TRUSTED. SECURE. SCALABLE.

Comply with UK Corporate Governance Code

Corporater Business Management Platform Trusted by Top Organizations

Gain the confidence you need with

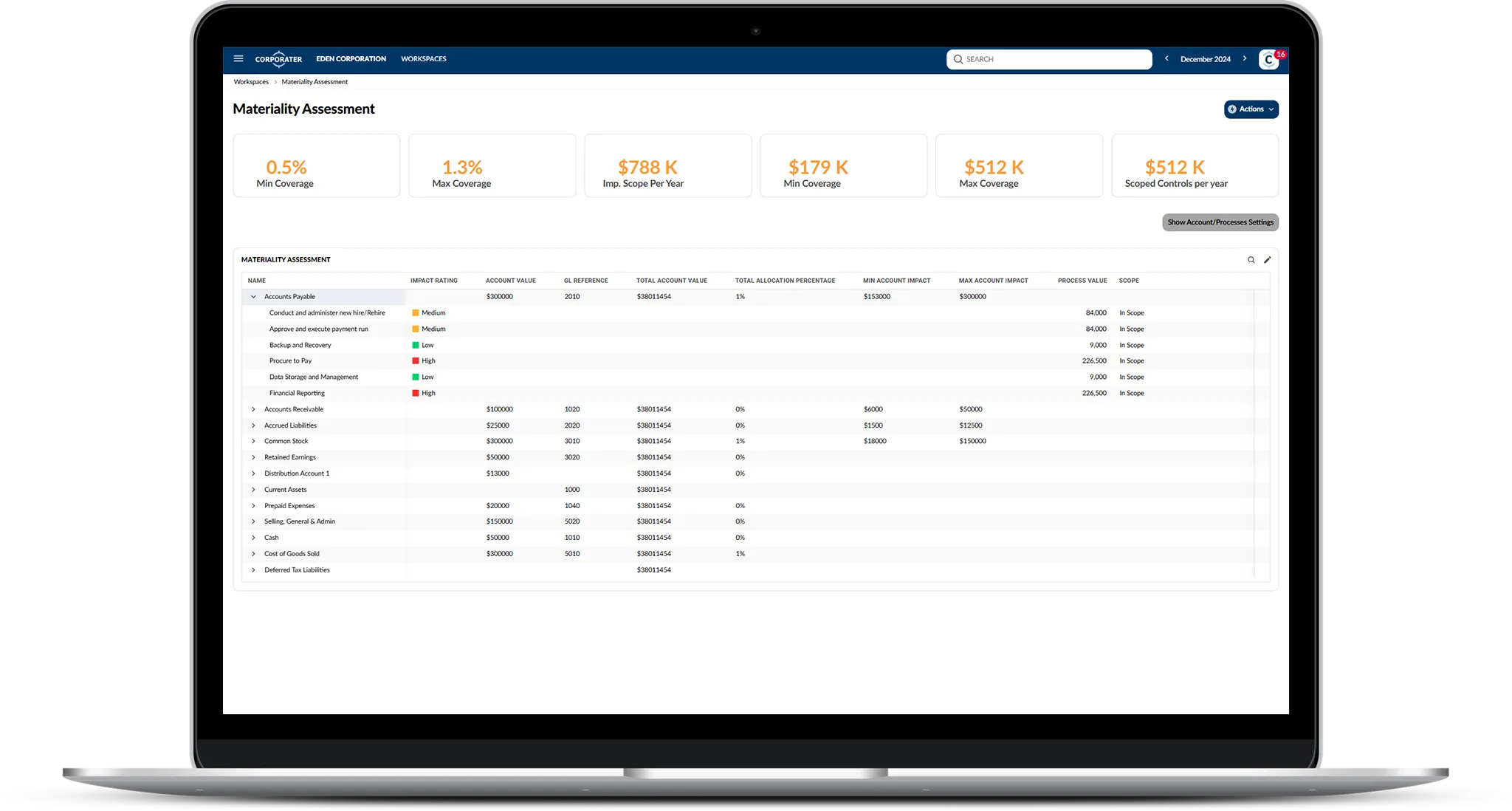

your material and key controls

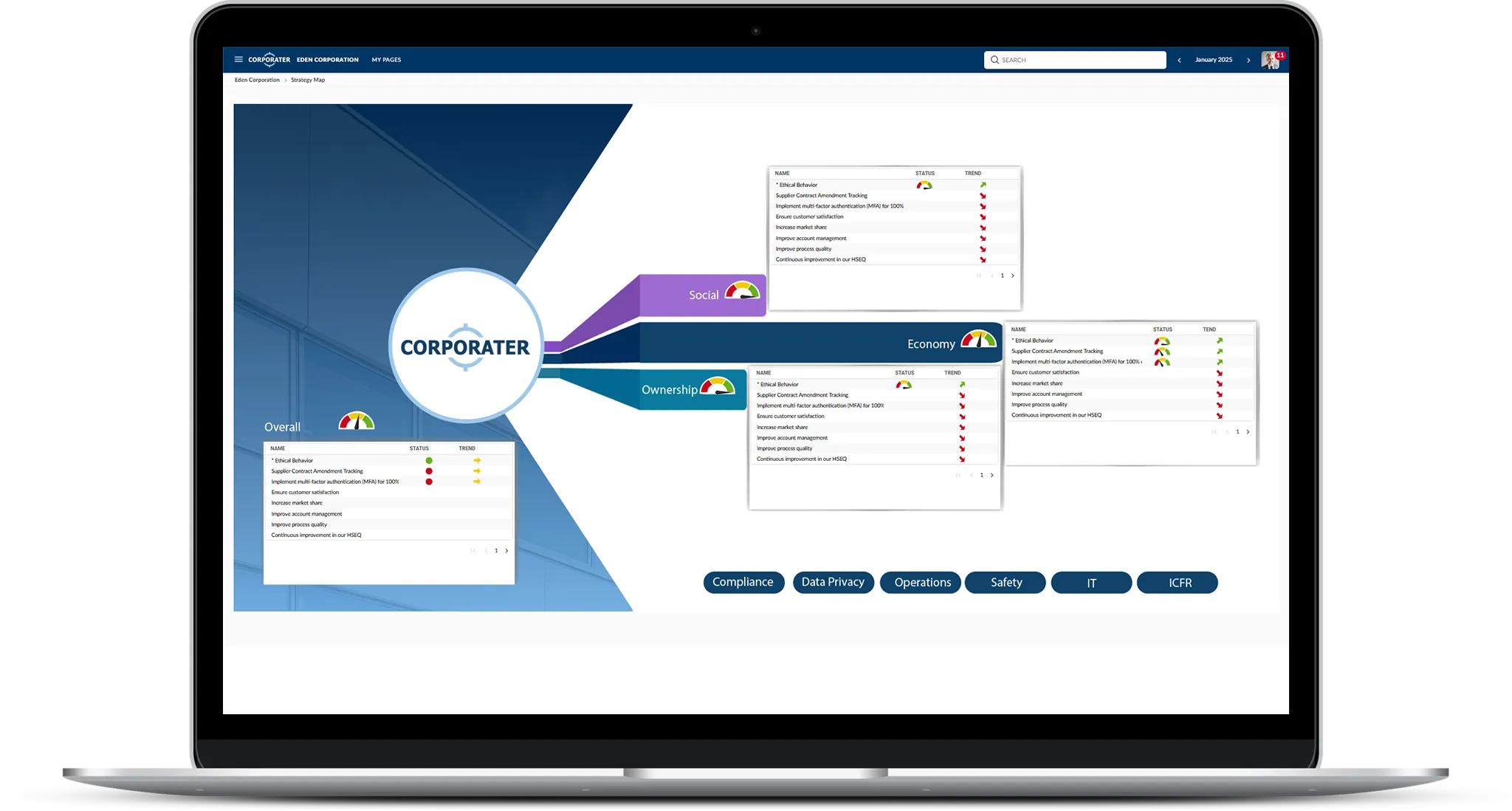

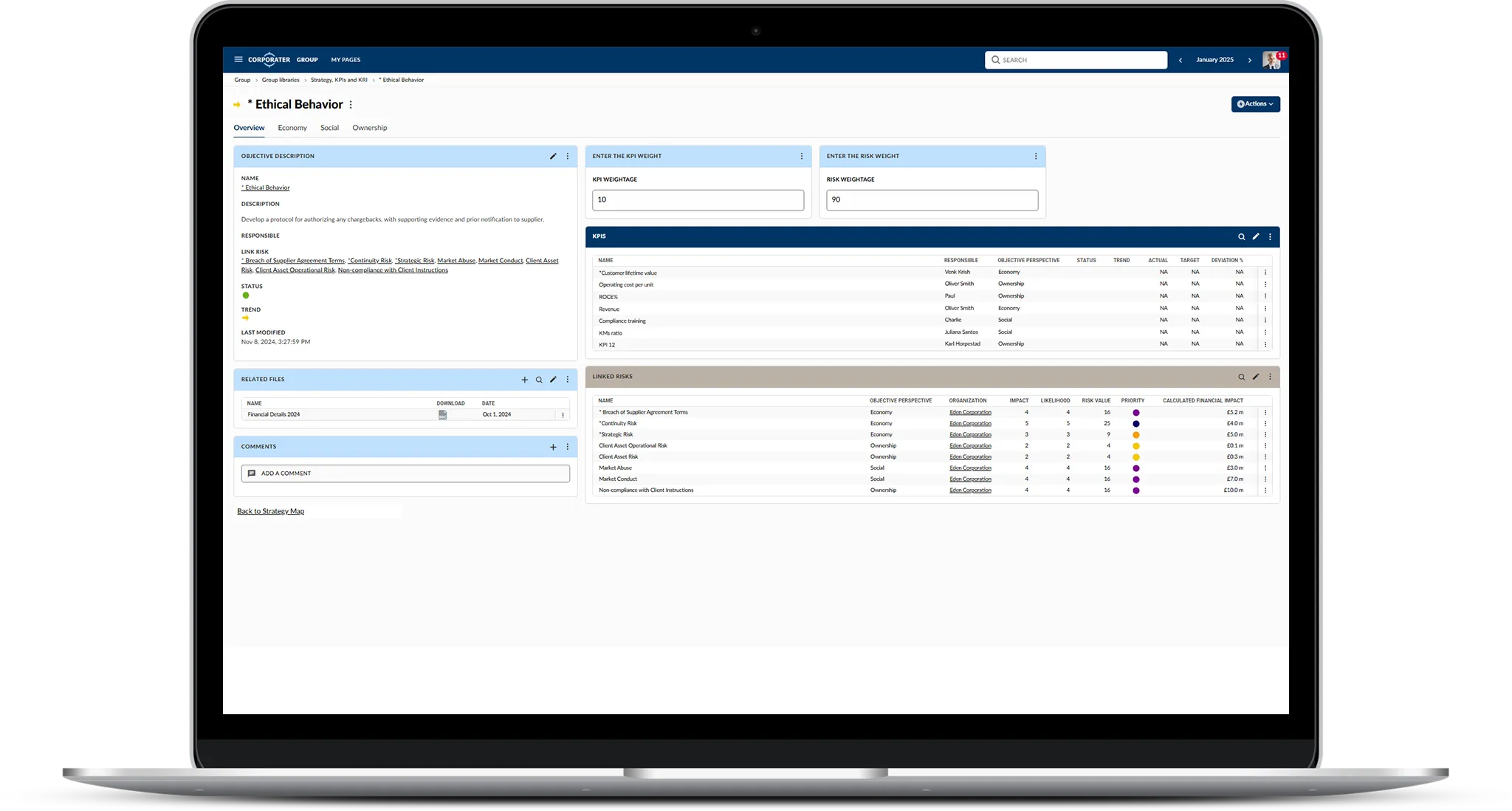

Corporater provides purpose-built functionality designed to meet the needs of modern boards and management teams. Organizations can operationalize the FRC’s updated governance requirements by taking a holistic approach, and integrating GRC with business purpose, objectives, and the performance of the objectives.

Enable governance and reporting of risk appetite/bearing capacity, compliance levels, and both key and material control effectiveness metrics aligned with performance of strategic objectives, using a single integrated platform. Corporater ensures alignment with the latest FRC requirements, including Provisions 29, 25 and 24. It also supports the broader compliance needs, helping organizations adapt to changes and maintain high standards of accountability and transparency.

Start the journey of integrating your Governance, Performance, Risk, and Compliance on one software platform.

Protect and Create Value for your Organization

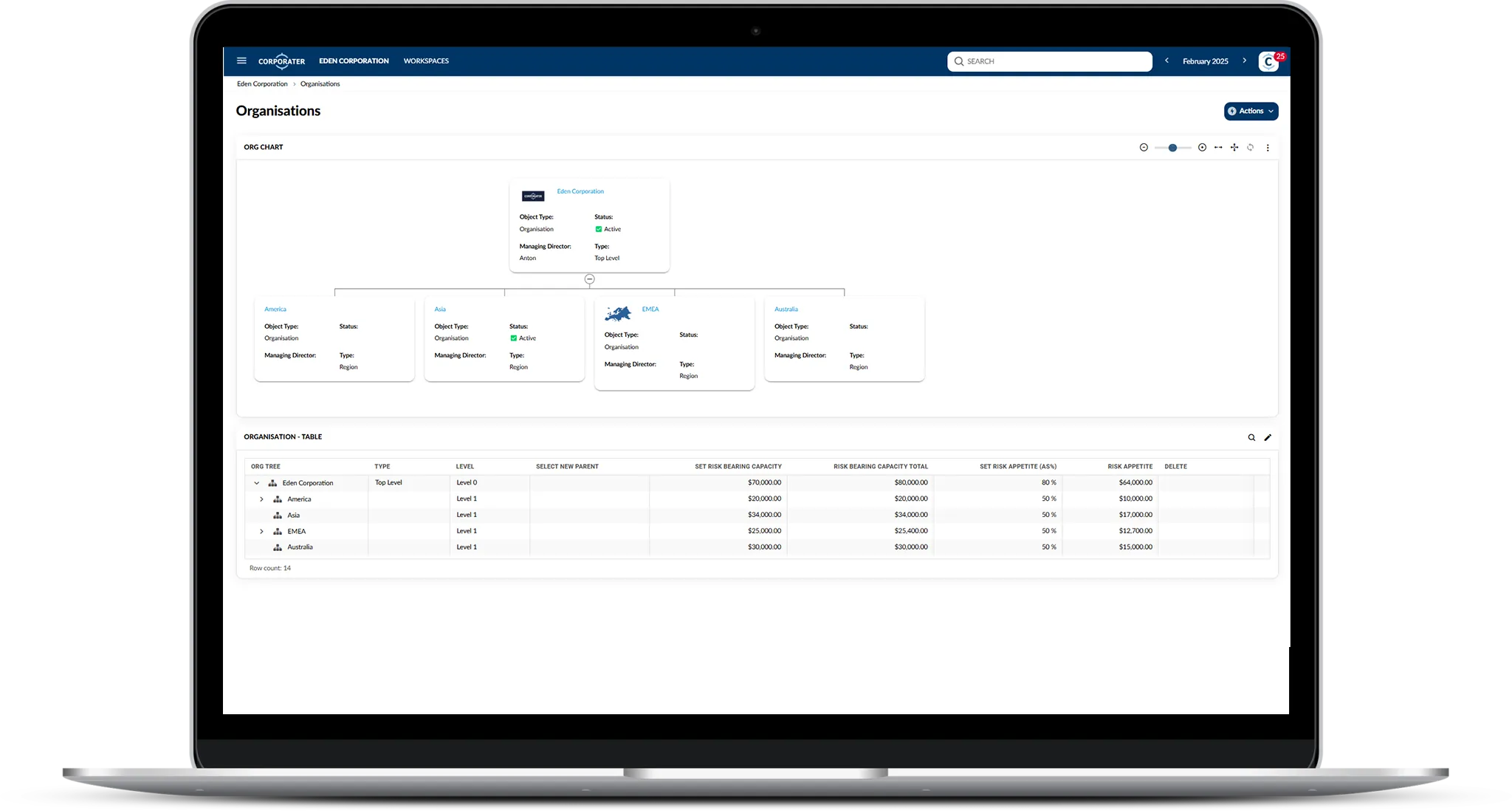

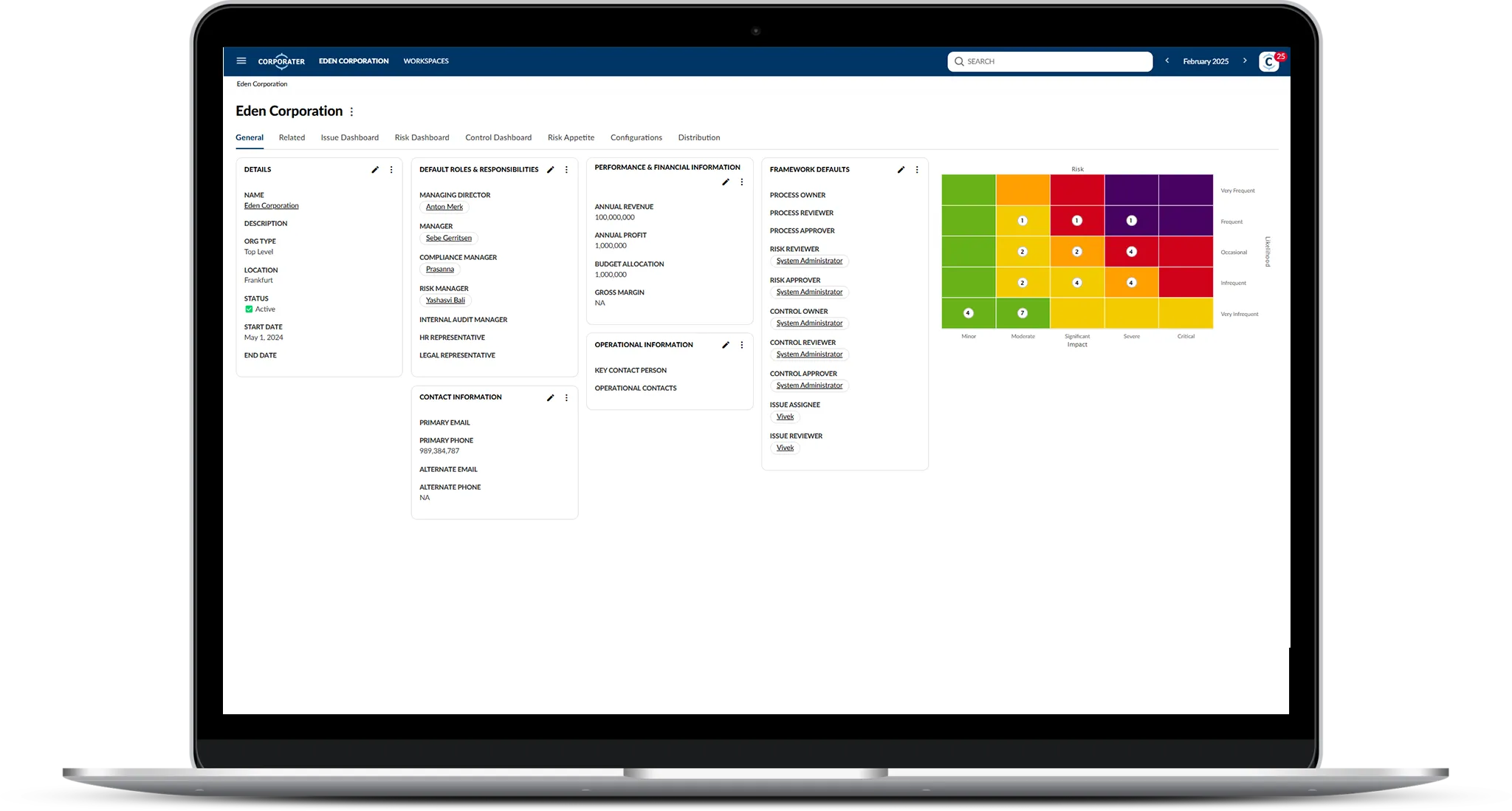

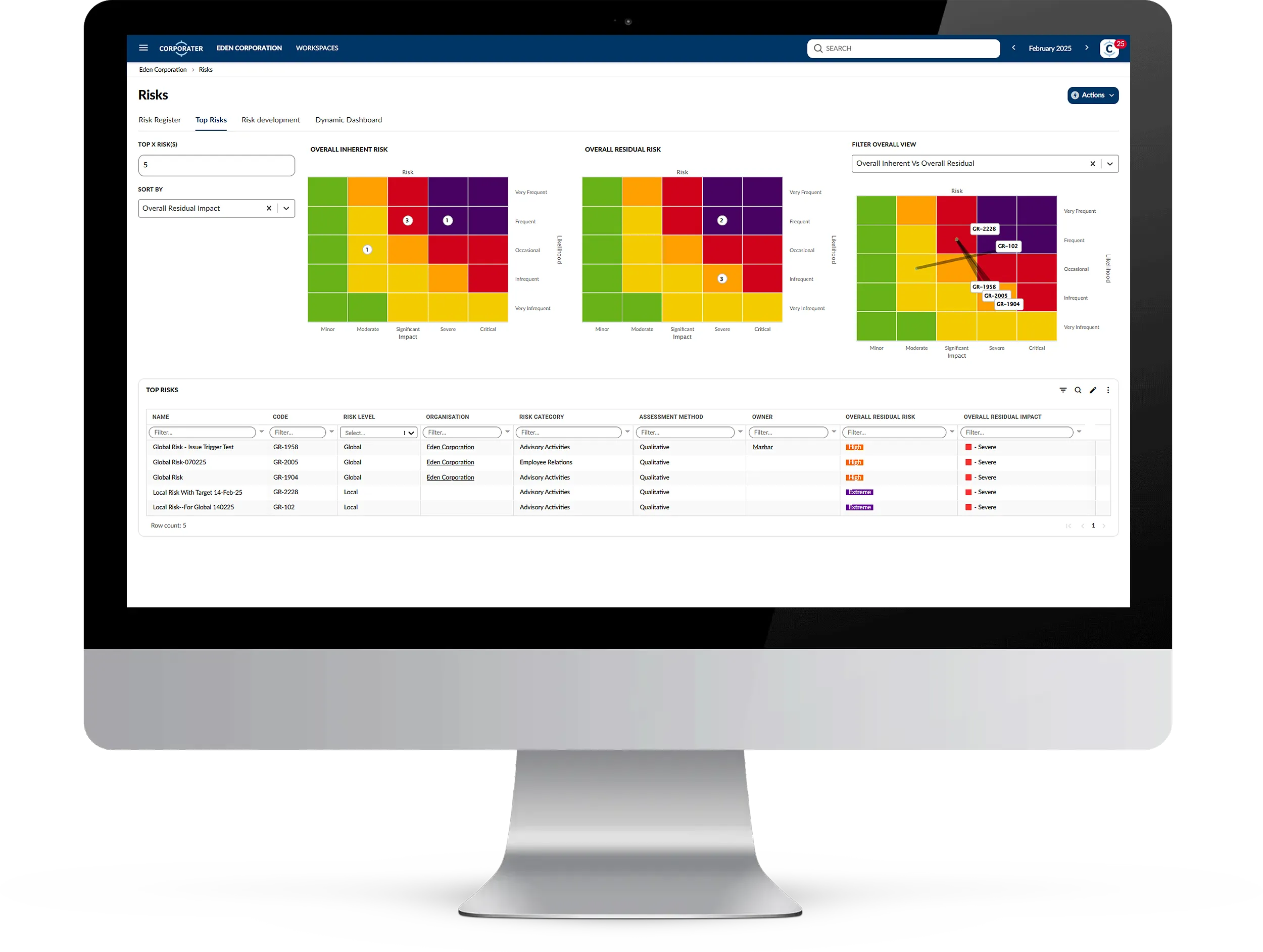

Provision 29 requires organizations to establish a robust and evolving risk management and internal control framework. Corporater ensures that governance structures remain adaptable, allowing businesses to continuously refine their internal control systems in response to regulatory changes and operational risks. The platform provides a flexible and configurable approach to compliance, enabling organizations to adjust processes without costly disruptions as governance expectations evolve.

Provision 29 places a strong emphasis on enterprise-wide assurance, ensuring that governance and risk controls are not siloed but embedded within the entire organization. Corporater creates a digital twin of your governance structure, mapping risk, compliance, and internal controls across all departments and business units. This embedded approach fosters greater collaboration, transparency, and accountability, making it easier to report on internal control effectiveness as required by the revised corporate governance framework, giving you control and oversight.

The UK Corporate Governance Code emphasizes that risk management and internal controls should not operate in isolation but must be integrated with the organization’s strategic direction. Corporater’s platform aligns governance, risk, and compliance (GRC) processes with business objectives, ensuring that risk management activities are directly linked to corporate performance. This alignment drives better decision-making, enabling leadership teams to demonstrate accountability in line with Provision 29’s requirements.

Read What Analysts Say!

GRC 20/20 Solution PerspectiveCorporater - Delivering an Integrated view of G[P]RC to the Enterprise

Organizations choose Corporater as they seek a single agile and integrated architecture to automate a range of GRC, performance management, and other business processes. Typical use cases for Corporater span the GRC space, and the solution is highly configurable for an organization to build its own business process/management solutions.

Request Demo

Features Supporting UK CGC Provisions

Digitalize and model the company`s purpose, values and strategy. Connect to GRC and Performance domain for communication, alignment, management, assurance, and reporting.

Assess and monitor culture in accordance with company values and strategy, using the interconnected model of Corporater.

Maintain stakeholder register, conduct stakeholder assessments using surveys. Set processes/procedures for effective stakeholder engagement.

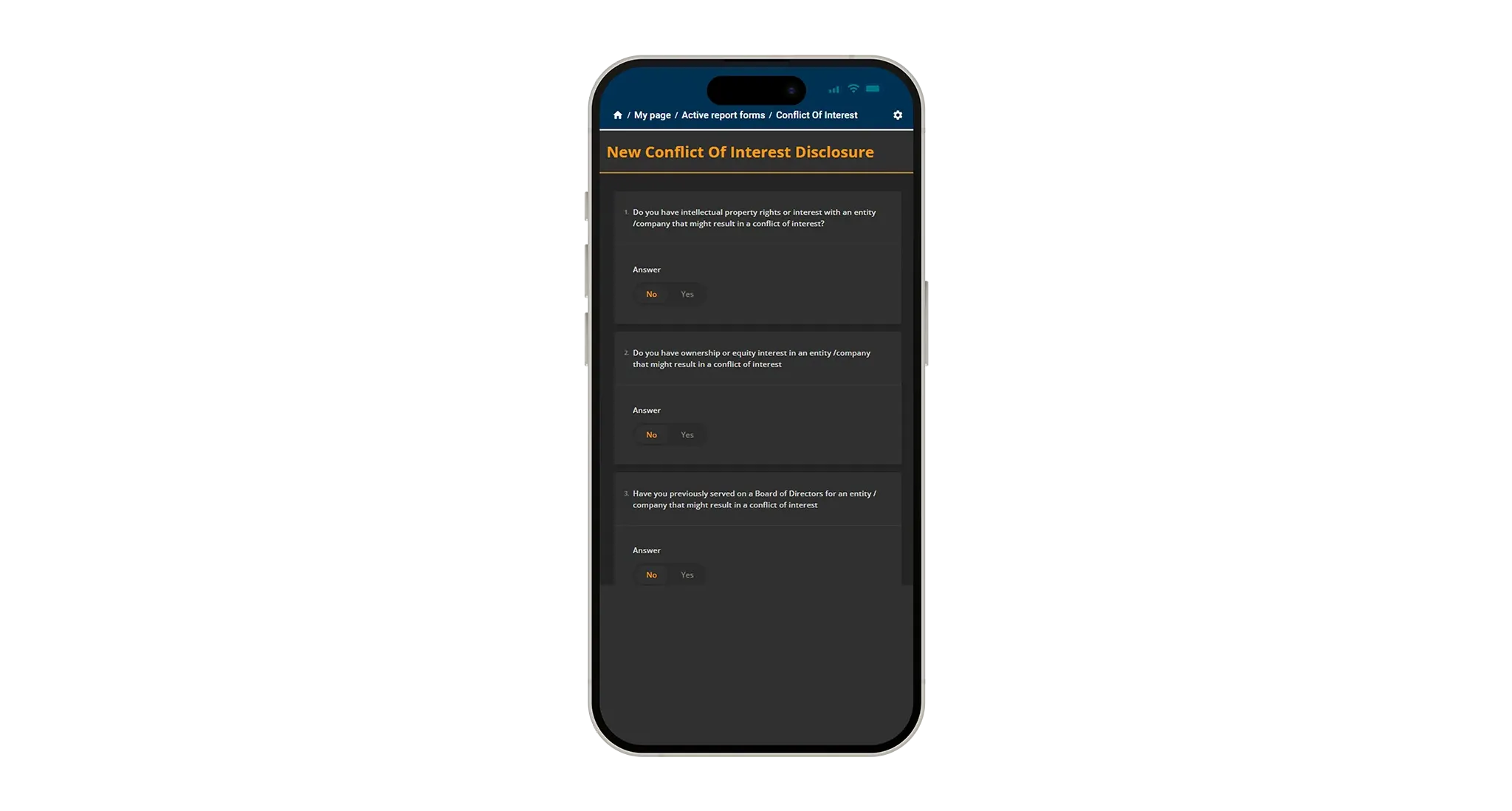

Keep employees informed about policies and hold them accountable for their tasks. Monitor status of all policies and procedures, assignments, and complete tasks.

Maintain a Roles and Responsibilities Matrix with assigned roles and responsibilities to set your plans into motion.

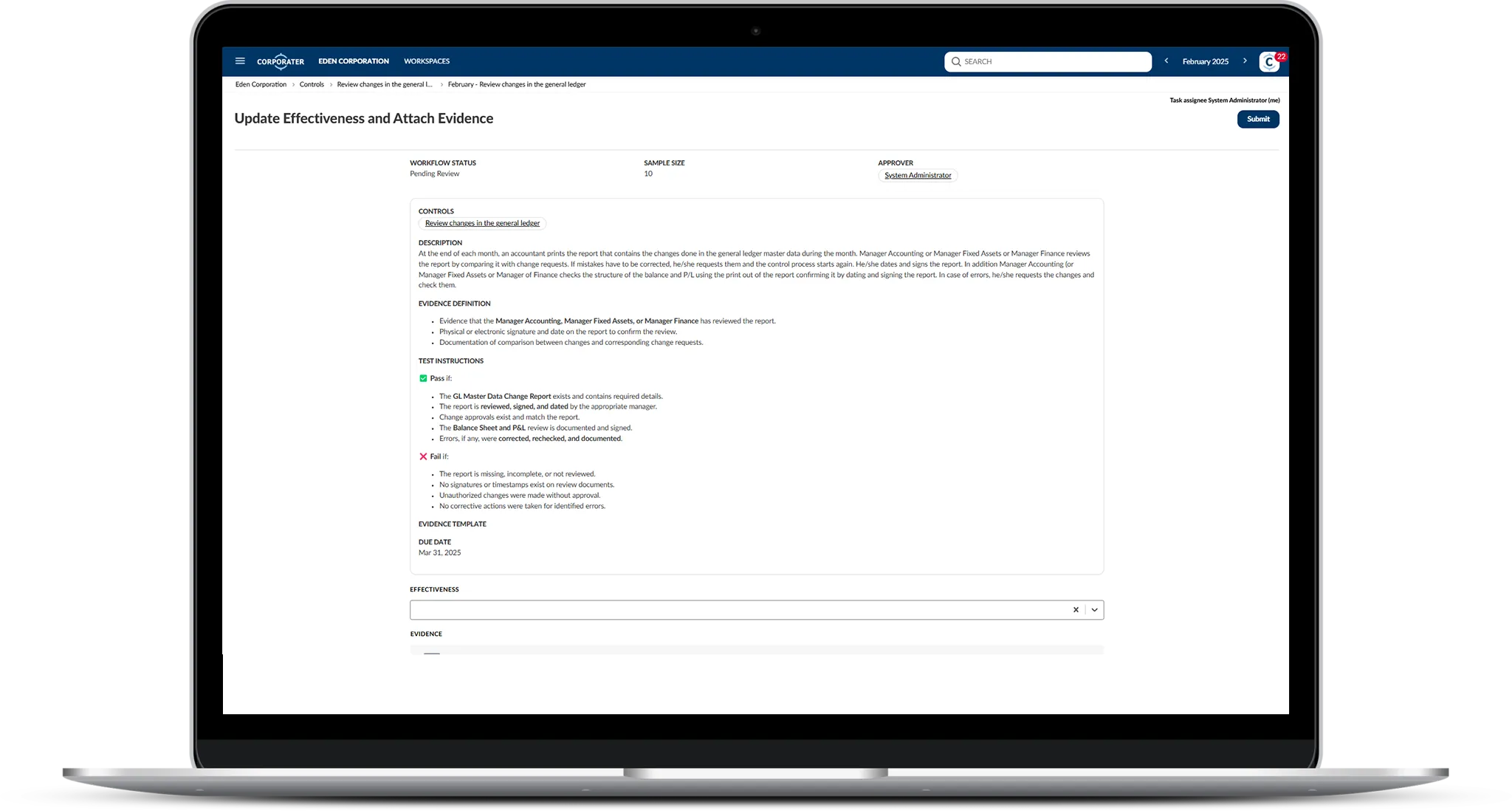

Establish, document, and formally and rigorously execute a process/procedure/ ensuring audit trail and transparency.

Use Corporater to conduct Annual Board Performance Self Assessment with audit trail and formal report.

Corporater supports Board initiatives follow-up and progress.

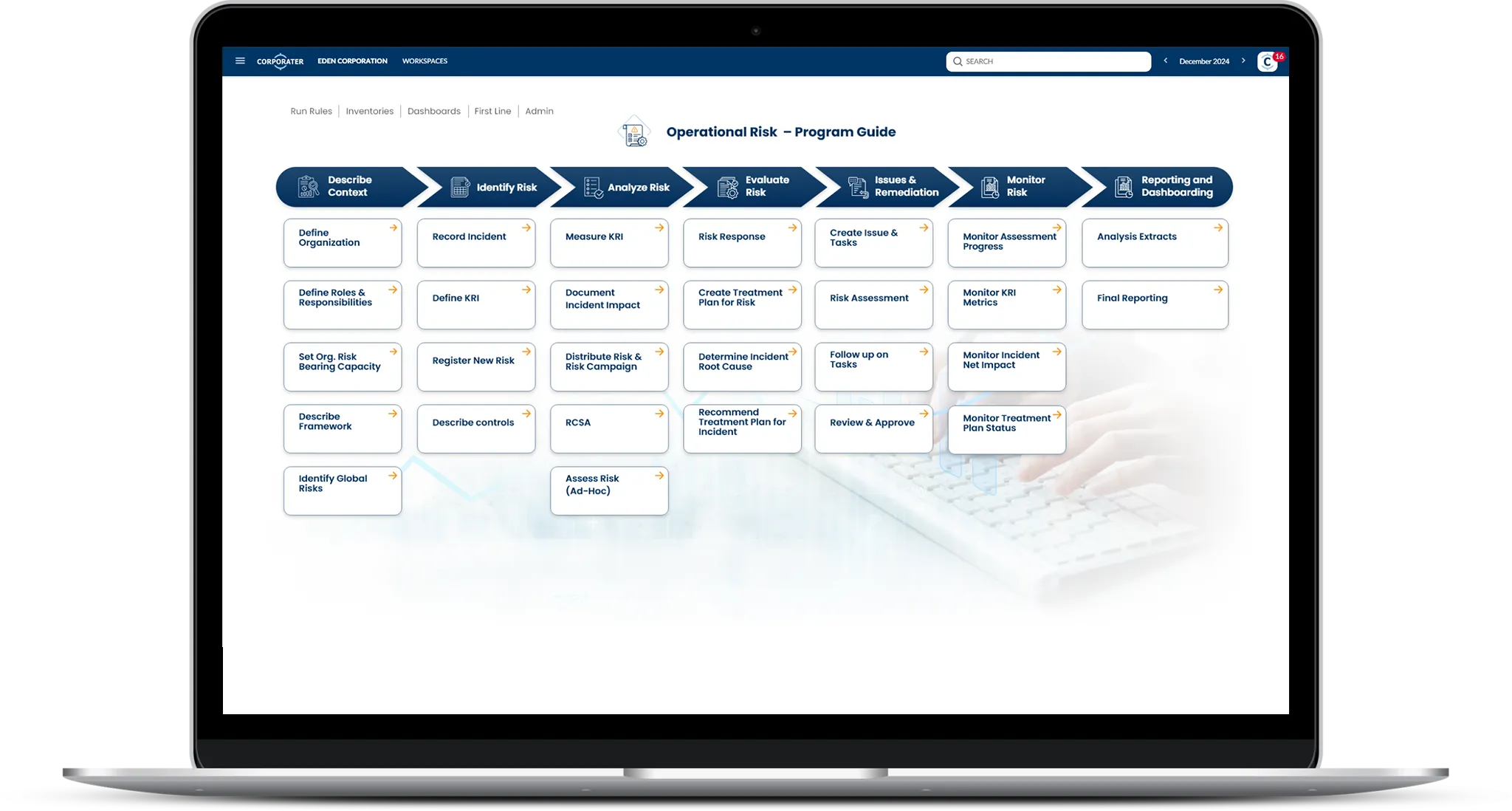

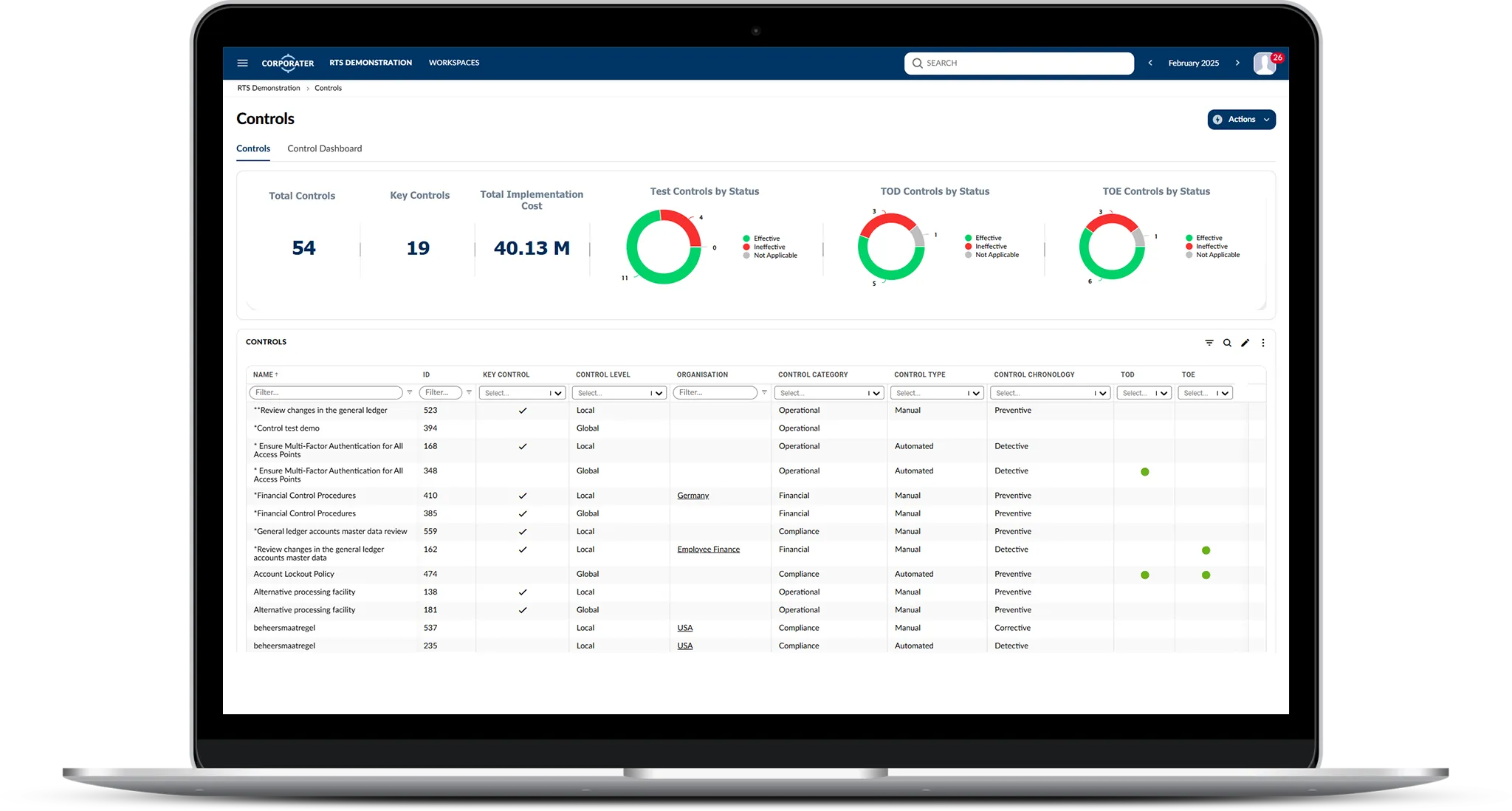

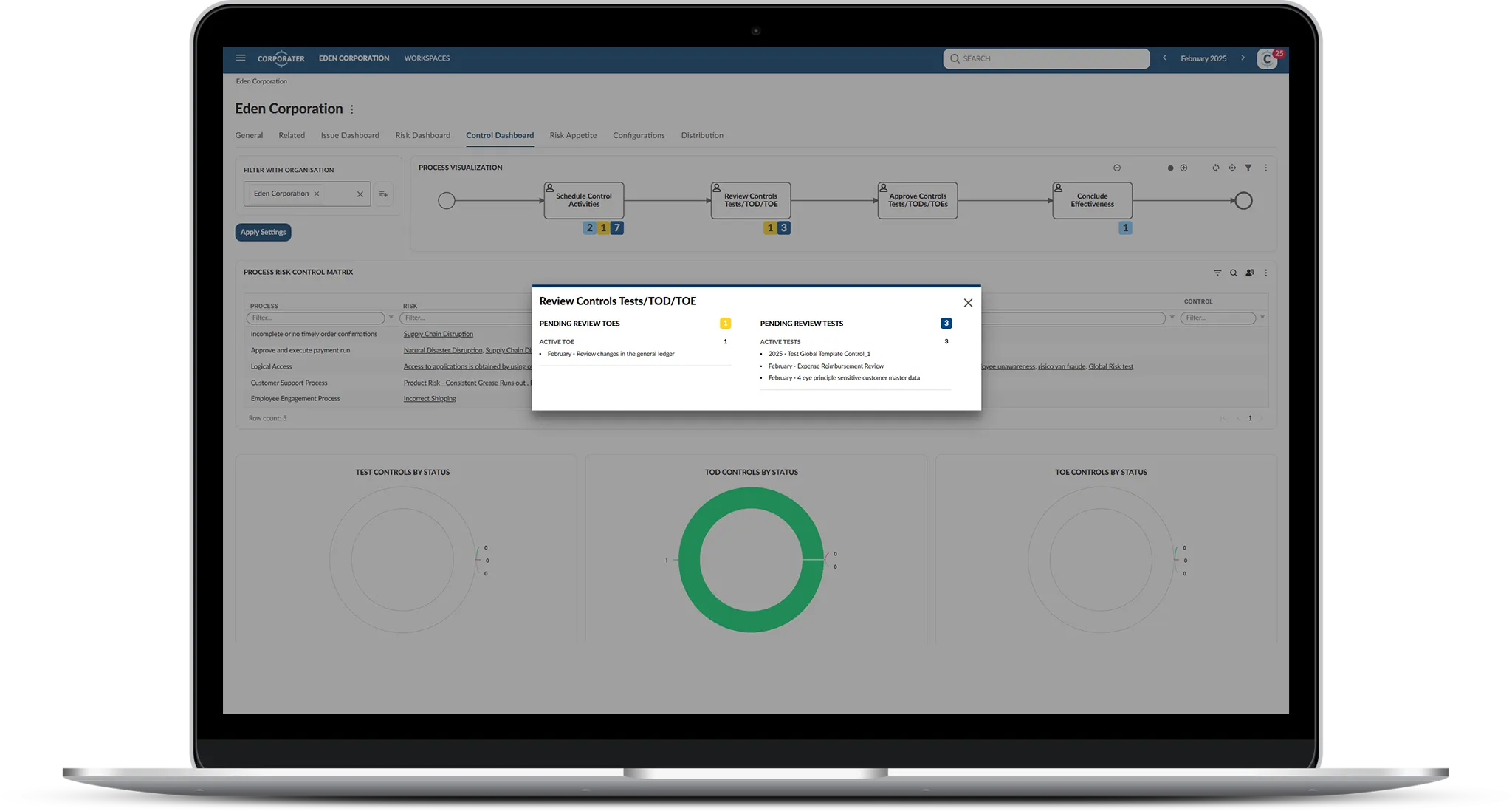

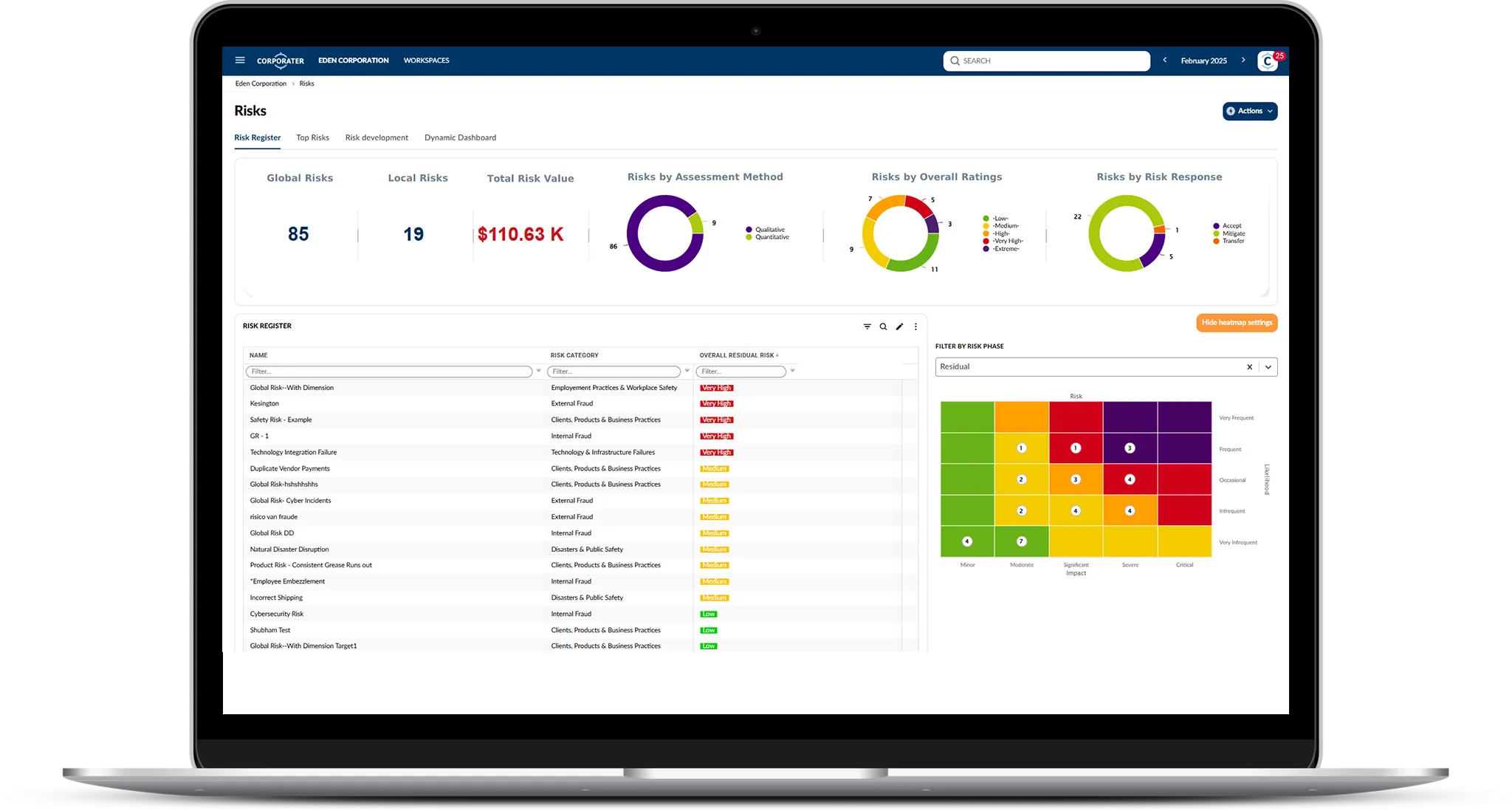

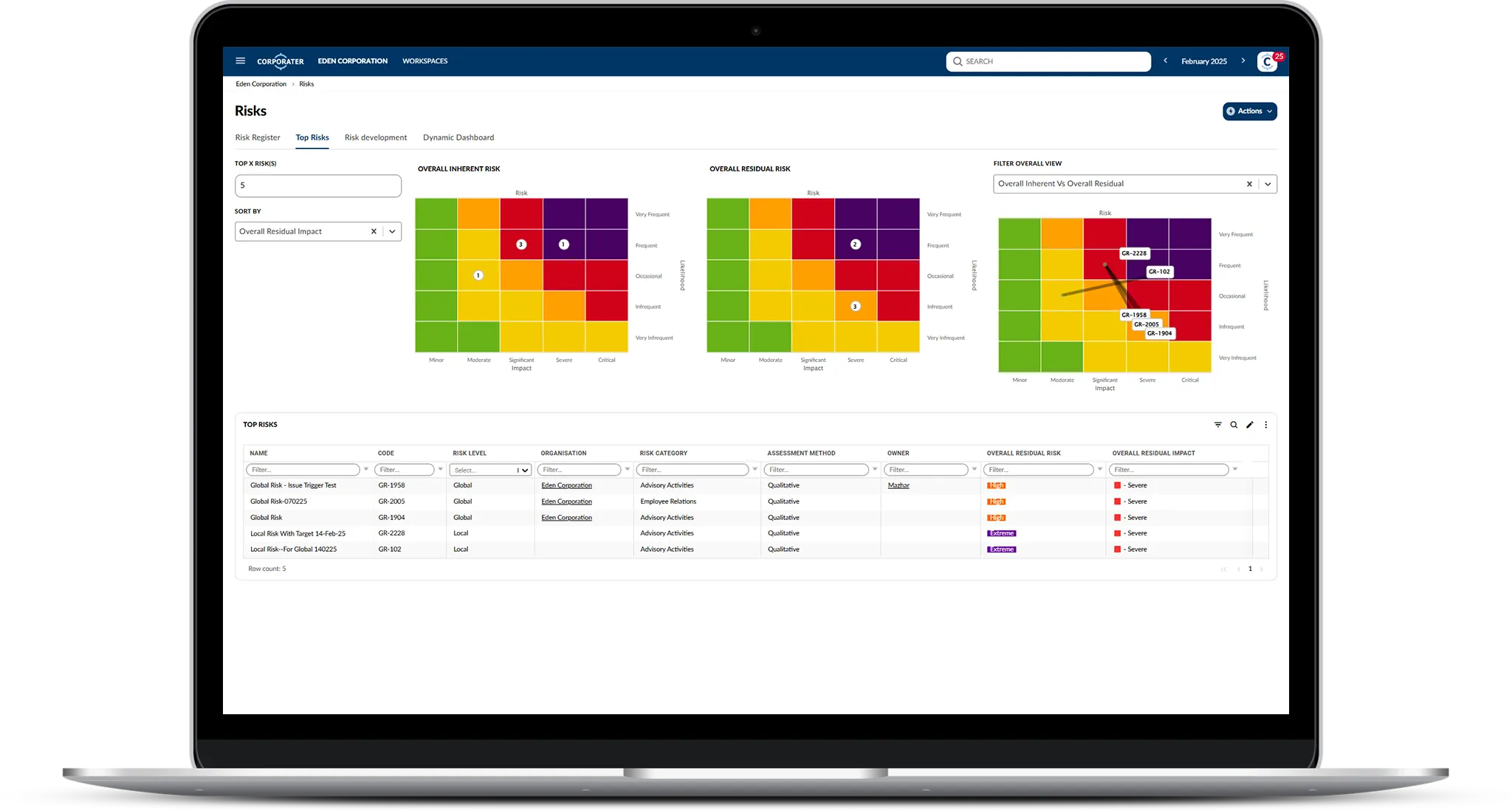

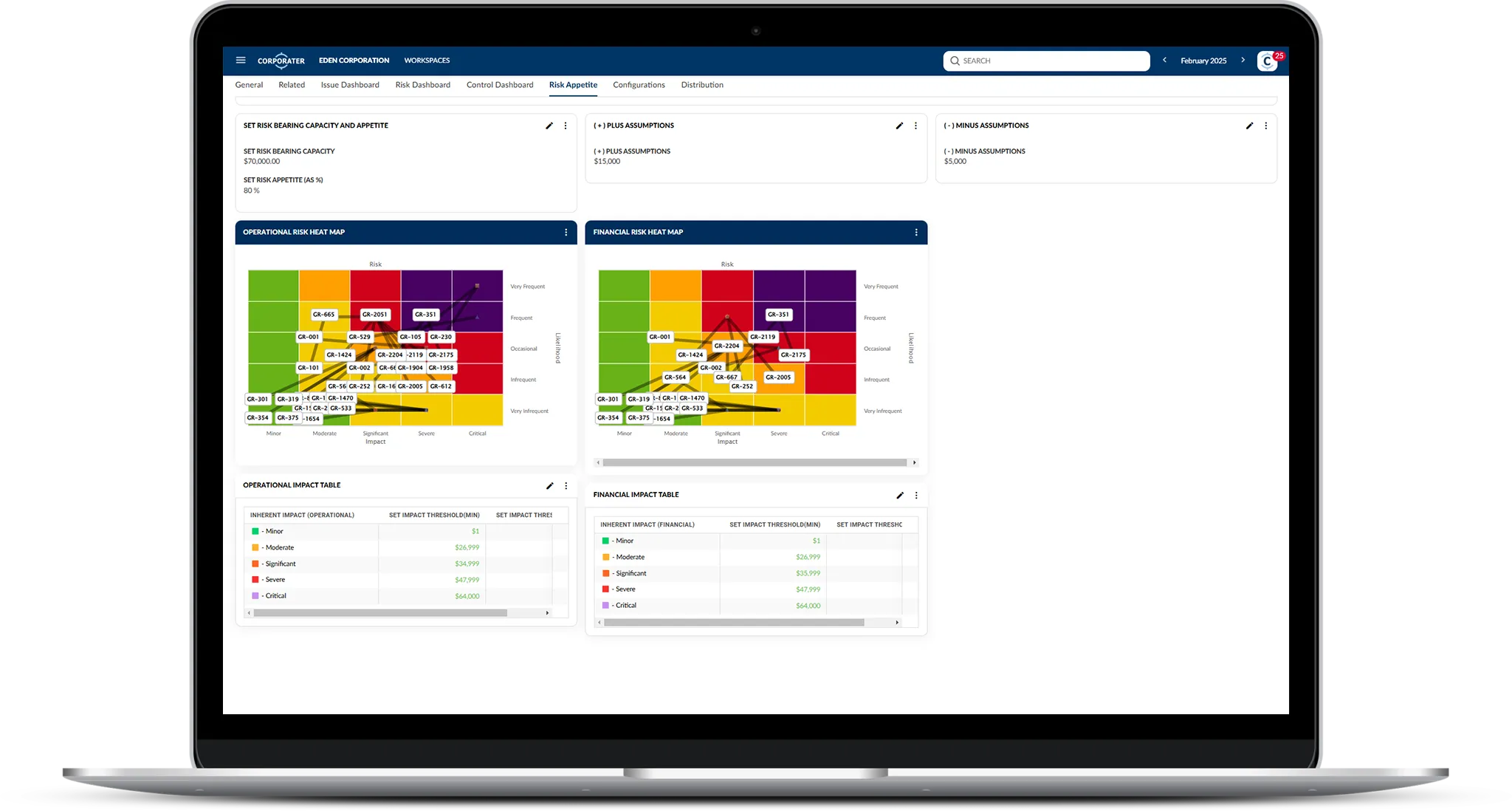

Enable end to end processes for Risk Management and Internal Control Management, including Risk Governance, such as appetite and more.

Enable live, updated reports in the form of dashboards or PDFs, including to monitor and review the effectiveness of the company’s risk management and internal control systems.

Review audits, Risk Management data and Internal Control System data containing evidence of risks, risk assessments, risk controls/internal controls, control management, incidents, and more.

Automate evidence gathering, and report generation to support recommendations.

Supported by Corporater Policy Management.

Use Corporater ERM/IRM/ICS capabilities for governance and reporting – to enable risk appetite/bearing capacity.

The UK Corporate Governance Code emphasizes the need for robust internal controls and effective risk management systems. But how prepared is your organization?

This short assessment is designed to help you evaluate your current level of maturity and identify opportunities for improvement.