Establish an effective AML program to comply with legal requirements, identify money laundering, and combat financial crime.

Build an effective AML Compliance Program

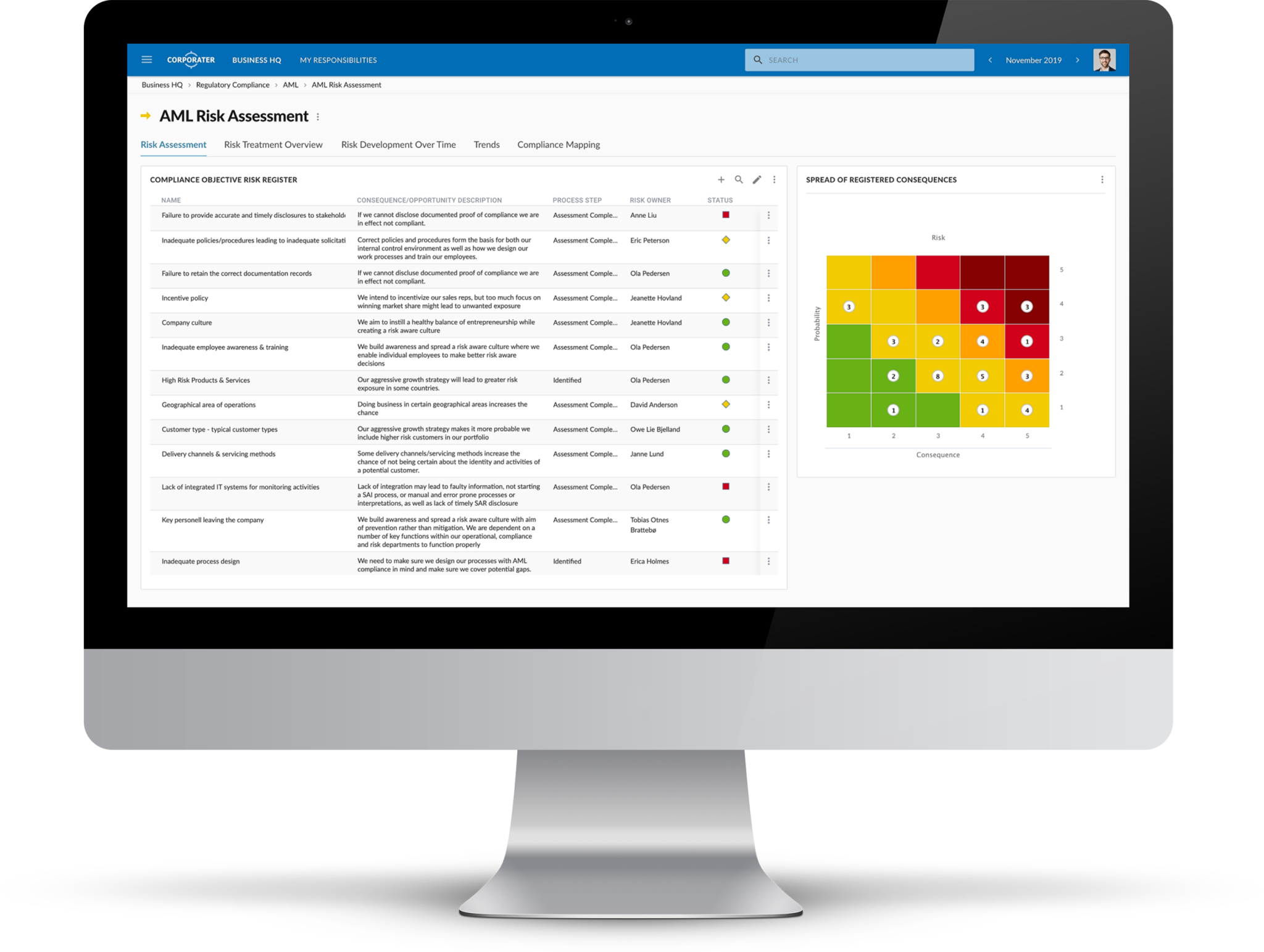

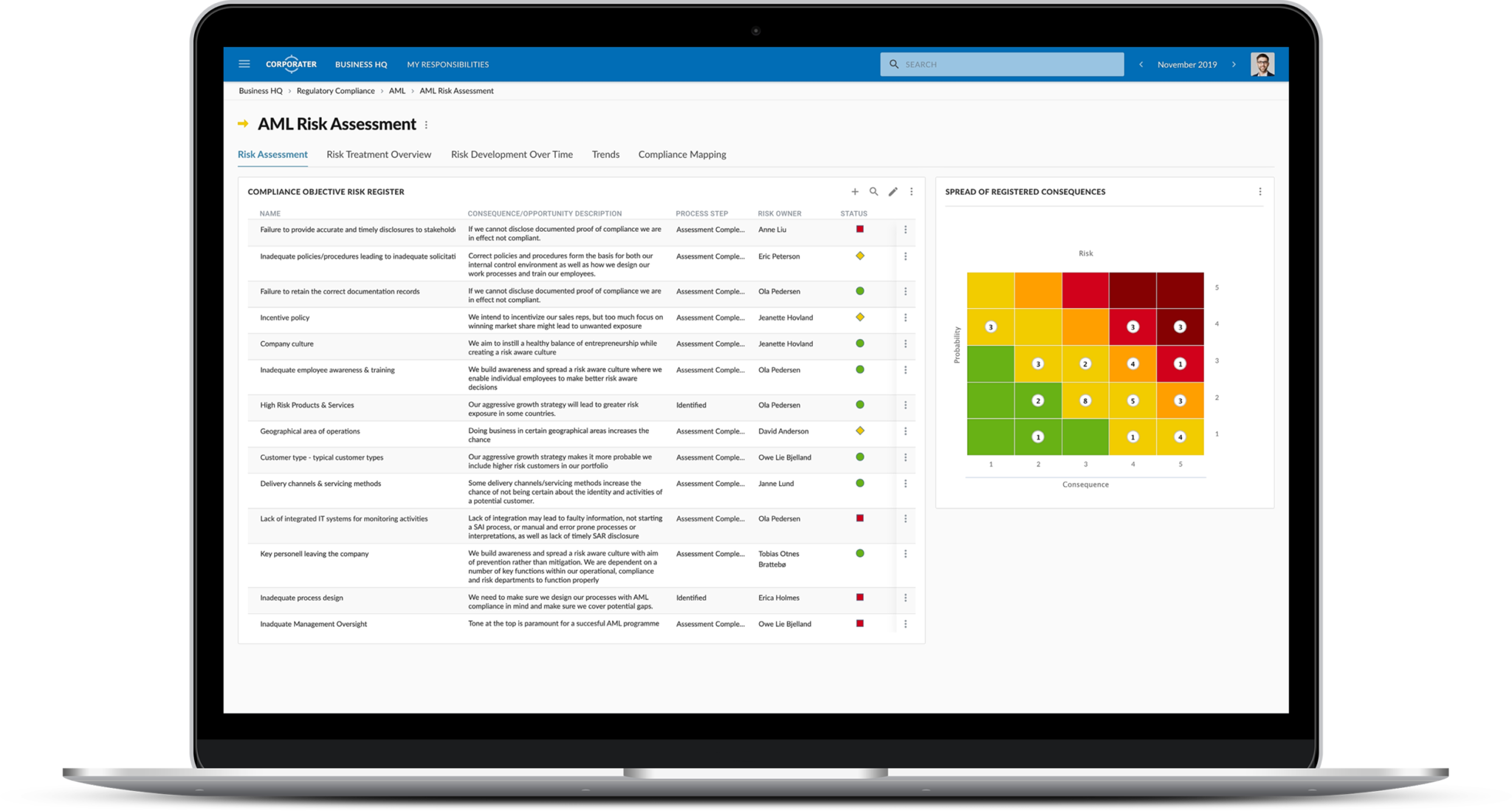

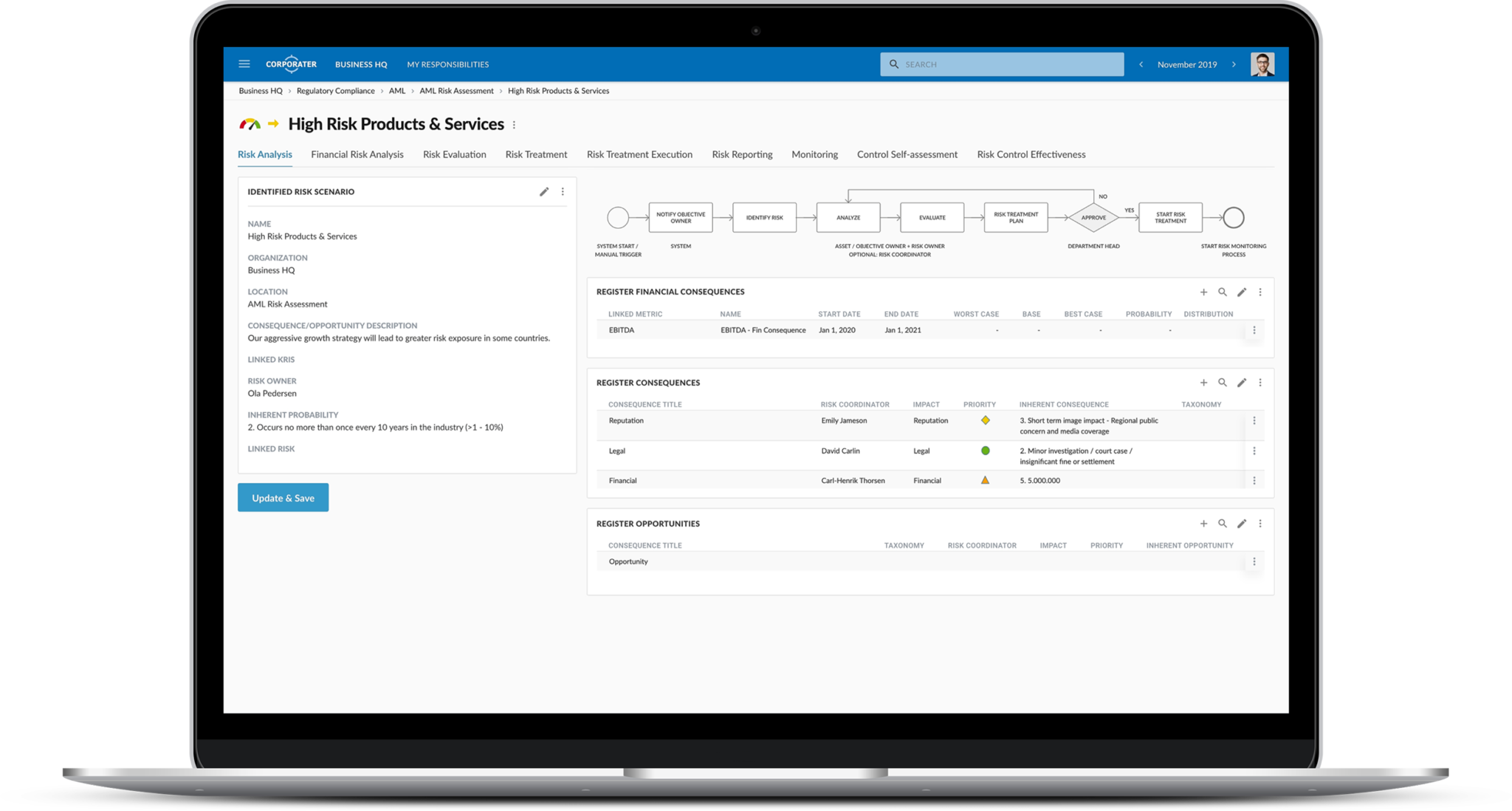

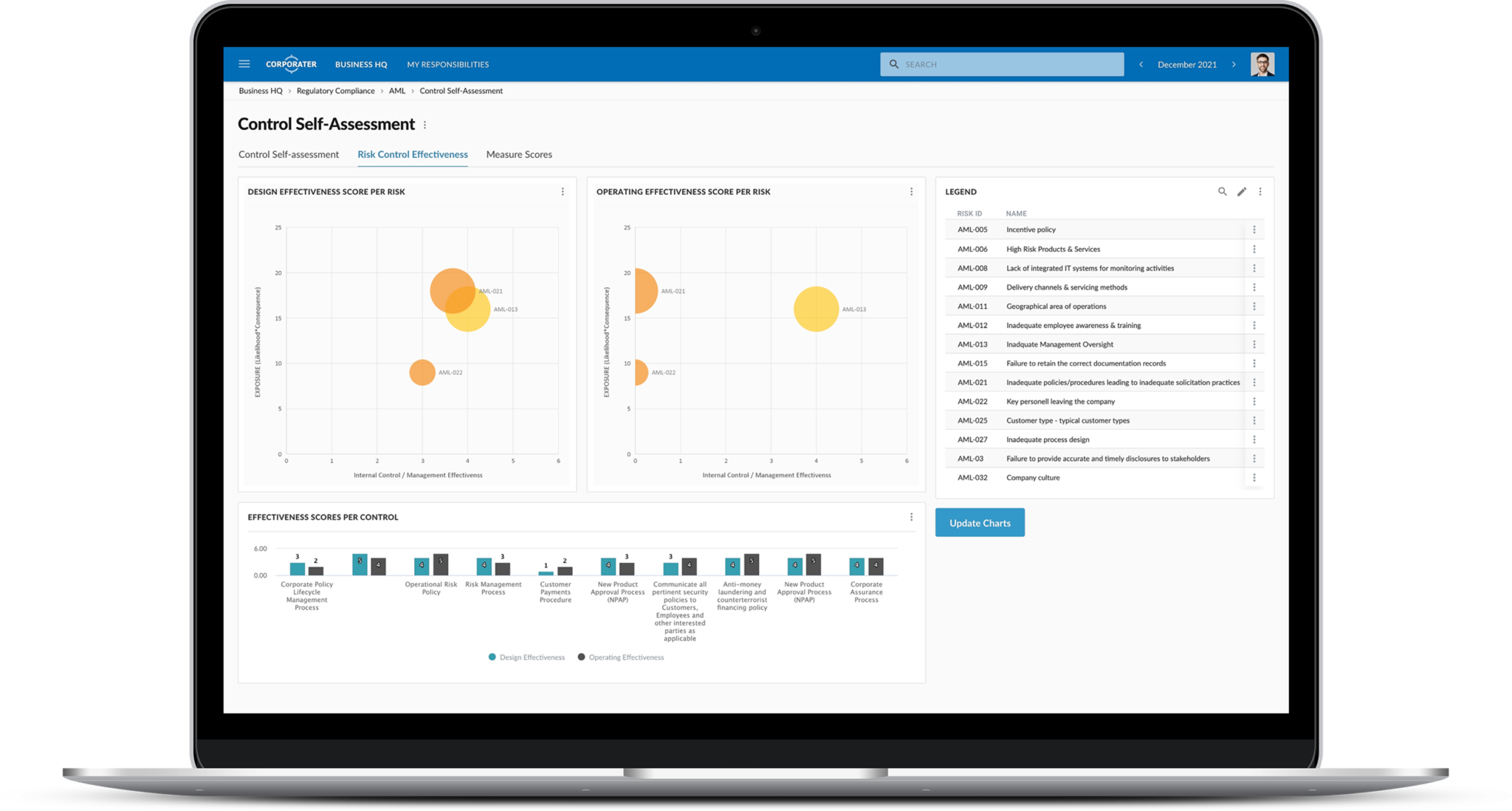

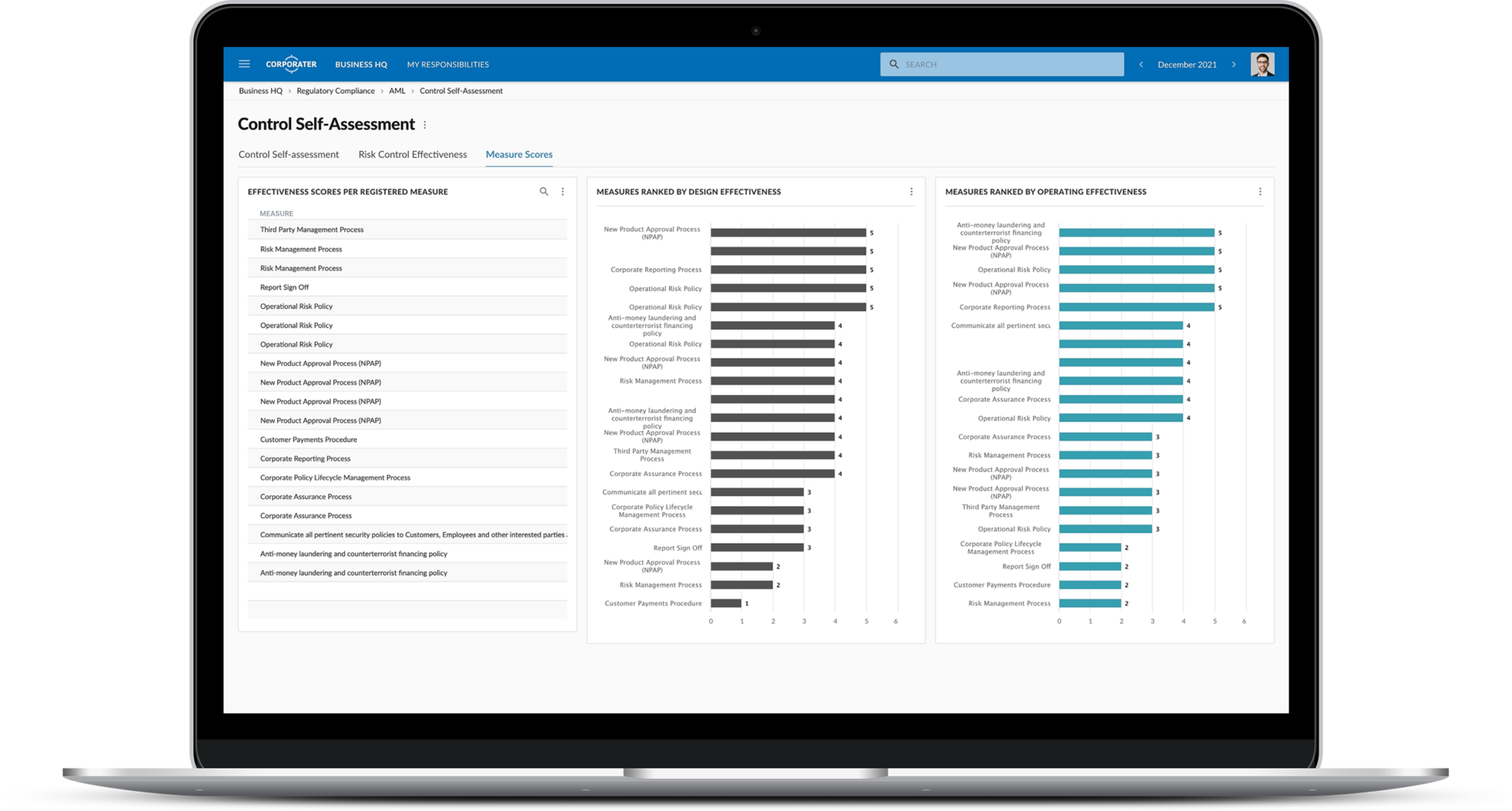

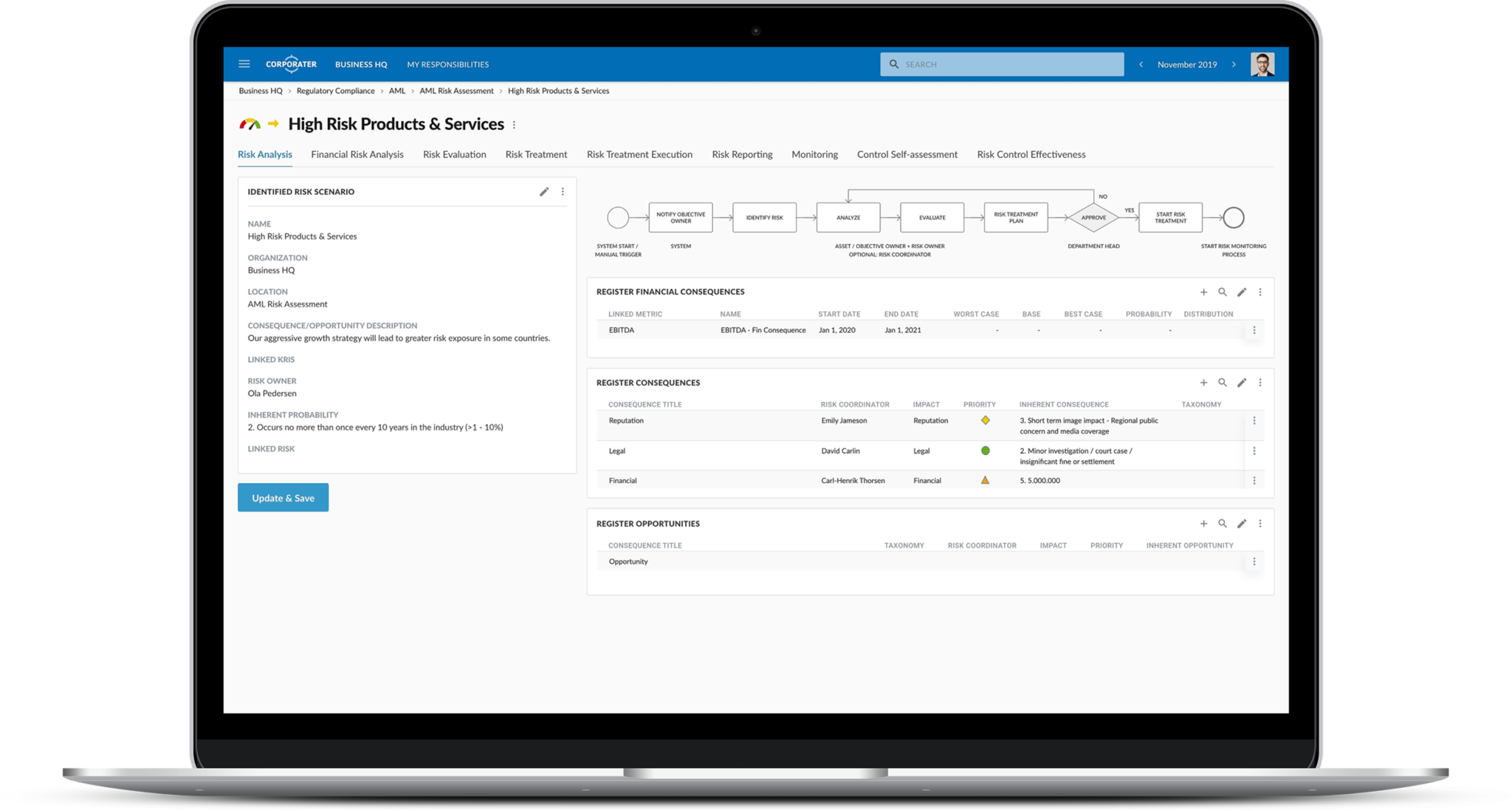

Corporater Anti-money Laundering (AML) software solution is a digital tool that enables organizations to establish an effective AML compliance program for battling financial crime. It enables organizations to have a holistic view of their AML requirements, demonstrate compliance with prescribed regulations, and detect and prevent crimes such as money laundering, fraud, data theft, security threats, privacy breaches, and non-compliance.