TRUSTED. SECURE. SCALABLE.

Assess Impact and Manage Risks Individually and Collectively

Corporater Business Management Platform Trusted by Top Organizations

Corporater ORM Software

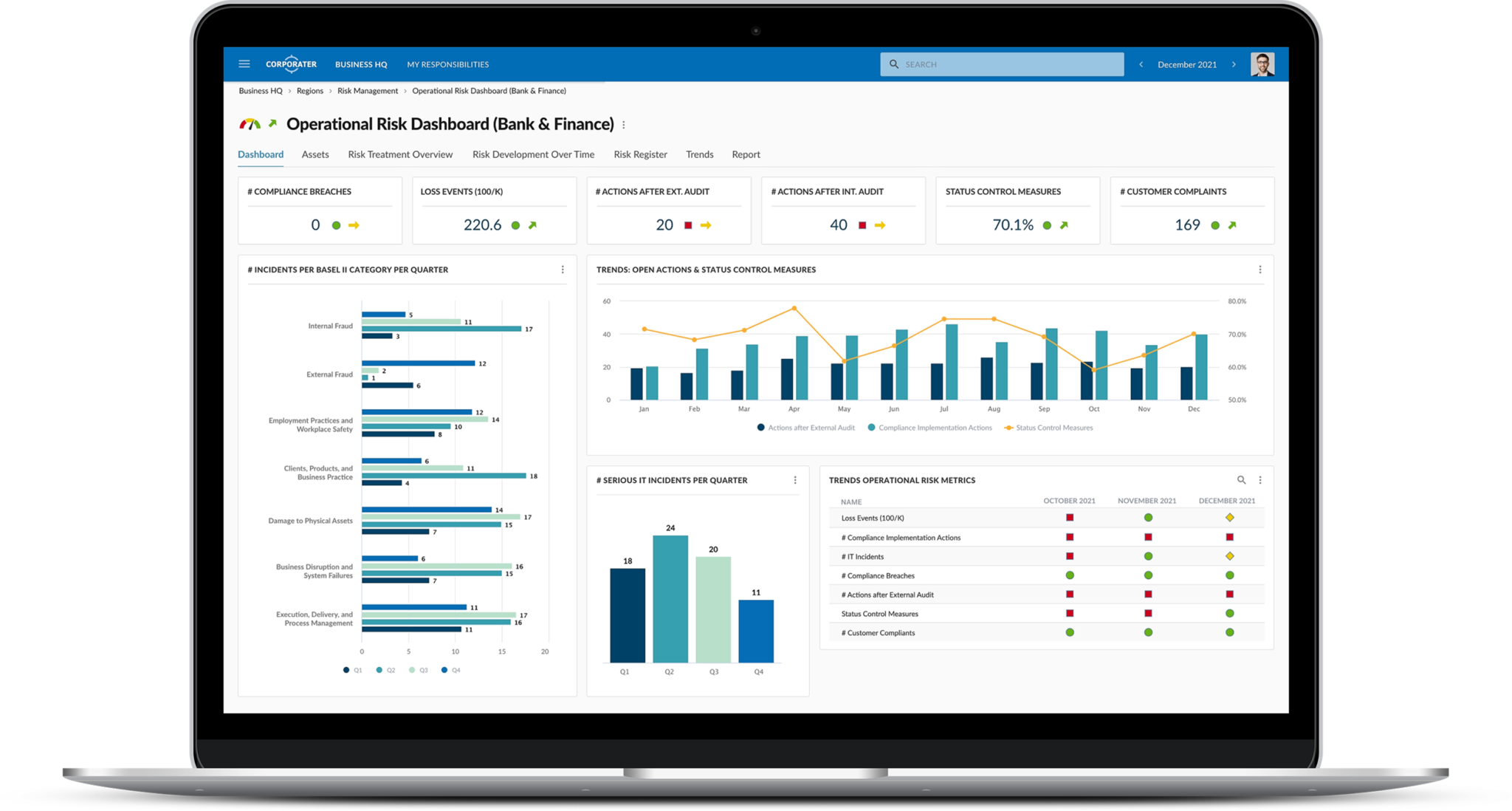

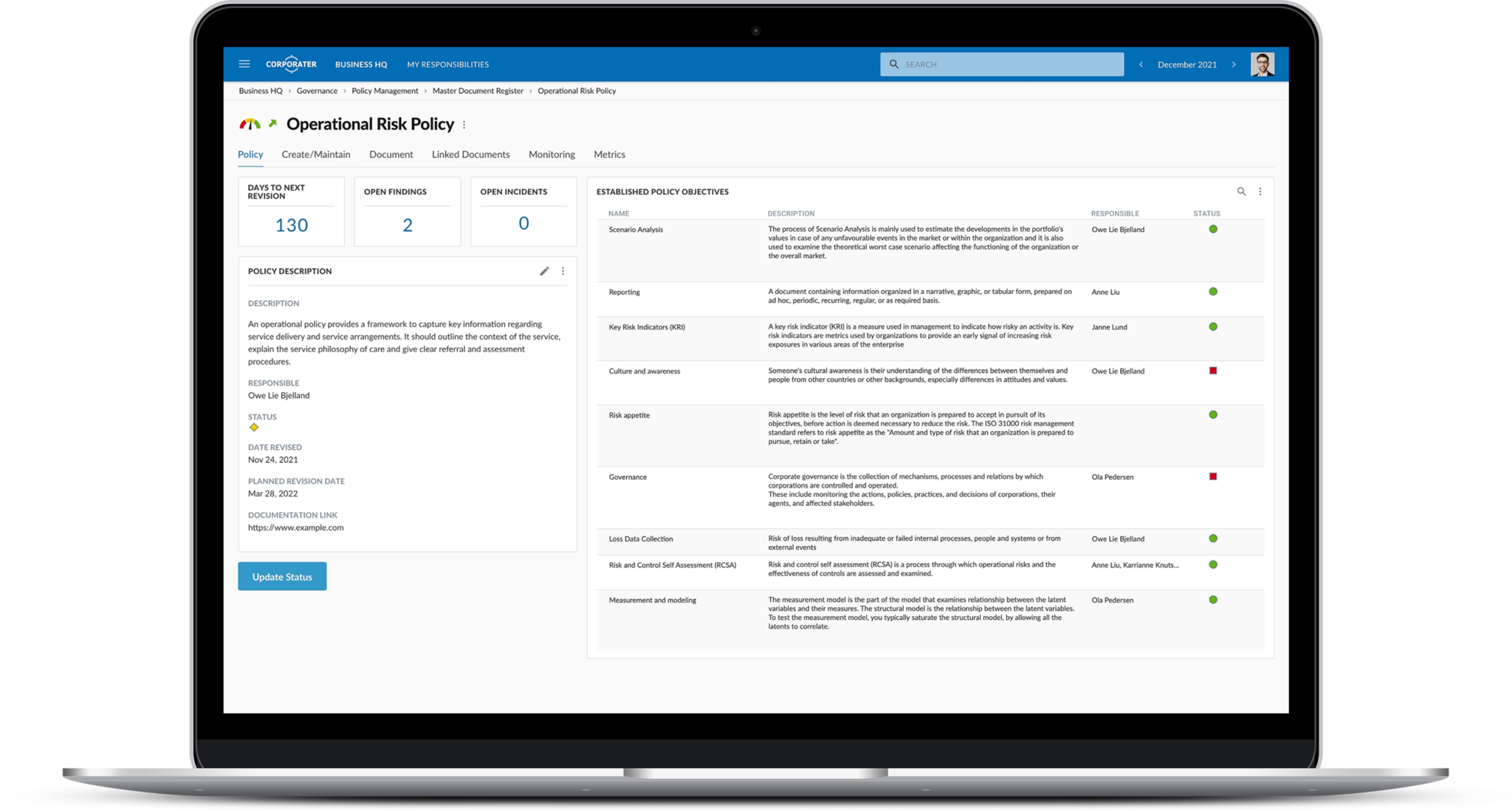

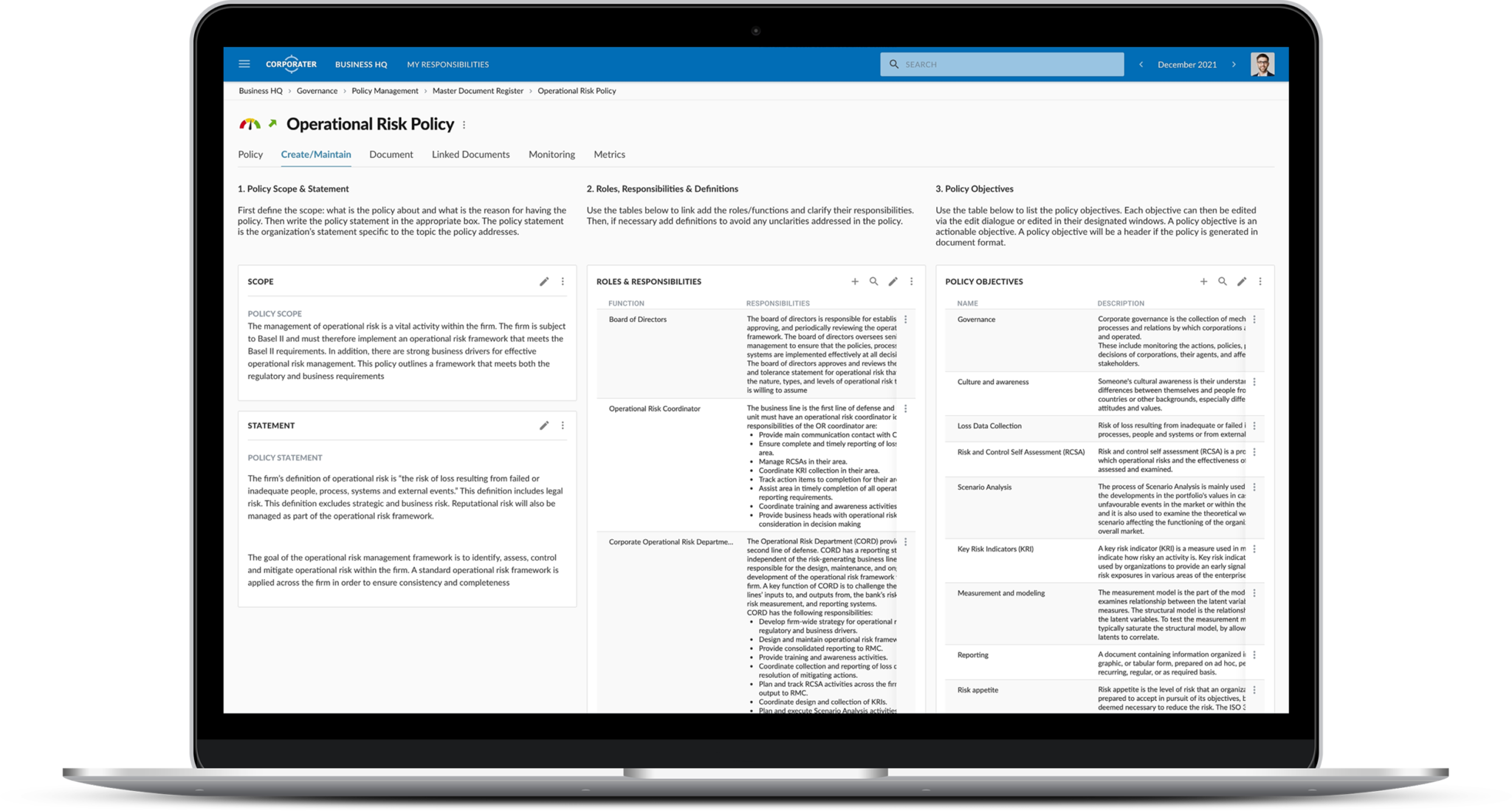

Corporater Operational Risk Management software enables the first line, the operational managers/process owners, to establish and operationalize the policies, define processes, and actively manage risks through risk assessments. Measure key performance, risk, and compliance indicators and ensure strategic alignment of objectives. Efficiently track incidents, take remedial measures, and conduct self-assessments within the business processes.

Corporater offers tools to create and maintain an up-to-date risk register of risks to have a complete and current view of risks. You can establish shared standards and processes, and a clear process for moving from initial due diligence to business continuity.

Organizations can achieve operational risk governance in accordance with relevant compliance standards and taxonomies, and assurance of compliance, e.g.: Anti-Money Laundering, BASEL & Solvency, Information Security & Data Privacy.

Key Benefits

Define risk areas posing a threat to your organization’s existence across all departments, levels, and processes, and link to assurance frameworks.

Analyze, rank, and continuously quantify identified risks based on their probability of occurrence and quantitative effects.

Don't just monitor risks, choose risk avoidance, risk reduction, risk-sharing, or transfer - to minimize risk impact.

Request Demo

Key Features

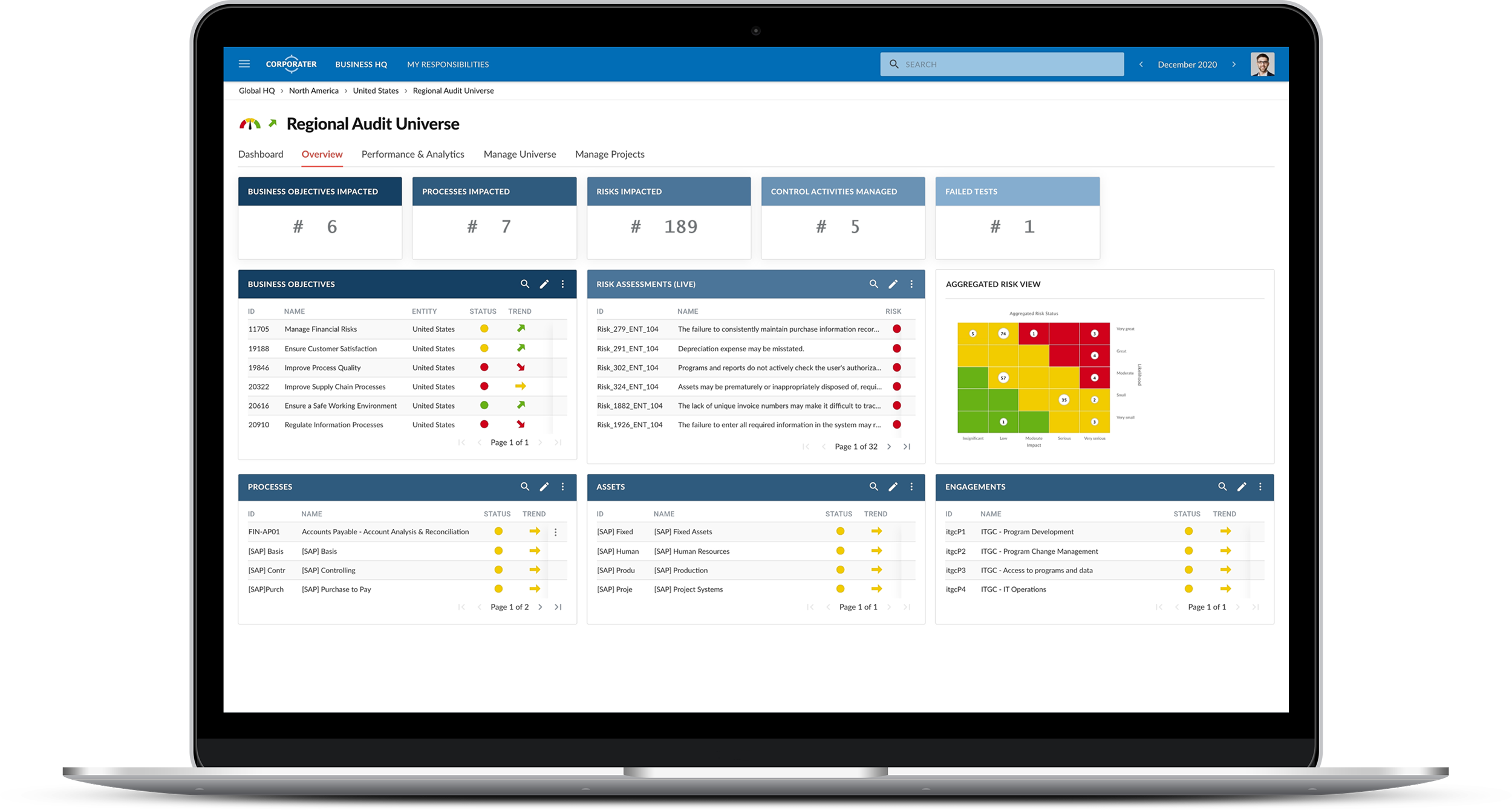

Continuously identify risks in various ways – from forms, data integrations, or user input – and record them in a centralized risk register (risk inventory). Enable top down, bottom up and/or hybrid identification.

Build and maintain a centralized risk register. Group risk register allows creating top-down risks and consolidate risks from entities. Local risk registers can be customized to specific needs of departments, jurisdictions, etc.

Establish a consolidated cockpit of the financial risks. Holistically identify, analyze, evaluate, and treat non-financial risks. Enable risk consolidation and aggregation from internal and external data sources.

Assess, evaluate, respond, treat, and report your risks. Corporater supports quantitative and qualitative risk assessments. Risk can be assessed using expert mode, guided wizards, surveys, AI assisted and more.

Risks can be distributed, re-assessed and managed across different entities. Processes can be used to orchestrate even complex assessment and approval processes. Different processes can be implemented for different risk domains.

Continuously monitor internal and third-party risks across the organization. Monitor identified, residual and secondary risks, take a corrective action, and measure effectiveness of your response.

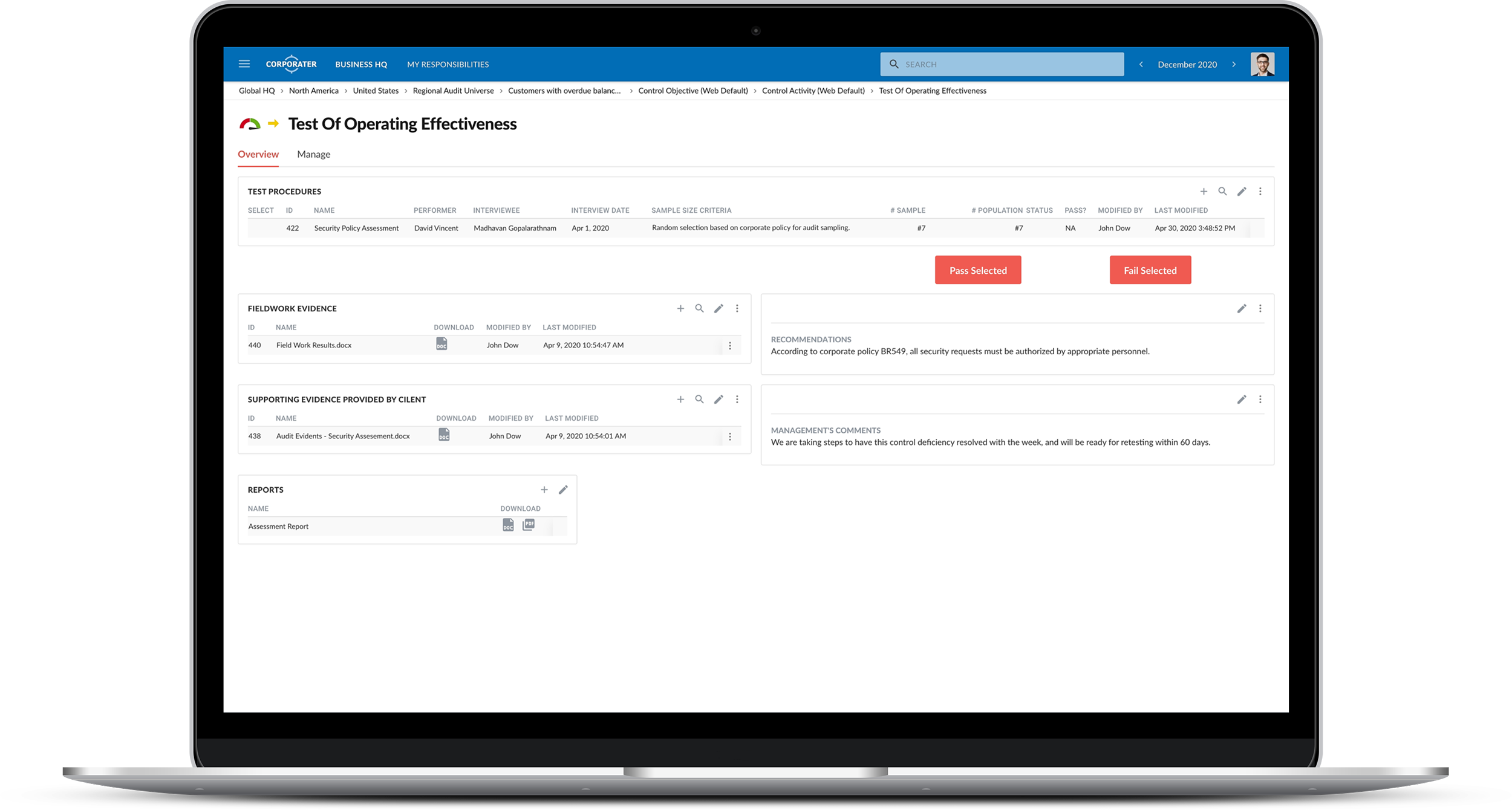

Establish and automate incident management processes to minimize adverse impacts on your organization. Track, monitor, manage, report, and resolve risk issues and incidents using a single system.

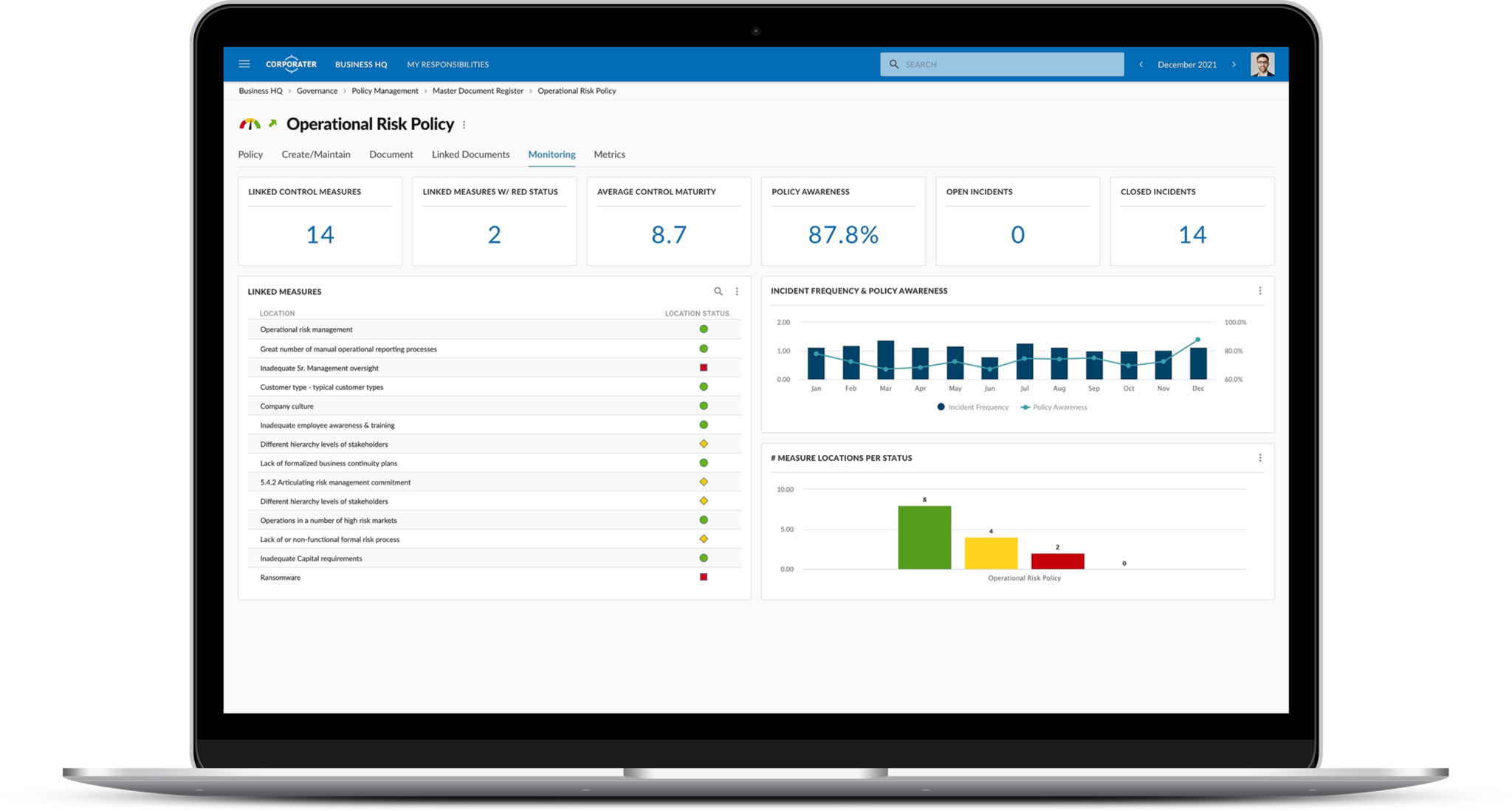

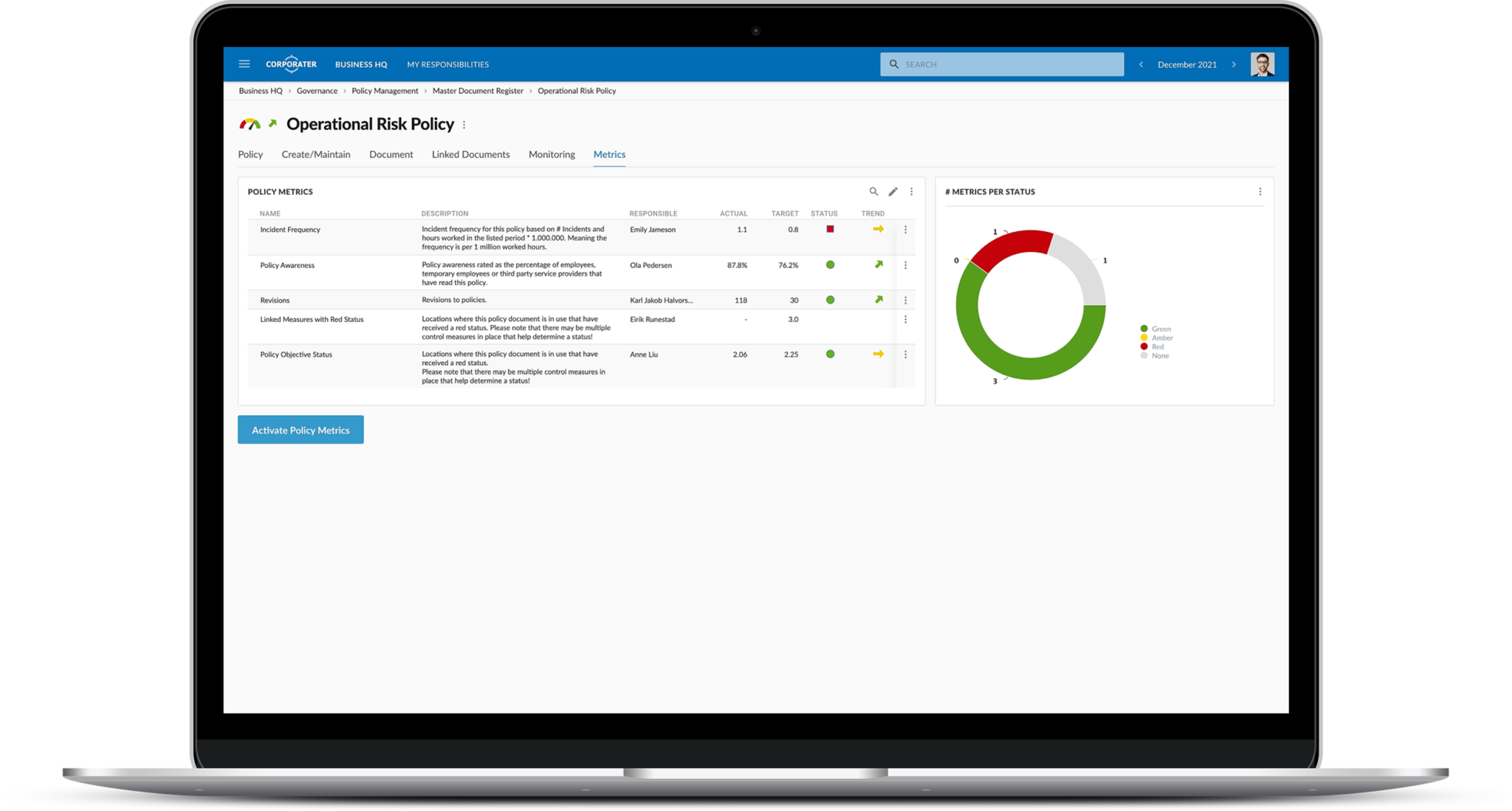

Set up control test templates and improvement databases. Use control libraries on both group levels and entity levels. Enable status and alerts for risk treatment activities. Document and monitor control activities that mitigate risks.

Create a role-based risk dashboards to have a complete overview of risks, their potential impact, options for risk mitigation, and more. Generate custom risk reports and submit them through review/approval process.

Download Operational Risk Management Solution Brief

Our solutions help proactively identify, assess, and address operational risks across your organization to keep your business operations protected.