Anti-money Laundering Software

As regulators aim to ensure that organizations are putting policies and procedures in place to properly identify, monitor, and mitigate risk, the scrutiny surrounding compliance is rapidly increasing. Banks and other financial institutions are required to create an Anti-Money Laundering (AML) compliance program to prevent the risk of financial crime. Designing and maintaining an effective AML compliance program has proven to be a difficulty for many firms due to the intricacy of AML legislation.

Corporater Anti-Money Laundering (AML) solution is an enterprise-grade digital tool that allows organizations to govern, manage, and assure a solid AML compliance program, as well as demonstrate compliance with AML standards. Corporater enables AML compliance officers to take a risk-based approach to AML compliance, reducing the risk of financial crimes while ensuring compliance.

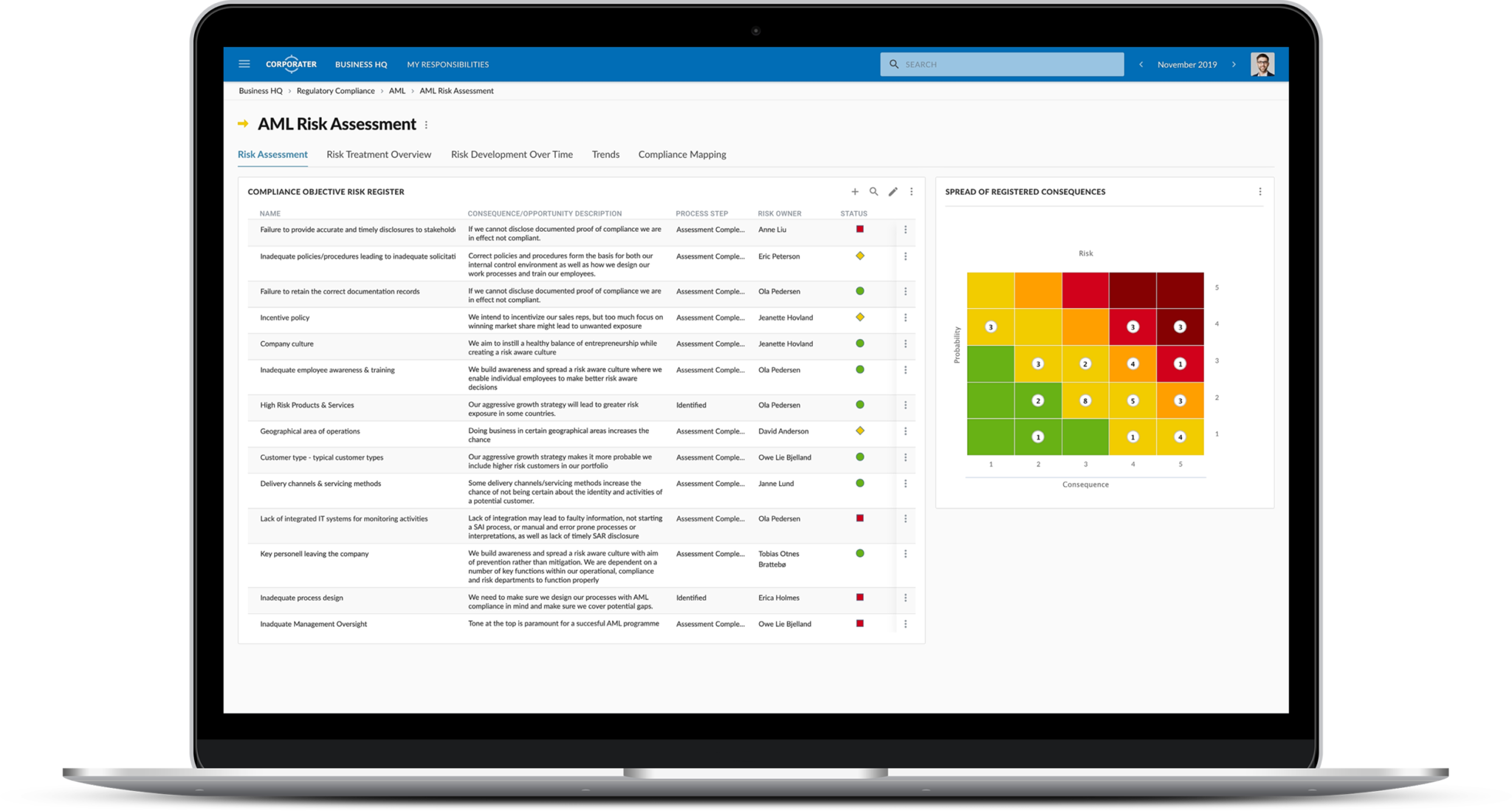

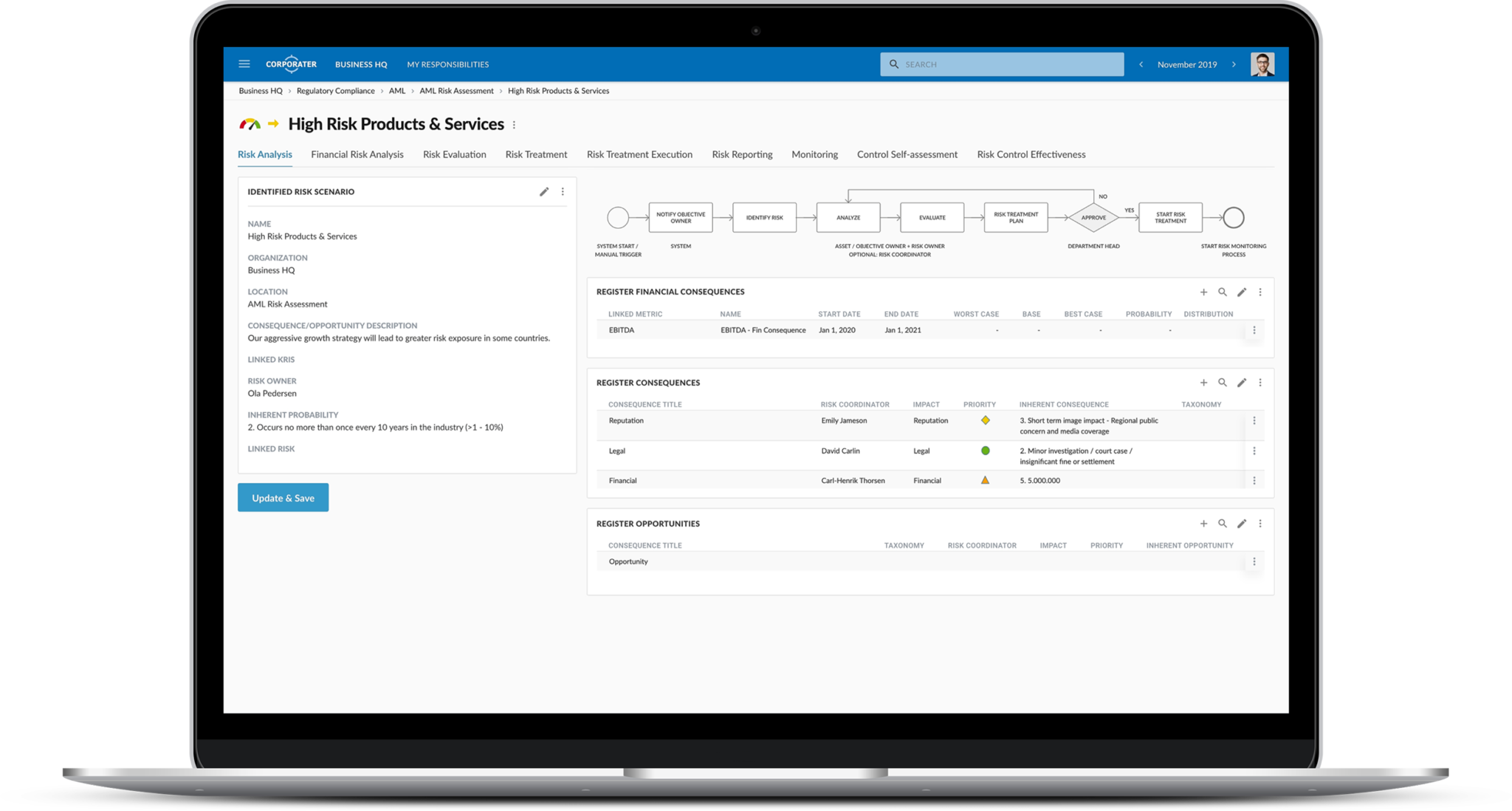

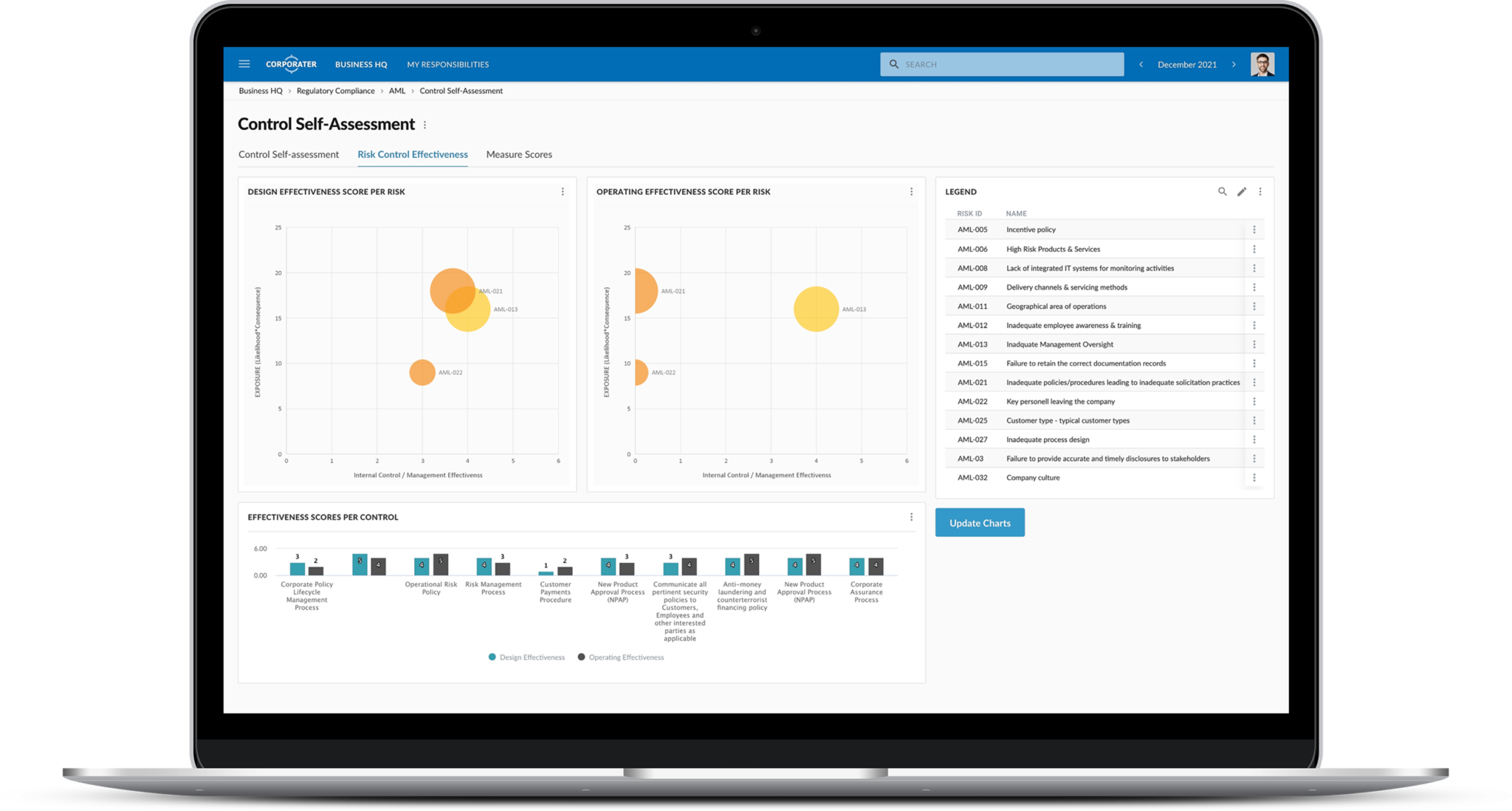

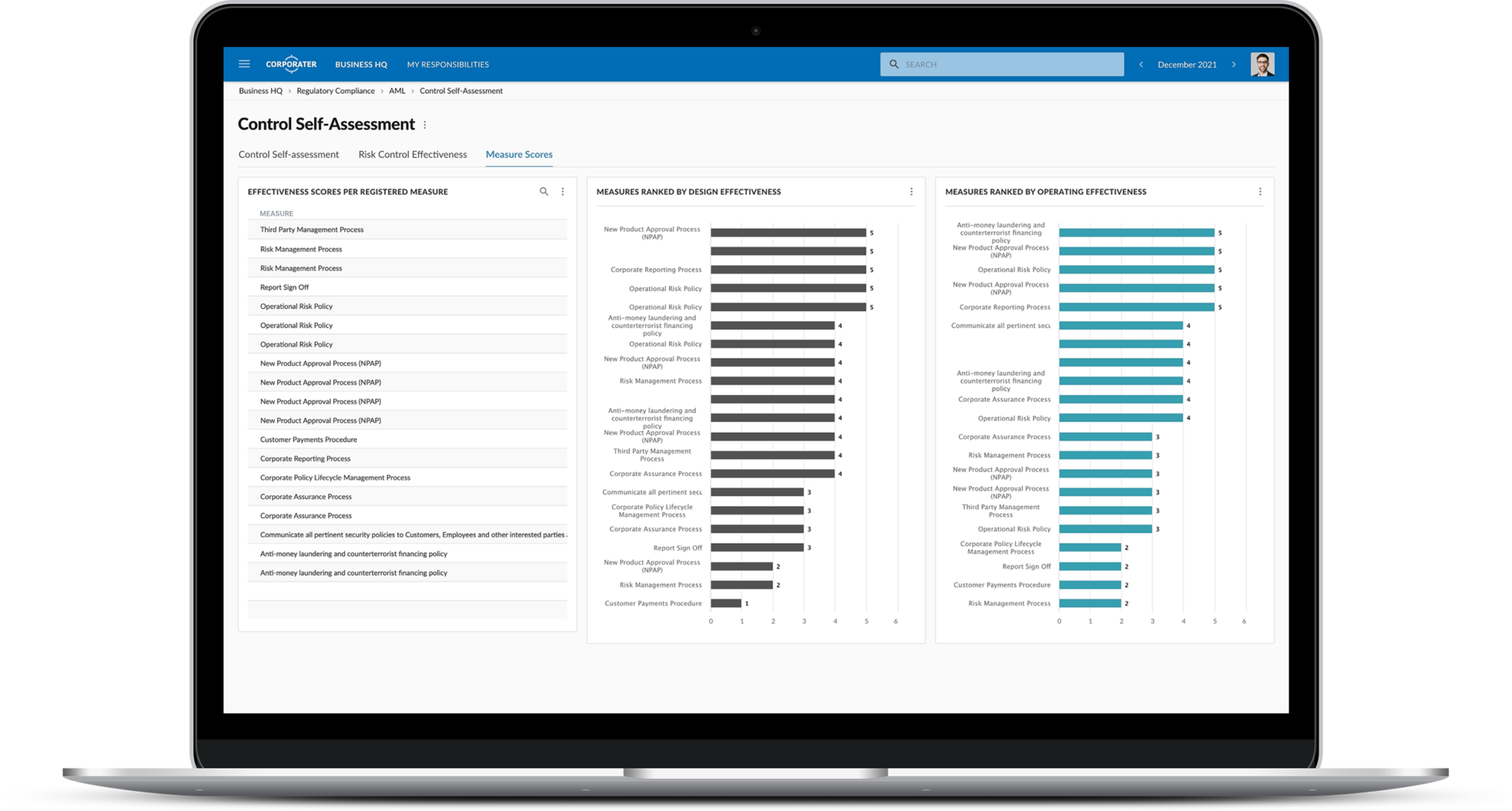

Our built-in workflows allow users to quickly identify, assess, mitigate, and monitor risks based on their priority, prioritize compliance concerns, and add context to compliance obligations.

Organizations can use Corporater AML Compliance software to:

- Holistically govern, manage, and assure AML crime prevention activities

- Configure custom AML dashboards to display relevant data metrics, KPIs, KRIs, and KCIs at each organizational level

- Identify, assess, address, and report AML risks across the organization

- Manage cross-border and multi-jurisdictional AML-compliance requirements at local and global level

Corporater AML solution can be used as a point solution or in combination with other Corporater and third-party solutions to form a holistic GRC program that continuously strengthens the three lines of defense. Built on the Corporater Business Management Platform, the Corporater AML solution can be seamlessly extended with solutions such as Enterprise Risk Management, Business Continuity Management, Internal Audit, and others.