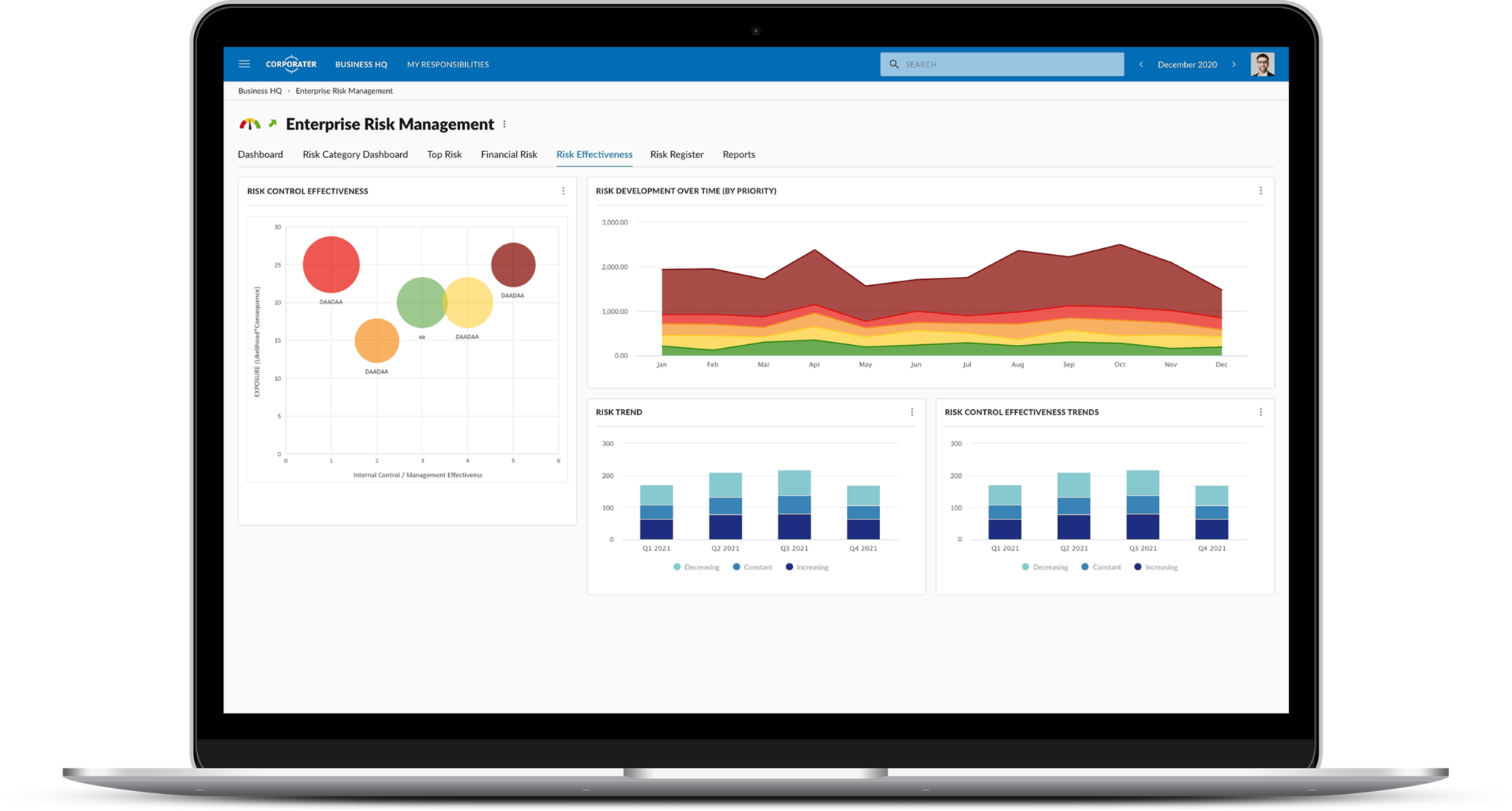

Make faster and better decisions based on up-to-date, transparent, traceable, and systematic information visualizations.

Include all aspects of risks that may threaten your strategic objectives, including facets of business integrity.

Request Demo

Key Features

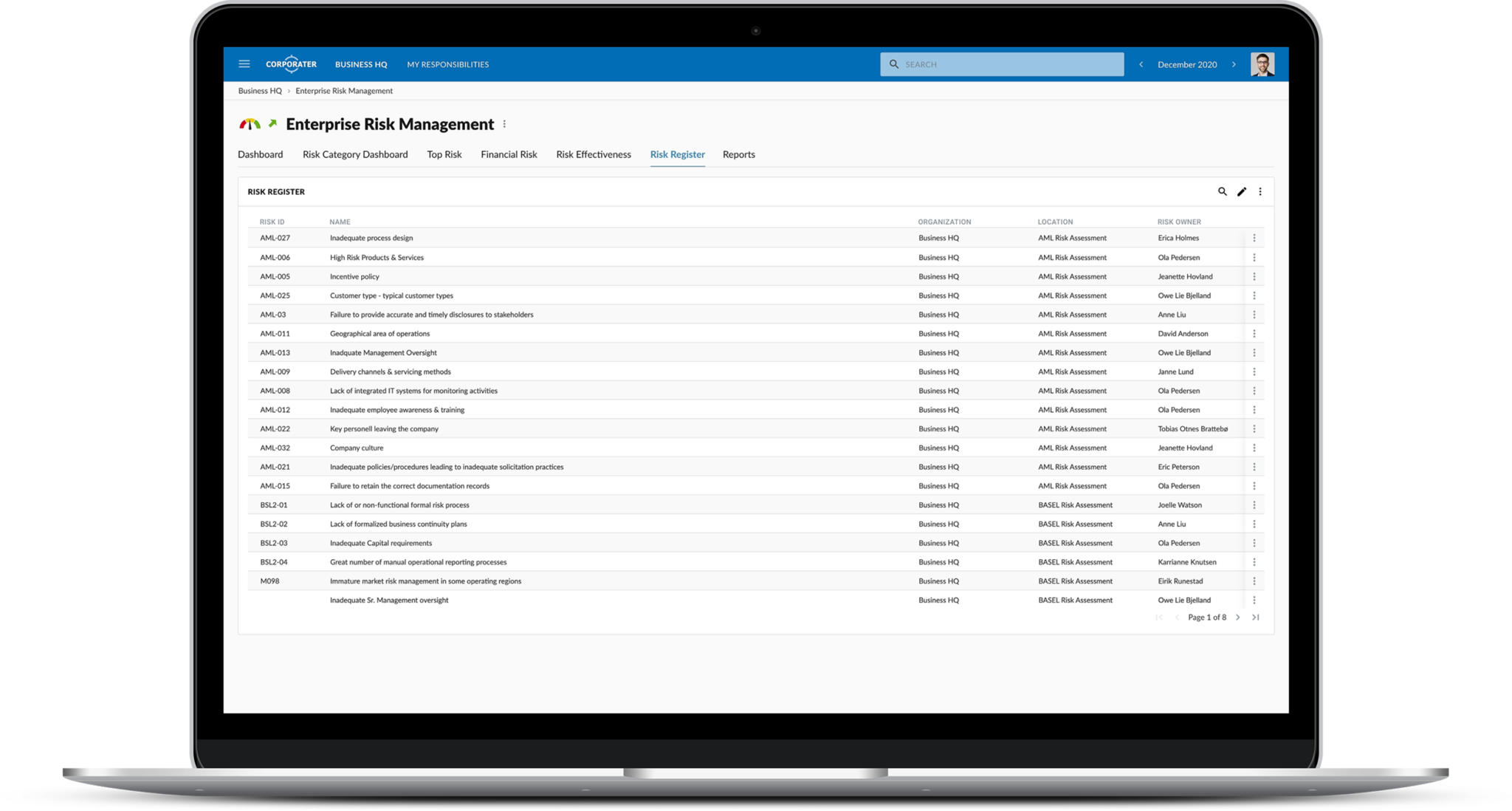

Continuously identify risks in various ways – from forms, data integrations, or user input – and record them in a centralized risk register (risk inventory). Enable top down, bottom up and/or hybrid identification.

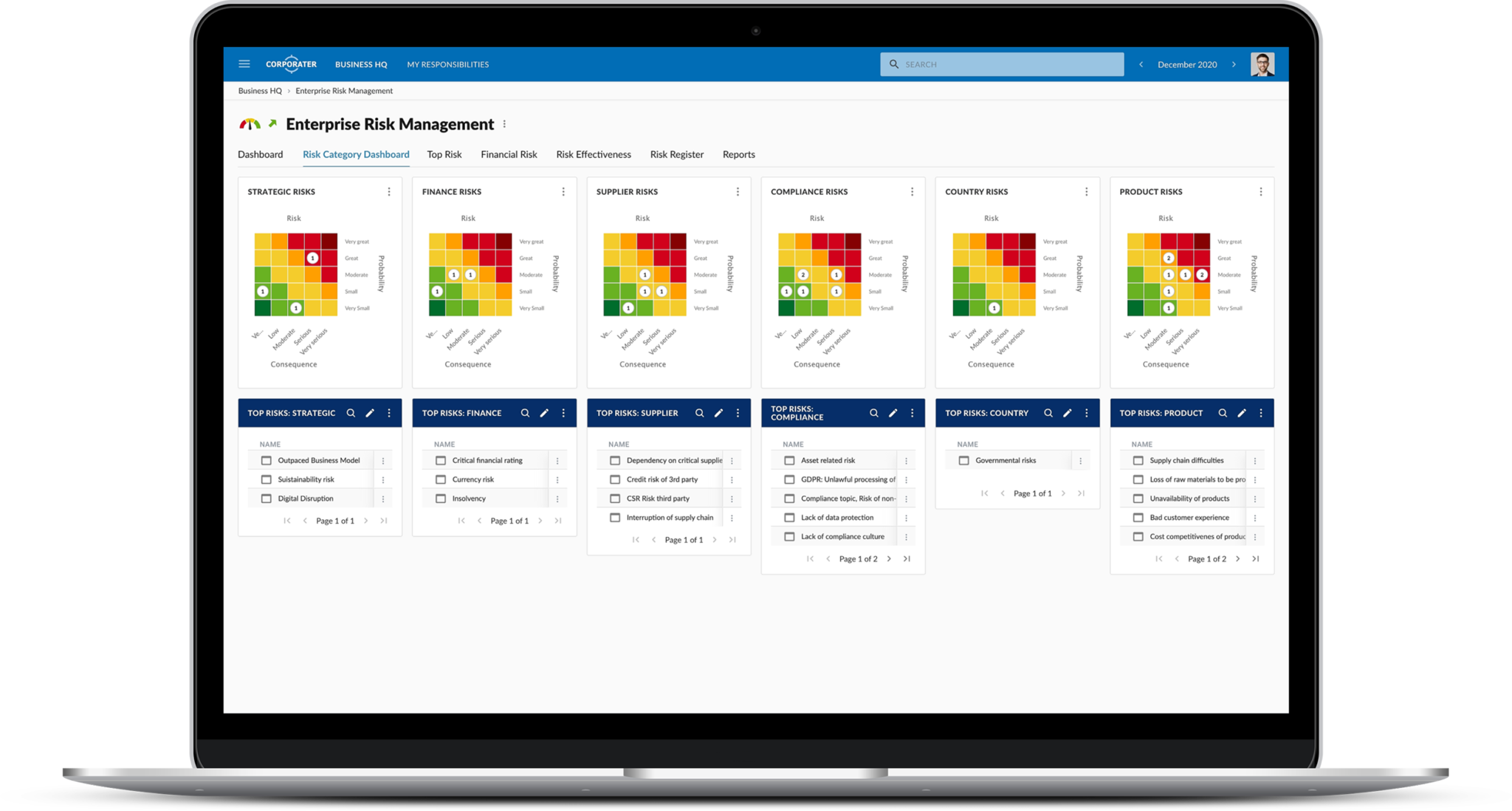

Build and maintain a centralized risk register. Group risk register allows creating top-down risks and consolidate risks from entities. Local risk registers can be customized to specific needs of departments, jurisdictions, etc.

Keep your organization prepared for the unexpected with Corporater risk planning and early risk identification. Communicate risk across the organization, identify KRI gaps, and set remediation plans into action.

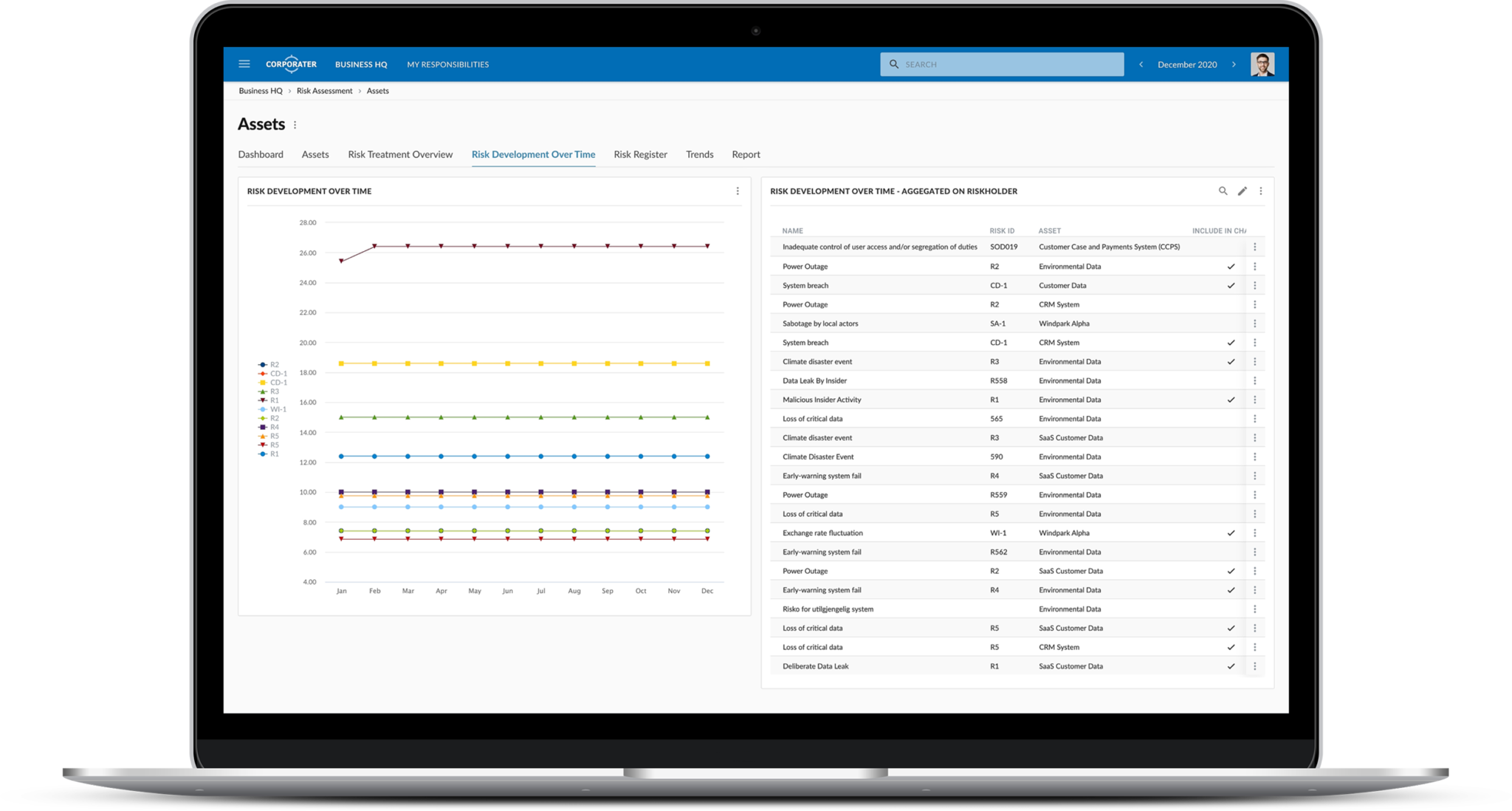

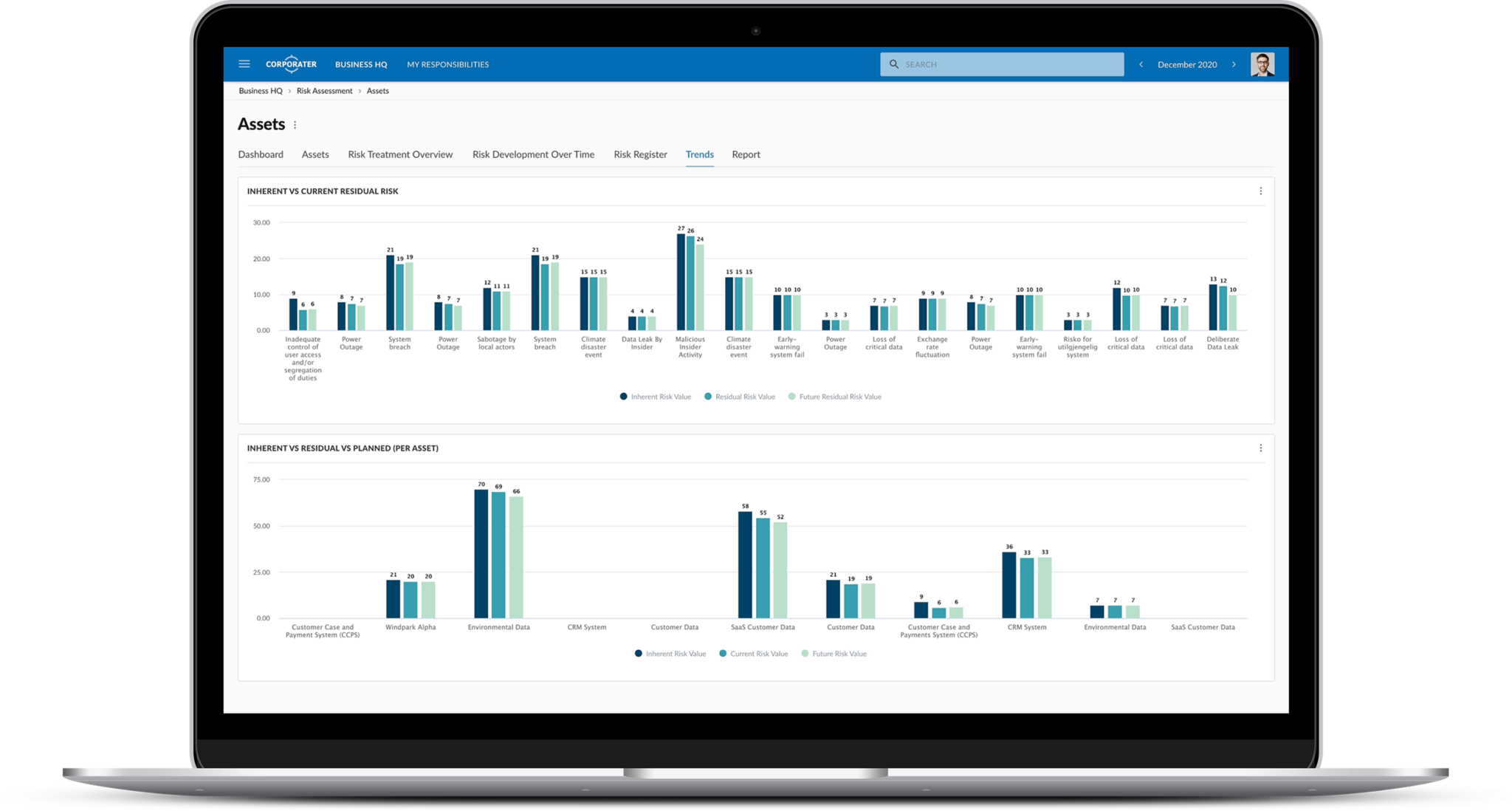

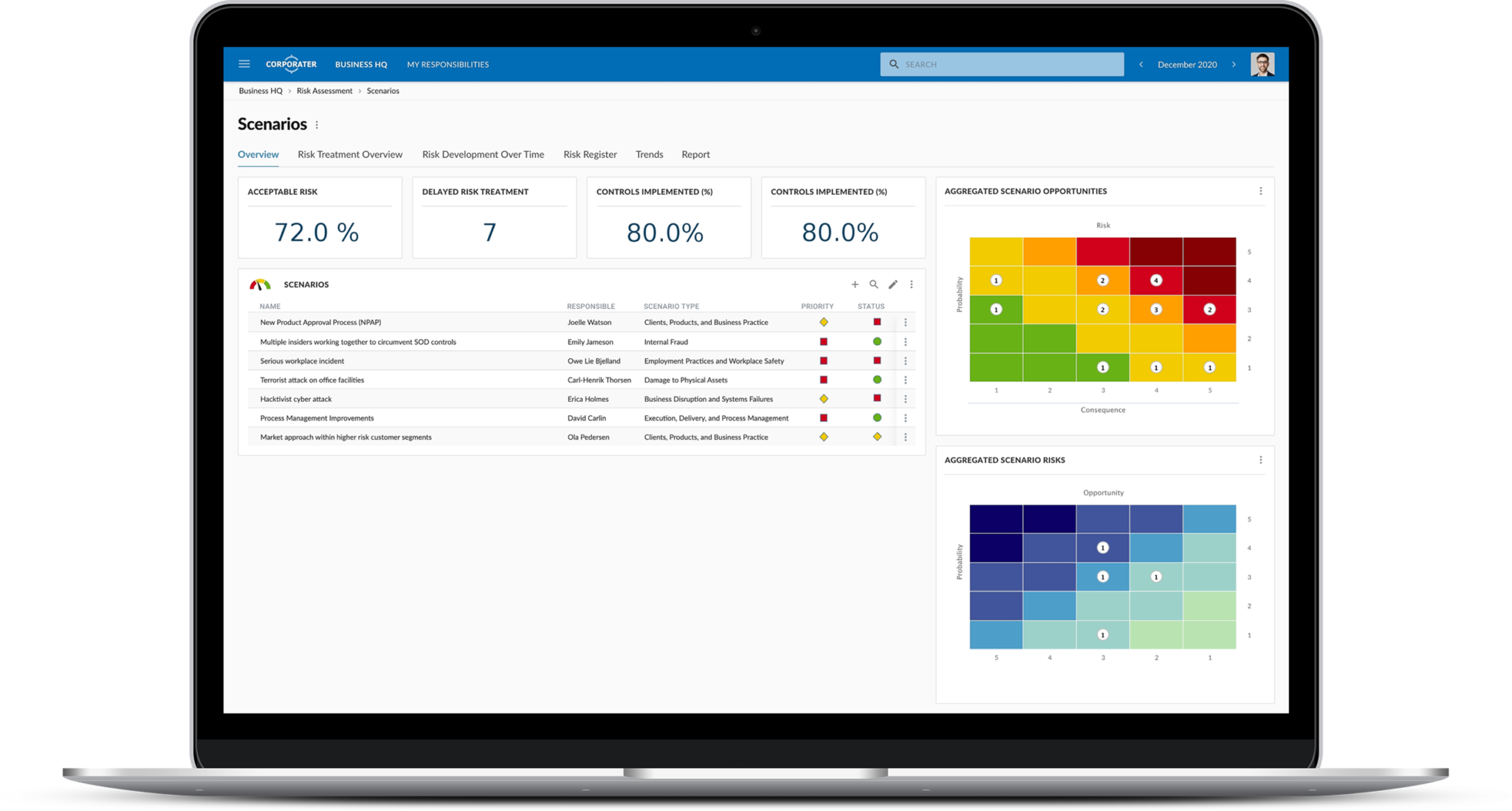

Assess, evaluate, respond, treat, and report your risks. Corporater supports quantitative and qualitative risk assessments. Risk can be assessed using expert mode, guided wizards, surveys, AI assisted and more.

Risks can be distributed, re-assessed and managed across different entities. Processes can be used to orchestrate even complex assessment and approval processes. Different processes can be implemented for different risk domains.

Establish and automate incident management processes to minimize adverse impacts on your organization. Track, monitor, manage, report, and resolve risk issues and incidents using a single system.

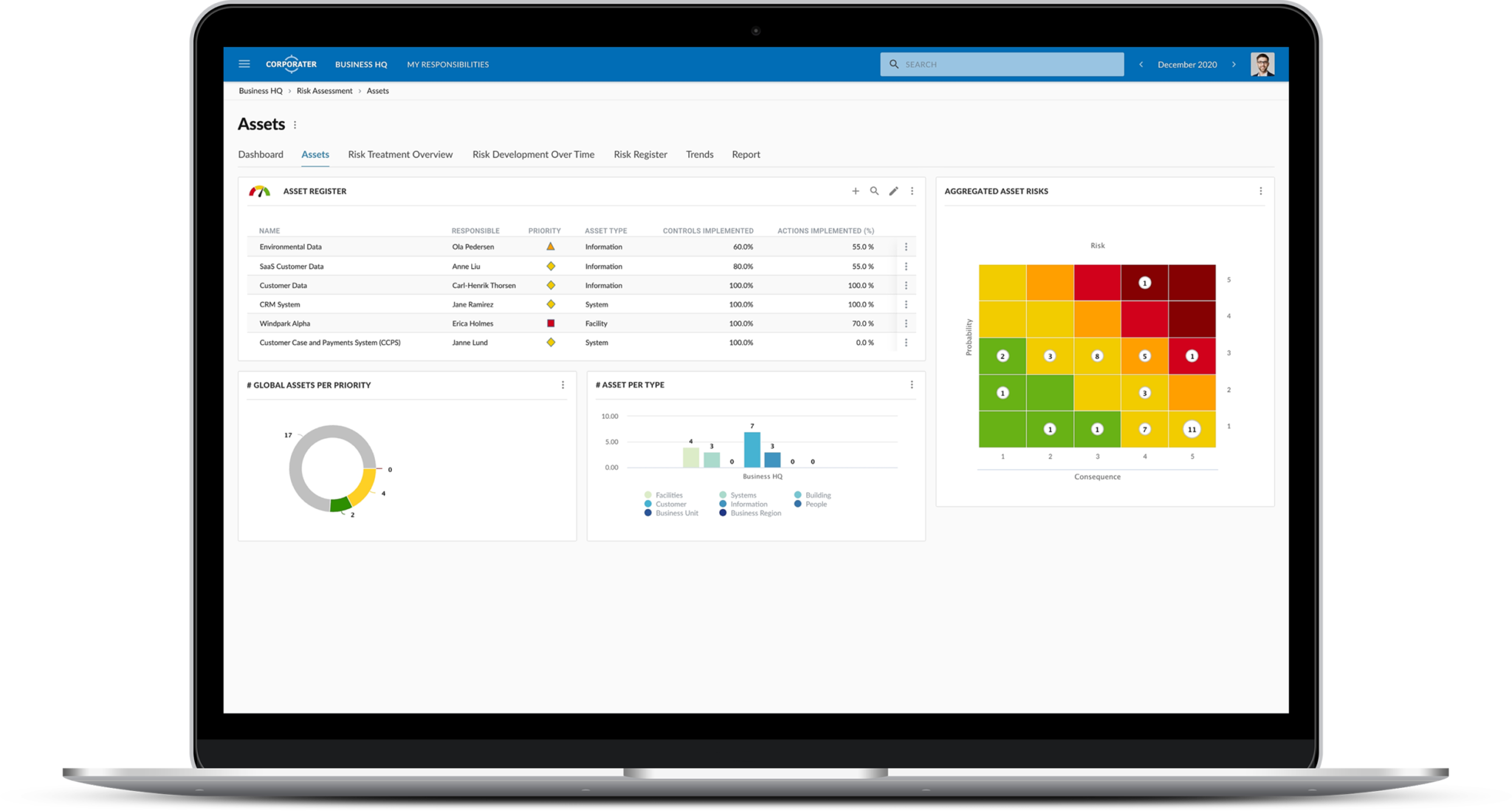

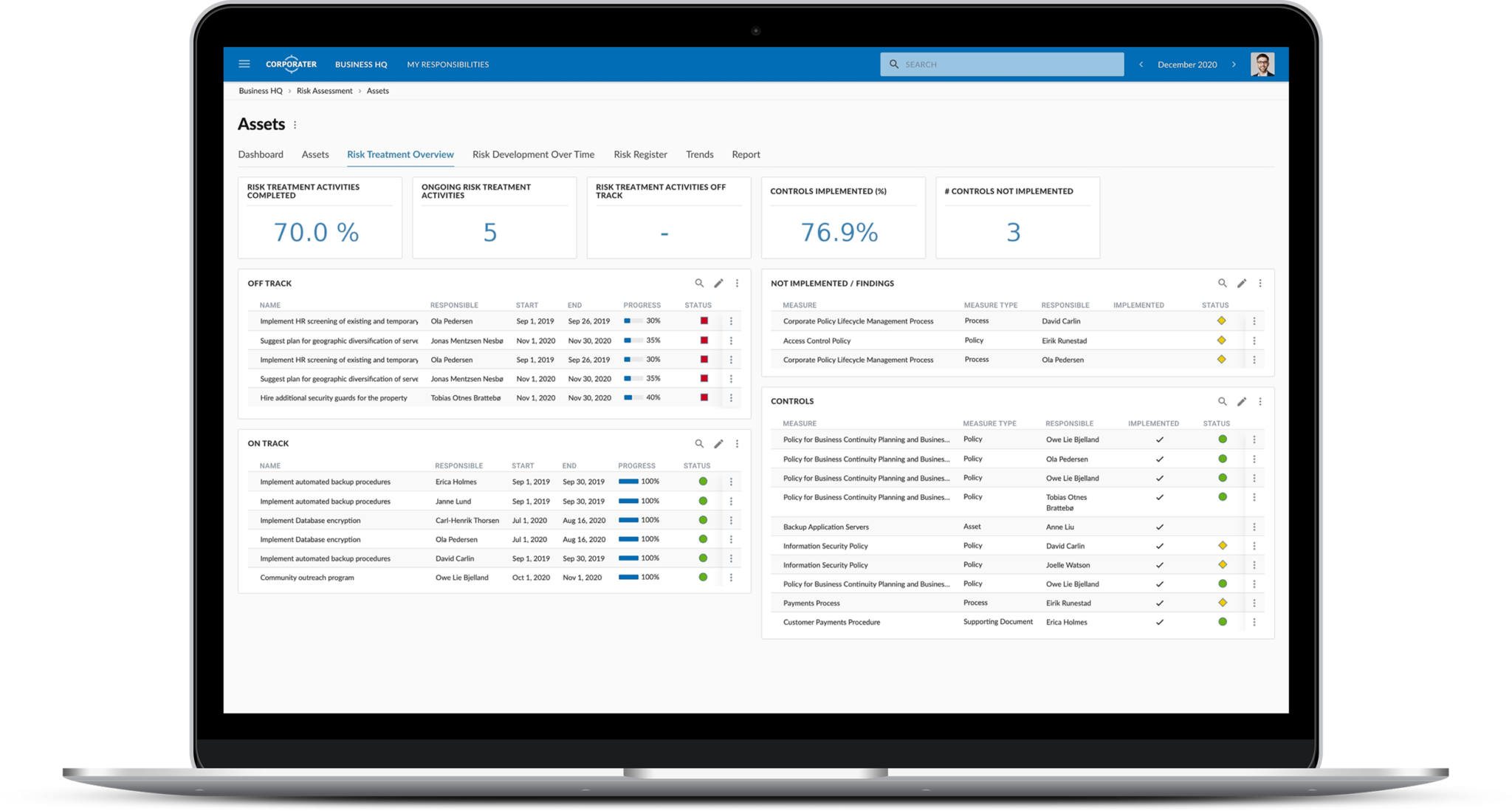

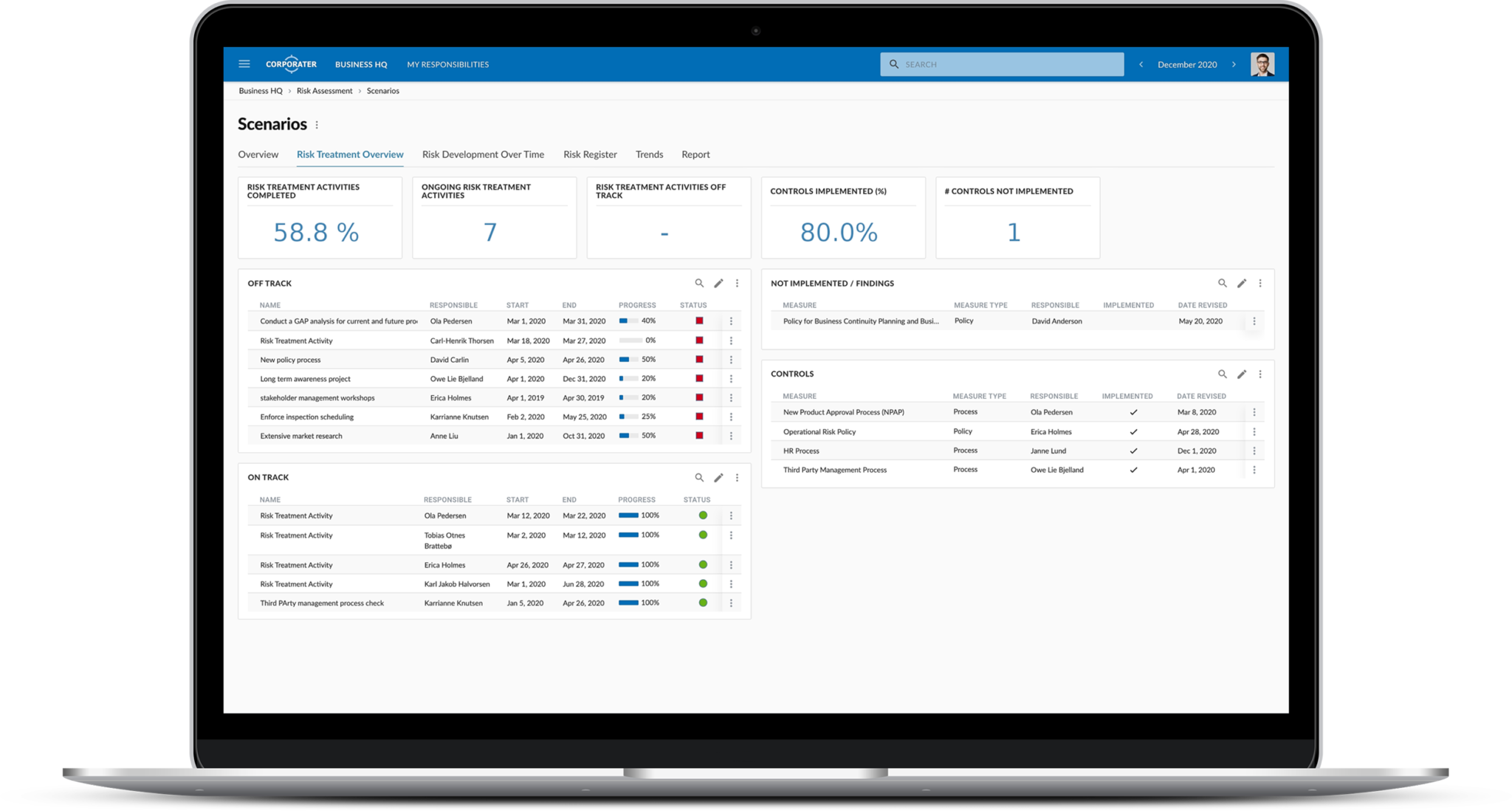

Set up control test templates and improvement databases. Use control libraries on both group levels and entity levels. Enable status and alerts for risk treatment activities. Document and monitor control activities that mitigate risks.

Create a role-based risk dashboards to have a complete overview of risks, their potential impact, options for risk mitigation, and more. Generate custom risk reports and submit them through review/approval process.

Take appropriate action to minimize risk impact — risk avoidance, risk reduction, risk-sharing, or transfer. Define custom risk management actions and document decisions. Set automated notifications to communicate assignments, responsibilities, approval status, and overdue tasks.

Download Corporater Enterprise Risk Management Solution Brief

Our solutions help consolidate all risk data into one central hub, monitor key risk indicators (KRIs) and risk exposure across multiple business units, conduct risk assessments, manage various types of risks, and report on risk mitigation controls measures.